FIS with WorldPay just produced an interesting report about the state of global payments.

EXECUTIVE SUMMARY: THE STATE OF PAYMENTS TODAY

In 2023, the Global Payments Report continues its core mission to detail the contours of consumer payment behaviour at checkout both in-store and online, and to offer merchants and the broader payments industry key insights into what’s happening today and how to prepare for tomorrow.

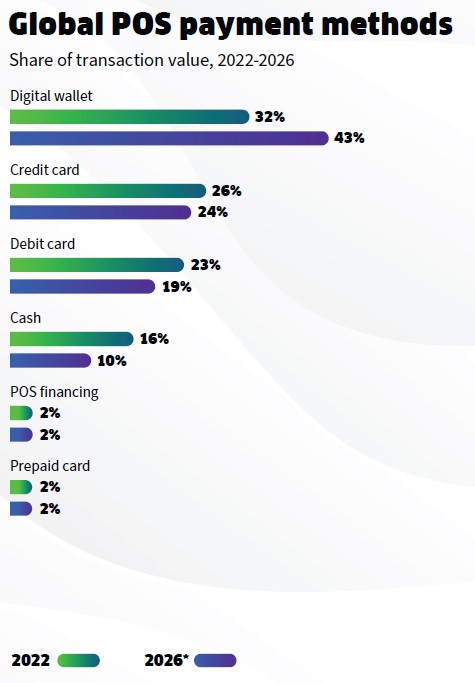

No longer king, cash remains essential. The decline of cash continues with -6% CAGR projected through 2026, as consumers gravitate to the ease, convenience and safety of digital payments. Yet a “cashless society” isn’t on the immediate horizon. Cash continues to play an essential role in most economies, accounting for over $7.6 trillion in global consumer spending in 2022.

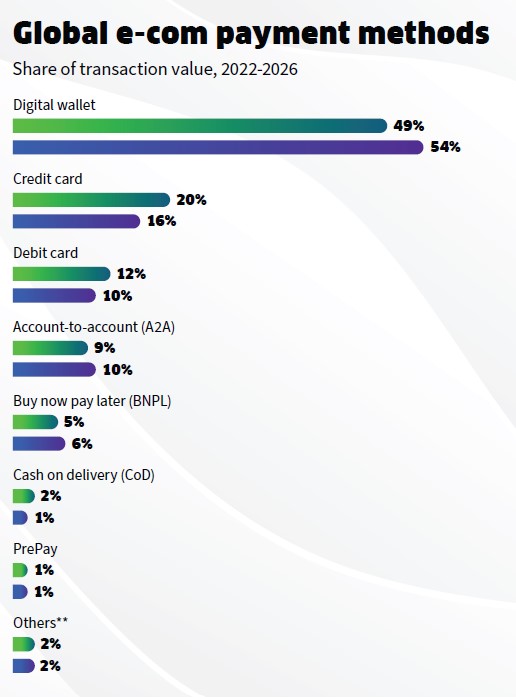

BNPL enters the next phase of its evolution. Following years of unrestrained growth, buy now pay later (BNPL) is facing increasing headwinds. Regulatory scrutiny, interest rate pressure and intense competition are transforming the sector. Yet BNPL remains popular among consumers and represented 5% of 2022 global e-com spend. BNPL “2.0” is likely to see sustained growth amid market consolidation and mainstreamed regulation.

Cryptocurrencies are emerging as a viable person-to-business (P2B) payment option. Cryptocurrencies experienced extreme market volatility in 2022, which served as a headwind against greater acceptance as a P2B payment method. Yet “fringe” still meant over $11 billion in 2022 global transaction value. Consumers are eager to exchange crypto for goods and services, and intermediaries that convert crypto to fiat are making that possible.

Account-to-account (A2A) payments are taking off, driven by real-time payment (RTP) rails. RTP schemes increasingly enable A2A payments from persons to businesses (P2B). A2A is disrupting payment value chains with lower costs of payment acceptance versus cards. Global A2A transaction value surpassed $525 billion in 2022 and is projected to grow at 13% CAGR through 2026.

Consumer use of credit cards remains strong, while sources of credit are diversifying. Despite our forecast of modest share declines, global credit card transaction value continued to rise both in store and online. Credit card spend exceeded $13 trillion across all channels in 2022. Consumers are increasingly paying via credit card funded digital wallets, BNPL and POS financing offered by banks, fintechs and merchants.

Digital wallets extend their dominance. Wallets such as Alipay, PayPal and Apple Pay remain the leading payment method globally in e-com (49% share) and at POS (32% share), accounting for ~$18 trillion in consumer spending. Wallets remain among the fastest growing payment methods with 15% CAGR at POS and 12% annual growth in e-com forecast through 2026.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...