People fear banking collapses and, with five in a week, is this contagion?

In the last few days Silicon Valley Bank, Signature Bank, First Republic, Railsr and Credit Suisse have failed. Technically they are still alive but, realistically, they flat-lined. Is this a financial crisis? No. Each bank had different issues and so I thought I would give a little analysis. I’ve already done Silicon Valley Bank and lead with Credit Suisse today, a bank founded in 1856 (SVB was established in 1981).

Credit Suisse is part of the establishment in Switzerland alongside UBS*.

They are the leading names of Swiss banking which, if you missed it, is very anti-state having been established by the principles of the Knights Templar dating back over a thousand years ago. The formation of Switzerland is all about the protection of the individual and resistance to state controls. Maybe that tells you something about the attitude of Credit Suisse culturally but, more importantly, it is the reason why Switzerland is the heart of private banking and protections of customer information.

It is the reason why anyone who wants to avoid the governments controls goes there. Just watch The Wolf of Wall Street.

These are private bankers. A bit like Vegas, what takes place in Credit Suisse stays in Credit Suisse … but that attitude creates a culture of risk, and Credit Suisse’s culture is proving to be high risk.

Credit Suisse’s culture reflects the Swiss nature of private banking laws, regulations and attitudes. For example, Bloomberg has written (in November 2022) a fascinating review of the bank and its recent history, which identifies four key issues (please note that I am not making these accusations but they are alleged by Bloomberg).

First, the bank’s attitude towards risk-taking. Back in 1990, the bank decided to take on Wall Street by acquiring First Boston. For a while, they were Credit Suisse First Boston, and then became simply Credit Suisse. Thirty years later, did any of you consider Credit Suisse to be a player on Wall Street? They failed to take on Wall Street, even after making this high stakes gamble.

Second, internal controls were awful. One of their own bankers Patrice Lescaudron, who had no banking experience when he joined the bank in 2004, ripped off his clients. “With no clients and no banking experience before joining Credit Suisse, Lescaudron initially spent as many as 10 months a year in Russia hustling for business.” He did get some clients including Bidzina Ivanishvili, a billionaire and former prime minister of Georgia.

Then the 2008 financial crisis hit and Lescaudron had problems with clients losing money. So, he started dipping into Ivanishvili’s account, without Ivanishvili’s knowledge, to use the Georgian’s money to try to win back losses for these other clients. The deceptions were shockingly simple. He cut out Ivanishvili’s signature from a document, pasted it on trade orders and photocopied them. Buoyed by his initial success, his scheme continued and grew.

What surprises me here is that Lescaudron was given verbal warnings and written cautions by supervisors in 2008, 2011 and twice in 2013, for breaching the bank’s compliance policies, but was not called out until 2015. There’s a cultural issue there.

Third, there was the corporate spying scandal brought to light when Tidjane Thiam joined Credit Suisse as their new CEO in 2015.

In something like a scene from a movie, Thiam had an altercation with the head of Wealth Management Iqbal Khan, who was his neighbour in Zurich. Khan made a disparaging remark about Thiam’s garden, and shortly after quit Credit Suisse and joined UBS. This led to worries about corporate dealings and whether Khan might steal staff and share company information, so he was followed by private security hired by Credit Suisse’s COO.

As Bloomberg summarises the affair: Driving through Zurich with his wife, Khan noticed he was being followed. He stopped the car and took pictures of his pursuers with his mobile phone. That led to a physical altercation with one of the men trying to grab the device away. Police were called in, and the men were detained.

Finally, the bank lost a huge fortune on managing the wealth of billionaire Bill Hwang. Hwang’s fortune was managed by Archegos Capital Management, a New York-based investment firm, and it turned out that Credit Suisse had over $2 billion of exposure at risk with their fund. When Archegos said it could not pay its bills, in March 2021, the bank was in trouble. By the time that Credit Suisse understood the mess it had got into, they realised that their losses were around $5.5 billion, more than a year’s worth of profit. It was the blow that tipped the bank into the existential tailspin it’s grappling with today.

Is there a cultural thing here?

Add to this, I am surprised that Bloomberg missed the fifth issue, which was the collapse of Greensill. Last month, the Swiss financial watchdog has ruled that Credit Suisse “seriously breached its supervisory obligations” in its relationship with the disgraced financier Lex Greensill and his companies.

Greensill, which lent money to companies by buying their invoices upfront, collapsed after credit insurers withdrew cover, amid concern over its huge exposure to the steel and commodities tycoon Sanjeev Gupta’s GFG Alliance. Credit Suisse has been trying to recover $10bn (£8.2bn) of funds trapped in Greensill, as well as overhauling its risk management and compliance.

So, I found myself on stage at Finovate this week talking about the demise of Silicon Valley Bank and, at the end, said that old banks can just as easily fall as new banks. There is no relationship between the recent bank failures. There is no systemic failures. There are just banks who have bad cultures and management. In SVB’s case, it was believing interest rates would always stay low. In Signature Bank’s case, it was that crypto was the way to go. In Credit Suisse’s case, it was that they played hard and lost.

Why is this in the headlines now?

