I’ve met many FinTech founders and the one thing they have in common is youthful optimism (even those over 30), but I was taken with an article written by Arwa Mahdawi in The Guardian the other day asking why so many so many under 30-year-old founders face jail.

You see the thing about youthful optimism is that it often lacks experience. It’s a thing I talk about often here on the blog, in terms of FinTech as a parent-child partnership. Finance is the parent that wants to keep the status quo, and ensure everything is safe and sound. Tech is the child, who wants to rip down the walls, paint the ceiling and disrupt everything to create a better future for themselves. Just look at Greta Thunberg.

In the case of many of these bright young things, I am fully supportive. Folks like Greta and others have a right to object. However, do they have a right to run a business? Of course they do! Do they have a right to run a business that could lose millions? Well, yes, but I have reservations. Do they have a right to run a business that could lose billions overnight? OK, now my risk radar rises.

The more exposure and the more at stake I, as a person with experience, want to see safeguards and guarantees. This is especially true when it comes to banking and financial services. The whole reason banking and financial services is regulated the way it is, is to provide those safeguards and guarantees. It is the whole reason why banking and financial services companies have thousands of regulations and compliance services to deal with. It is not a frivolous industry.

It is the reason why it has taken ages for Revolut to get its banking license.

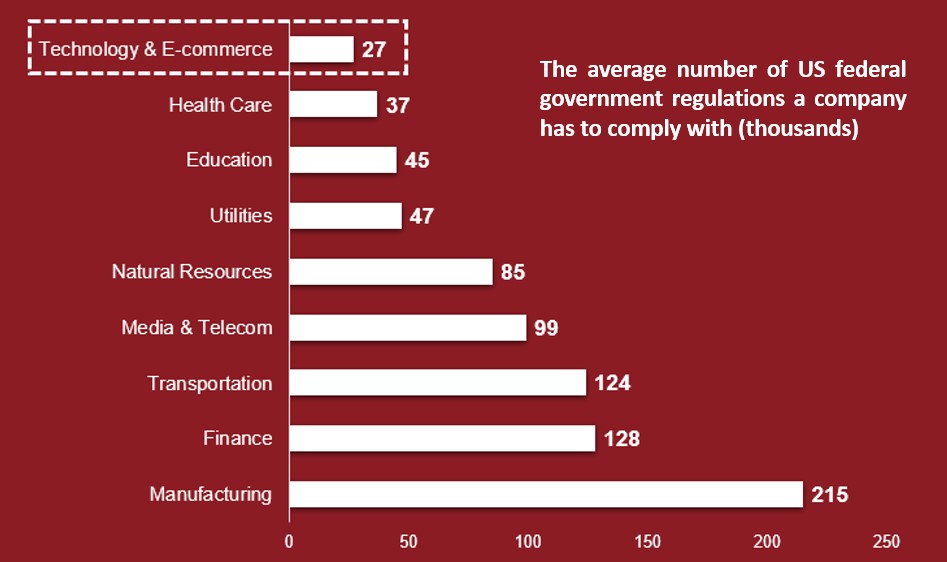

If you are purely providing payments transactions, it is a whole world of difference from providing full deposit-based banking. It is the reason why the average financial institution deals with five times more regulations and laws than the average technology company, according to the Bank of America.

It is also the reason why banking and financial services regulations change every 12 minutes on average, if you deal with a global economy. It is not that bankers ask for these regulations. It is because the system creates them to keep the system strong and stable.

This is also the reason why young visionaries can end up falling on their sword. It may be due to the stress of learning that their vision is flawed; or that the regulator call their business and their practices into question; or that they are just plain fraudulent and illegal.

In the first instances, I know that most FinTechs have tried to balance these issues. They have learned that you cannot just ignore the regulators; that banks work the way they do for a reason; and that they need experience in the business and not just vision. It is why, when I walk into a FinTech's boardroom, I look for someone with wrinkles, as experience at the executive level is required.

