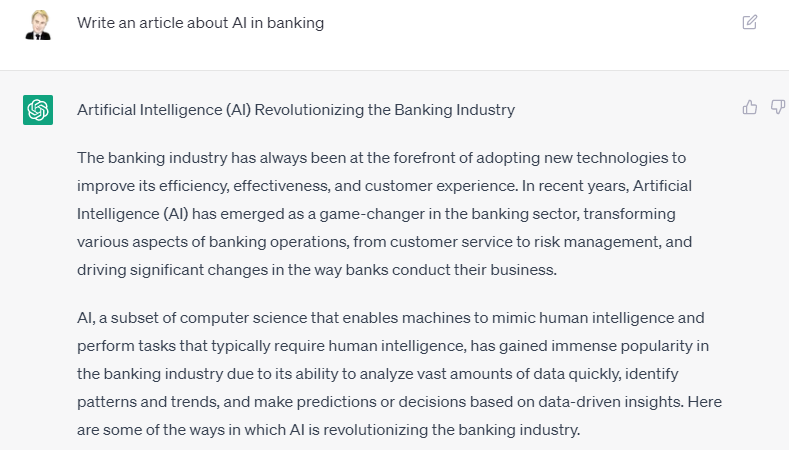

The banking industry has always been at the forefront of adopting new technologies to improve its efficiency, effectiveness, and customer experience. In recent years, Artificial Intelligence (AI) has emerged as a game-changer in the banking sector, transforming various aspects of banking operations, from customer service to risk management, and driving significant changes in the way banks conduct their business.

AI, a subset of computer science that enables machines to mimic human intelligence and perform tasks that typically require human intelligence, has gained immense popularity in the banking industry due to its ability to analyze vast amounts of data quickly, identify patterns and trends, and make predictions or decisions based on data-driven insights. Here are some of the ways in which AI is revolutionizing the banking industry.

- Fraud detection and prevention: AI algorithms can analyze large volumes of data, including transaction patterns, customer behavior, and historical data, to detect potential fraud in real-time. AI-powered fraud detection systems can quickly identify suspicious activities and help banks take proactive measures to prevent financial losses.

- Customer service and chatbots: AI-powered chatbots can provide automated customer service, answering customer inquiries, resolving simple issues, and handling routine tasks, such as balance inquiries, transaction history, and account updates. Chatbots can improve customer experience by providing instant support and reducing wait times.

- Risk assessment and underwriting: AI can analyze vast amounts of data, such as credit scores, financial statements, and market trends, to assess credit risk and automate loan underwriting processes. AI-powered risk assessment can help banks make more accurate lending decisions, reduce manual labor, and streamline loan approvals.

- Personalized banking experiences: AI can analyze customer data, such as spending patterns, investment preferences, and financial goals, to provide personalized banking experiences. This can include personalized product recommendations, investment advice, and financial planning, which can enhance customer engagement and loyalty.

- Compliance and regulatory reporting: AI can help banks automate compliance processes by analyzing transactions, monitoring for suspicious activities, and generating reports to ensure compliance with regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC). AI-powered compliance systems can improve accuracy, reduce risks, and enhance regulatory reporting.

- Wealth management and portfolio optimization: AI can analyze market data, historical trends, and customer preferences to optimize investment portfolios and provide wealth management advice. AI-powered wealth management systems can help banks create tailored investment plans and manage portfolios more effectively.

- Data analytics and insights: AI can analyze large volumes of data to provide valuable insights for banks, including customer behavior analysis, risk assessment, market trends, and forecasting. AI-powered data analytics can enable banks to make data-driven decisions, enhance business strategies, and gain a competitive advantage.

Conclusion

In conclusion, artificial intelligence is transforming the banking industry, allowing banks to enhance customer experience, increase efficiency, and reduce costs. With the continued development of AI technology, we can expect to see even more significant changes in the industry in the coming years. However, banks must also address the challenges and considerations associated with AI to ensure that they are using the technology in an ethical and responsible manner.

... postscript

I couldn't be bothered writing a blog today so I got ChatGPT to do it (maybe Bard coming next week, but it will give the wrong answer apparently)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...