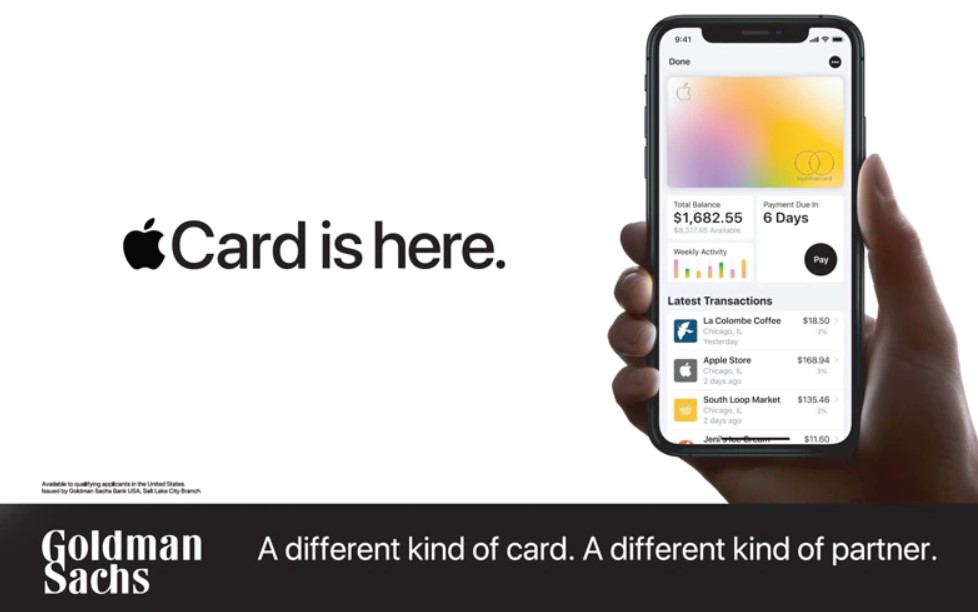

If you haven’t noticed recently, Apple has been making moves into money. They started with a partnership with Goldman Sachs to launch a credit card. More recently, they’ve launched Apple Pay Later, their BNPL (Buy Now Pay Later) service, and then a savings account offering 4.15 percent interest, 10x the national average in the USA. As The Financial Times notes: “the question for banks and other providers of financial services is how worried they should be about a tech company with 1.2 billion iPhone users, a $2.6 trillion market cap and a history of disruptive innovation making moves on to their territory”.

Apple makes more profit than JPMorgan and Citigroup combined just from their subscriptions and Apple Store services. These services are just a fifth of their total revenues. Equally the company has made a special point about privacy. It claims that “every user should have clear insights into how their data is used, and tools to decide when to share their data and who to share it with”. Check it out:

In fact, it’s interesting that Apple has taken this stance, as most others have not. It is a clear differentiation and maybe a USP (Unique Selling Point) for them.

This came to the fore three years ago when the police demanded that Apple provide them with the information on the Pensacola killer’s iPhone. They did not and, according to Apple Insider, Apple won't unlock iPhones or other devices for law enforcement, but it can and will provide substantial data about a user when it gets a subpoena.

This gives them a clear stance and opportunity around trust. I can trust Apple not to compromoise my data or my life. This then gets interesting as trust is a hugely debatable point. What is it that I trust?

Banks think that they’re trusted, but that’s not what consumers or companies think. They may trust that they won’t lose their money, thanks to guarantees by governments and the FDIC and its’ equivalents, but they don’t trust their brands or their leaders.

This is why, for JPMorgan Chase chief executive Jamie Dimon, the risk is clear enough for him to label Apple a bank. “It may not have insured deposits, but it’s a bank,” he said in June last year. “If you move money, hold money, manage money, lend money — that’s a bank.”

Similarly, Stephen Squeri, chief executive of American Express, admitted to analysts on Thursday that he too is “paranoid” about Apple and Amazon, which he called “phenomenal” companies with deep links to the consumer. “We’re not naive enough to think that we can just go on . . . strolling down the street here,” he said. “We think everybody is coming after us.”

The thing is that if Apple was a bank, why does it need Goldman Sachs?

Answer: because the legal requirements of compliance, regulations and risk, means that it’s not worth doing banking for a company famed for innovation and agility. Having said that, maybe the day that I write: Apple acquires Goldman Sachs, isn’t so far away.

Meanwhile, for additional thoughts on this, Andrew Carrier's column is worth checking out.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...