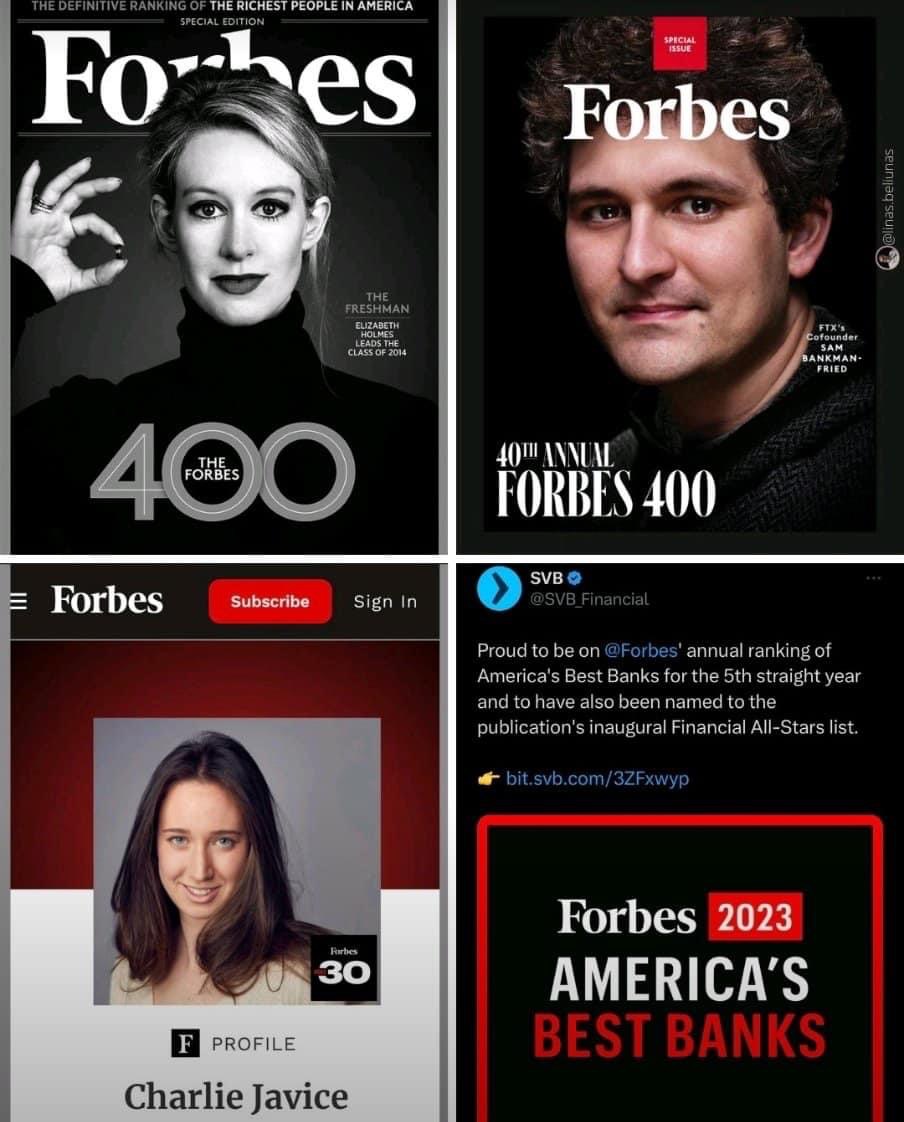

This is why many of the neobanks got slapped down when they go to get their banking licenses, and found that regulators wanted them to show their onboarding checks and balances worked. It is why we have seen quite a few FinTechs wanting to work with large banks to expand their business. It is why many FinTechs have hired bankers to join their executive teams. But Arwa in The Guardian was asking why so many stellar players in the Forbes 30 under 30 list of the most exciting young start-up founders end up in court or jail.

Case in point: Charlie Javice. Charlie is the founder of Frank, an American FinTech that helped students with loans. JPMorgan acquired the company in 2021 for $175 million as it appeared to be amazing! After all, as Charlie posted on LinkedIn, Frank had grown to serve “over 5 million students at over 6,000 colleges” in just four years. Wow! But then it turns out she was allegedly lying. Last week Javice, 31, was charged by the justice department with “falsely and dramatically inflating the number of customers of her company” in order to get JPMorgan Chase to buy it.

According to the lawsuit, she claimed that Frank had five million clients when, in reality, it was just 300,000. The allegation is that she enlisted a data scientist to make up a few million customers and JPMorgan (with their 250,000+ staff) didn’t spot this during its due diligence. Javice denies this fabrication but, even so, faces 30 years or more in prison for separate counts of conspiracy to commit wire and bank fraud.

Question: What was wrong with her?

Answer: Naivety, Arrogance, Narcissism, Pride, Envy, Greed, Deceipt … sounds like the seven deadly start-up sins.

Sam Bankman-Fried (FTX) and Caroline Ellison (Alameda Research) suffered from the same issues, as have many others such as CZ (Binance) and Do Kwon (Terra). I’ve met quite a few of these folks and the consistent theme running through those meetings is a sense of massive ego and arrogance and a lack of limits or listening #justacomment

Anyways, the reason so many Forbes’s 30 Under 30 founders end up in court or jail is that they fall foul of the seven deadly start-up sins.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...