I’ve seen so many updates about Central Bank Digital Currencies (CBDCs) lately that it’s obviously an inevitability. Maybe …

Bear in mind we have CBDCs and cryptocurrencies. Are the two in competition or complimentary? I think that’s a really important question. The question is: which do you trust more?

Trust in CBDCs is that, because they are backed by governments, they are better. If the system fails, the system will back me up. But then, with cryptocurrencies, if the system fails the network will back me up. Who do you trust more?

Paolo Sironi, a great guy at IBM, posted a recent LinkedIn update on the subject, and made clear that, with a CBDC, you have:

INTEGRITY – the currency must be “safe, for all, at no / ultra low cost”. As entire economies go digital - and cash dwindles away - monetary policies need to anchor to digital technology.

RESILIENCE - It’s not healthy to rely on single foreign sources for critical infrastructure (eg, energy crisis during the war in Ukraine). The Euro system must develop a digital form of money that is based on “digitally resilient critical infrastructure” … as most digital payment solutions are not European.

INTEGRATION - It must be “universally available to all”, anywhere, at anytime, without need of a bank account.

SINGLENESS of money must hold in digital cash as well (but stable coin don’t comply).

SECURITY means a dedicated design since new risks emerge on digital infrastructure.

PRIVACY: The CBDC must be as close as possible to cash in terms of complete neutrality about the data, that means a CBDC as Cash+ bearing similar core characteristics of anonymity. However, no CBDC can be truly “as private as cash” because it can’t be 100% anonymous. Cash will and must always be available to users

Oh, this is all so wonderful … until I read this:

Ms. Warren believes that the belief is in a government-backed coin, not just one that is made up. The thing is that bitcoin and cryptocurrency is made up by the people, for the people, and not by the government, for the government. This is the core of the argument. What backup does the US dollar have over bitcoin? The belief of the people. But if more people believe in bitcoin than the US dollar, what does the CBDC have as its advantage?

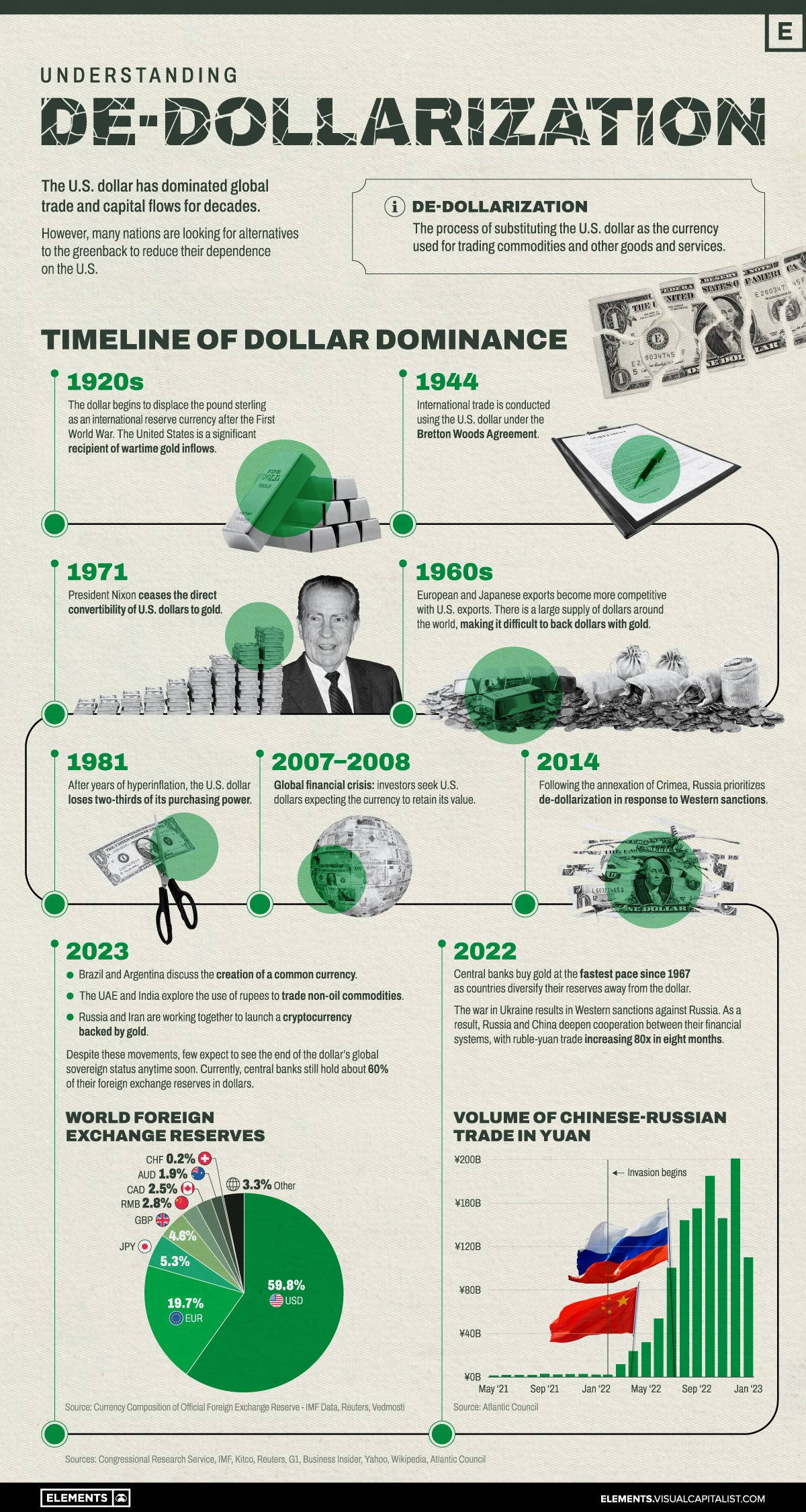

In fact, layering more into this debate is the discussion of de-dollarisation. The US dollar has been the key currency globally for as long as I can remember. Now, maybe it’s not.

De-Dollarization: More Countries Seek Alternatives to the U.S. Dollar

In other words, when you lose faith in your domestic currency, which currency do you use?

Interestingly, for most of those people in world’s where government currencies have been de-stabilised – think Nigeria, Zimbabwe, Venezuela and more – the answer is … bitcoin.

Watch this space.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...