Because Credit Suisse’s auditor questioned the banks accounts for the past two years and the Securities and Exchange Commission (SEC) started asking questions. After all the issues above, then the bank found itself in another crisis. This time for mis-reporting its accounts and financial statements for the past two years. In its latest financial accounts, the bank has stated, due to the auditor’s and SEC question, that “as of December 31, 2022, the Group’s internal control over financial reporting was not effective”. PricewaterhouseCoopers (PwC) in the report included an “adverse opinion” on the effectiveness of the bank's internal controls over the financial position of the bank in 2020 through 2022.

Add to the mix that their Saudi benefactors got the wobbles, and said they would give the bank no more credit, and you can see why they have issues. And it is not just the normal issues. The chairman of Saudi National Bank, Ammar Al Khudairy and Credit Suisse’s biggest shareholder, said that the bank wouldn’t boost its share of the bank “for many reasons outside the simplest reason, which is regulatory and statutory.” It is cultural and managerial issues.

And so the bank has tanked but, luckily, has been able to borrow a few dollars ($54 billion) from the Swiss central bank to survive. Even then, the bank is not stable. It has fundamental issues of culture and structure. So, what is the future? Maybe being acquired by UBS. According to JPMorgan analysts a takeover — with rival UBS a probable option for this — is the most likely. Maybe, but what would they be called? SUBS?

Whatever happens, there are still issues as a lawsuit has been filed by American clients over Credit Suisse's behaviour. According to the complaint, the defendants in 2022 made misleading statements or failed to disclose to investors that Credit Suisse was experiencing significant outflows throughout its fourth quarter and material weaknesses with internal controls. This will not go away quickly.

Meantime, there is little difference between Silicon Valley Bank (SVB) and Credit Suisse. SVB was a loss of confidence in the banks strategy and management, and Credit Suisse is a loss in confidence in the banks strategy and management. As stated by Kian Abouhossein, lead analyst at JPMorgan, Credit Suisse’s capital position isn’t an issue, but the situation is about ongoing market confidence issues with its investment banking strategy and future.

The system works … almost.

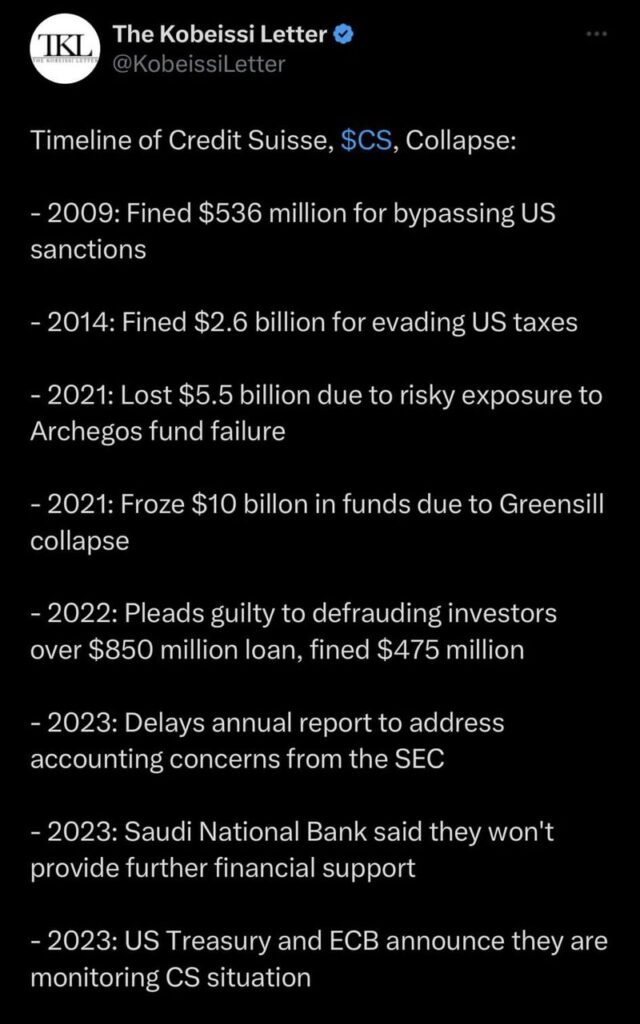

Source: @KobeissiLetter

From Breaking Latest:

Two numbers help to understand the fall of Credit Suisse: in 2007 the Swiss bank was the eighth largest publicly traded institution in the world by market capitalization. But, when its shares dropped 31% on March 15, before partially recovering (-24.24% at the close), the bank has plunged to 155th place, with a market capitalization of around 7 billion Swiss francs, approximately 7.15 billion euros. It means that Credit Suisse has wiped out something like 100 billion francs of capitalization in the last 15 years. At current valuations, it’s like losing a whole Goldman Sachs, calculate the Financial Times.

* UBS is fascinating also, having been formed by an amalgam of Swiss banks. I remember when they merged with the Swiss Banking Corporation in the 1990s to become the biggest bank of Switzerland

** If you are interested, a very good article about Silicon Valley Bank's culture - the opposite of Goldman Sachs - is here in The Financial Times

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...