My friend Dave Birch posted an insightful piece on Forbes the other day. I liked it so much that I asked him if I could share it here and he kindly said yes! Enjoy ...

The Impact Of ChatGPT And Open Banking Cannot Be Underestimated by Dave Birch, Author, advisor and global commentator on digital financial services.

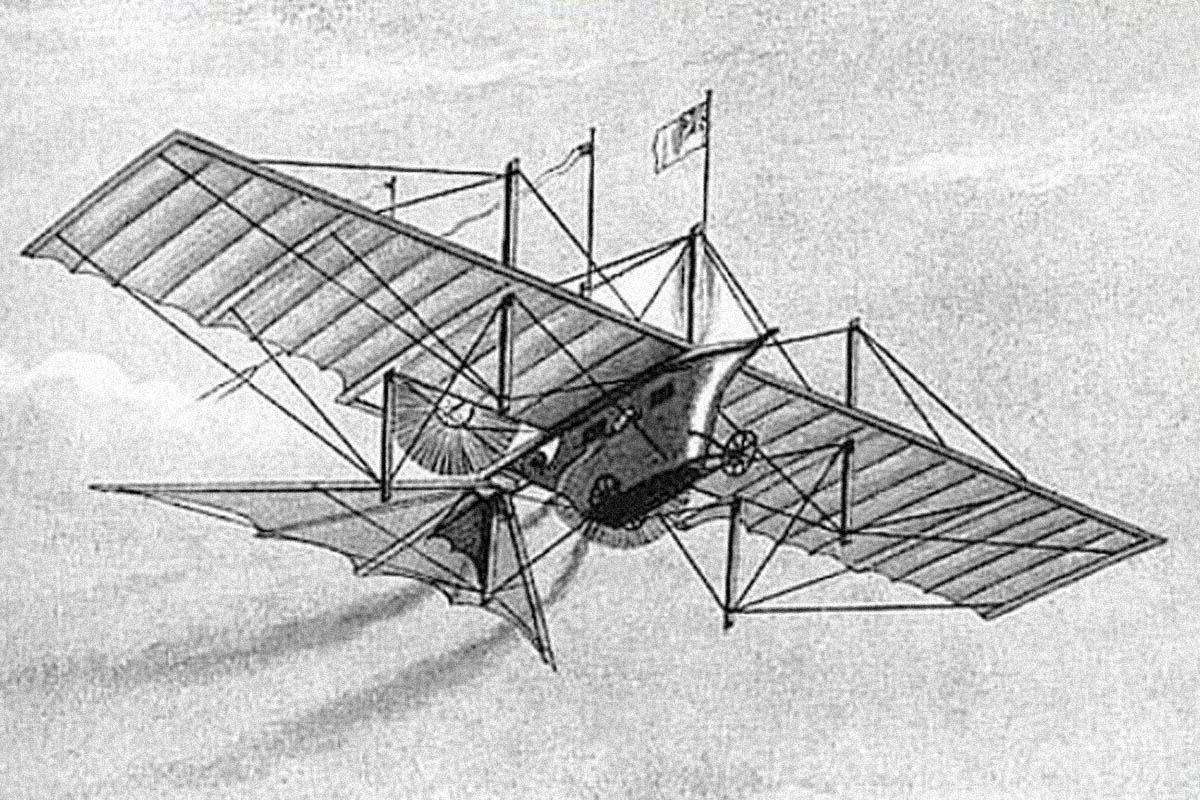

You’ve probably never heard of the Aerial Transit Company, but it should be a business school case study. The company’s directors John Stringfellow, William Samuel Henson and Frederick Marriott presented the British Parliament with a proposal to launch the country’s first airline, with a proposal to fly to Egypt, China and India and a business plan built around air mail services. But the short-sighted politicians turned them down, because the company did not have any airports or runways, pilots or for that matter aeroplanes either, because it was 1843 and they had not been invented yet.

Praise The Tinkerers

Why were these steampunk heroes trying to get permission to run an airline before there were any planes? Well, Stringfellow had been experimenting with balloons for many years before he began working with Henson to build an aircraft. Indeed in 1848 he achieved immortality by flying a steam-powered unmanned proto-drone the length of a local mill, which is why the English town of Chard is celebrated worldwide as the birthplace of powered flight.

(Yes, Kitty Hawk was the birth of manned flight, but the Wright brothers didn’t get it together until 1903 and anyway, after Stringfellow’s revolutionary invention, was it so much of a big deal to put a man on board?)

It is fascinating to me that Henson and Stringfellow went to Parliament some five years before they had a working plane. But I understand the thinking. While they were experimenting, they must have been thinking that even if they couldn’t figure out how exactly to get something heavier than air off of the ground, they were on the right lines and that eventually someone would do it. In which case, they must have reasoned, where was the money to be made? They alighted on air mail as the best business model and founded the company.

(As it happens, they were completely correct. The first customer for commercial aviation services was in fact the US Postal Service, which ran an inaugural service on 23rd September 1911, although the first regular airmail service between New York and Washington did not begin until 1918.)

© HELEN HOMES (2020)

The reason that I was thinking about those forgotten English pioneers was because of Mike Kelly. Mike, who is both an entrepreneur and a fintech nuts and bolts man (and a very nice guy), has been doing some tinkering and built a plug-in to link ChatGPT to his bank account using the U.K.’s open banking APIs. The plug-in, called “BankGPT” can tell you your balance, find transactions, discuss your budgeting and even make payments.

What fascinated me was the responses Mike got on social media, which varied from “have you read OpenAI’s terms and conditions” to “ChatGPT got something wrong when I asked it” to “all software has bugs, you are crazy” and “surely you can look up your balance yourself”. The responses missed the point of Mike’s experiment completely. He wasn’t demonstrating a minimum viable product (MVP) he was demonstrating how simple it is to connect AI and open banking. And he certainly wasn’t suggesting that ChatGPT was a go to market strategy for retail banks!

I think those responses missed the point of Mike’s proof-of-concept. ChatGPT is a window into the future of financial services: while no-one will deliver a consumer service using ChatGPT and Open Banking as they are now, AI and open finance will change retail financial services beyond measure. What Mike’s experiment showed is just how easy it is to connect the two: He’s built the powered drone, now we can start thinking about what we will do when we can all fly.

Financial Services Must Change

What will be the equivalent of airmail services? Well, I think one candidate will be financial health services. In July of this year, the U.K.’s Financial Conduct Authority (FCA) will bring in the delayed “Consumer Duty”, which will fundamentally improve how firms serve consumers. It will set higher and clearer standards of consumer protection across financial services and require firms to “put their customers’ needs first”.

The idea of bots taking over from consumers to help them toward financial health under a duty of care is very appealing, JPMorgan Chase is already developing a ChatGPT-like service (called “IndexGPT”) that uses AI to select investments for customers, and it does not take much imagination to see how this could evolve to access more data sources to help customers make better choices around many different financial services, including those not provided by the bank itself.

What does all this mean? It means that for most people, most of the time, in the not-too-distant future, their financial decisions, transactions and analysis will be performed by bots operating under relevant duty of care legislation with the co-ordinated goal of delivering financial health. Just as it took a few years for the airmail services, conceived before there were airplanes, to become real business so it will take a few years for financial health services, conceived before artificial general intelligence, to end the financial services industry as we know it today.

Follow Dave on Twitter or LinkedIn. Check out his website or some of his other work here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...