Predictions about banking in the future

After I posted my banks disappear post, Glenn Stanford replied to me on LinkedIn with a link to this: A history of the future of banking: predictions and outcomes by Maria Gloria Cobas and Larry R. Mote, Office of the Comptroller of the Currency and James A. Wilcox, Haas School of Business, University of California, Berkeley, November 2001. It’s a fascinating white paper of things people thought years ago. Here are a few ideas:

“In 1963, Dale L. Reistad of the American Bankers Association said at the first ABA National Operations and Automation Conference that we would be a checkless society by 2000.”

“A 1995 Business Week cover story cited predictions that the number of electronic purchases would grow more than seven-fold by the year 2000 and that, by 2005, nearly 20 percent of all purchases would be made electronically.” [In many economies, that figure was only reached by the late 2010s]

“Widespread use and acceptance of new technologies [would mean] that consumers would have little reason to visit either bank branches or ATMs by 2000.” Richard Rosenberg, Vice Chairman of Wells Fargo Bank [1980]

The report notes:

A prediction encountered often in the popular press, banking publications, and even in several learned treatises in recent decades is that the commercial banking industry is in an incipient state of decline and that banks will soon lose their traditional role as the most important type of financial intermediary in the United States and perhaps in the rest of the world as well.

But then goes on to say:

In general, the predictions made were overly optimistic. This over-optimism is similar to predictions about home banking and about a cashless society.

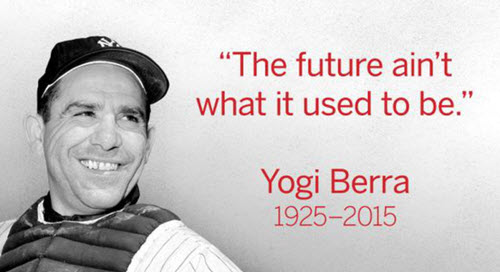

As someone involved in this space for most of my working life, I agree. We over-estimate the speed of change and under-estimate the impact. That line is often attributed to Bill Gates but it’s not his. It was originally put forward by J. C. R. Licklider in 1965:

“People tend to overestimate what can be done in one year and to underestimate what can be done in five or ten years.” Source: Quote Investigator

The thing for me is that we have been expecting a cashless, checkless, cardless society for years and yet we all still have access, and some even use, cash, checks and cards. We have been expecting a branchless, bankless, automated world of finance for years, and yet we still use branches, banks and physical systems today.

What is clear to me, from these years of experience, is that yes, we do over-estimate the speed of change and under-estimate the impact. It is clear that we could be cashless, cardless and bankless, but there has to be a clear reason, motivation and objective. Most of society do not see a reason to be cashless, a motivation to be cardless or an objective to be bankless. Equally for those that do, such as the crypto libertarians, have you noticed how many crypto folks have lost their investments?

So, here are my predictions:

- there will be bank branches in 2050 (just a lot less of them)

- digital cash will replace physical cash by 2050 (it’s already happening but will take this long due to inertia)

- digital cash will be backed by an authority, which could be the authority of the network [think crypto] or of the government [CBDCs]*

- the checkbook will no longer be issued in America by 2035 (inertia)

- a major fintech will acquire a major bank (think Stripe acquires HSBC)

- a major bank will acquire a major fintech (think JPMC acquires Klarna)

There are many more things I could add ... but the danger of predictions is that they are often wrong.

* I think it will be a mixture of both

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...