After my blog the other day, about the issue with decentralised finance having a lack of governance – who do you call if you lose your bitcoin? – several readers responded by asking: who do you call if you lose your cash?

But this is the point. People are using cryptocurrencies as an investment asset. They are hodling – the crypto term for holding currencies as a long-term investment – when cash and other forms of currency exist for exchange, not for investment. Cash is for buying stuff, not for hiding under the mattress.

Why do you think that most economies have a huge number of people who buy gold? They’re not using it to buy stuff. They’re using it to invest.

But then people ask me: what happens if someone steals my gold?

The thing about these questions is that, when things are physical and you understand them, it’s easier to manage. Cash, gold, diamonds or other things of value, are easier to manage for the average person on the street than digital assets. In addition, do you really want to use cash, gold or diamonds as your long-term value store?

This is where I take exception.

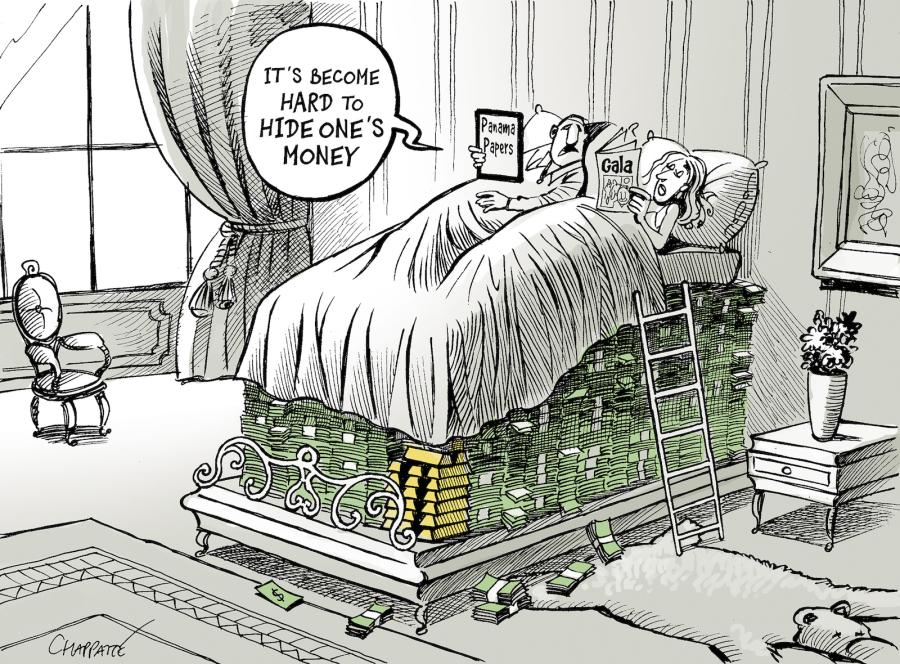

There is a huge difference between something for transactions versus something for storing value. If I use cash, gold or crypto to make a payment, that’s one thing. If I want to keep my investments secure for the long-term, then that’s another. If I buy gold or diamonds or have a huge amount of cash, where do I keep it? If I keep it in the house or under the bed, then that’s the risk I take.

Source: Chappatte

In the same way, if I want to de-risk the situation, where do I go?

That’s the reason why banks exist. Banks exist to manage risk and to take on the risk of your money and investments, and guarantee they are protected. This is the crucial difference between cash, gold, diamonds and cryptocurrency. The latter are designed for transactions; the banks are designed to be trusted stores of value. That’s why they have to be licensed and approved by governments. Without such approval, it’s just a Wild West.

In fact, it amuses me that so many crypto fans talk about cold wallets and managing things themselves, then crying and whining when their wallets fail.

The whole point is that it is fine to make payments, transactions, deals and trade, but that is a far cry difference from investing, saving and looking at holding assets, whether they are physical or digital. If I have am hodling, do I really want to hodl with something that could be easily lost, hacked or breached? Not at all. I want a digital asset custodian. That’s the reason why custodians exist, because they protect my assets.

A custodian bank, or simply custodian, is a specialised financial institution responsible for providing securities services. It safeguards assets of asset managers, insurance companies, hedge funds, and is not engaged in "traditional" commercial or consumer/retail banking like lending.

Source: Wikipedia

In other words, cash, gold, diamonds and cryptocurrency are all fine and dandy. They are all great assets to have. But would you rather store them under the mattress or with a trusted custodian who would guarantee their safety?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...