FedNow is the faster payments service for America, backed by the US Government and delivered by the Federal Reserve banks. The thing is that you, like me, may be asking is this real? America is getting faster payments in 2023 when many other economies got them in the 2000s? Well, yes and no.

The UK implemented real-time payments for consumers back in 2008, but they weren’t the first. The first one I’ve been able to find is Japan's Zengin system, which started processing payments in real-time speed in 1973, but it only went 24/7 in 2018. But that is a real-time gross settlement system (RTGS), which is different to immediate payments.

In fact, there is a big difference between real-time payments, faster payments and immediate payments. It is semantics but the first, real-time payments, tend to describe real-time payments between banks and counterparties; the second, faster payments, tends to apply to retail and consumer payments; and the third, immediate payments, applies to all payments whether B2B, B2C or you and me.

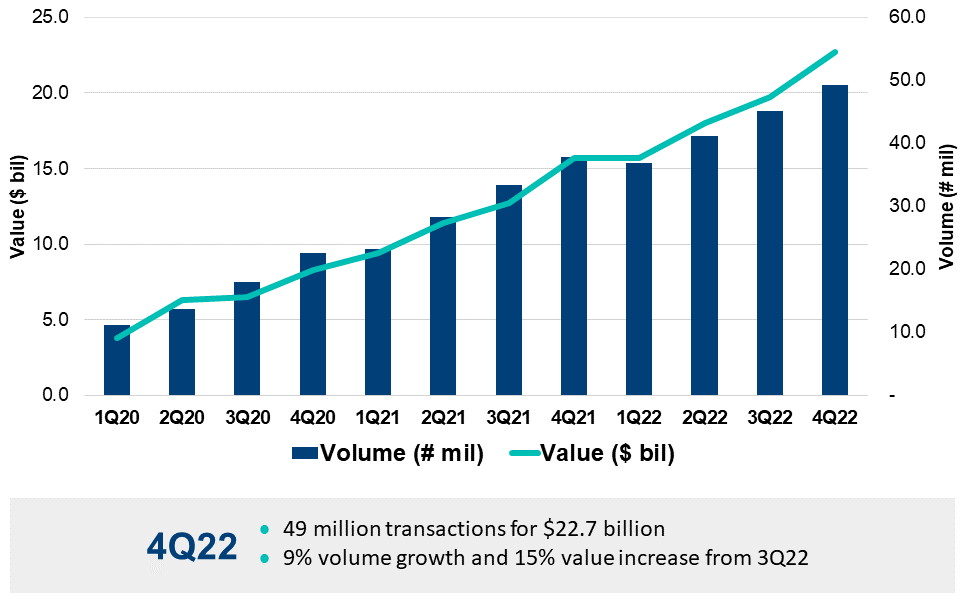

The reason for the delineation is that America has had real-time payments since 2017 through The Clearing House, celebrating its five year anniversary last year, with 285 participating banks and credit unions, and processing over $70 billion a year.

But real-time payments (RTP) from The Clearing House is not the same as FedNow. RTP connects banks; FedNow connects businesses, merchants and consumers. Originally planned for launch in 2024, the Federal Reserve brought the date forward to July 2023. Ten years in the making, it will allow all US citizens to make immediate payments, as long as their bank is signed up to the programme.

ISO20022 native, which means payments can be data enriched, FedNow represents a critical move for merchants, retail and businesses, who claim that access to faster payments and enriched data would influence their decision to switch banks. According to a survey by the Federal Reserve in the summer of 2021 two-thirds of those surveyed, and more than three of four large businesses surveyed, say that access to faster payments would factor into their decisions to switch banks in the future.

Which is why it intrigues me that there may be a bit of hidden agenda in what the Fed is doing here?

For example, bearing in mind that there are several retail payments systems in the USA, how come Venmo is not part of FedNow, but Zelle is? What’s the difference between Venmo and Zelle? Venmo is run by PayPal and Zelle is run by the major US banks. This means that the banks who offer immediate payments via Zelle have a clear advantage over PayPal, who own Venmo, because the latter will have payments that take three days or more to clear versus the former who can now offer immediate payments. It also gives a leverage for all US banks over the innovators in the FinTech community as the latter, unless they have a Federal Reserve bank licence, are blocked out of the immediate payments system.

In some ways, it’s a good thing. It helps smaller community banks and credit unions, as it gives them a fighting chance to compete in the ecosystem. On the other hand, it seems like a prohibitive move by the Fed to exclude others from that system.

Interestingly Zelle, the bank-owned payments wallet created to compete with Venmo, is also able to use The Clearing House’s RTP network since launch, whilst Venmo cannot.

In fact, because of the issues of fraud on the Zelle network, that’s why the Fed justifies not making it more widely accessible. It’s purely offered to banks, and not direct to consumer. The claim is that this is to avoid fraud. An estimated $440 million was lost by Zelle users through frauds and scams in 2021. Therefore, as FedNow arrives, they want to secure the system. Or do they want to use securing the system as a way of blocking non-bank competition?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...