Always a controversial figure, Anne Boden has hit the headlines again after stepping down as CEO of Starling Bank. Her announcement of remaining on the Board but no longer being the leader of the bank was originally made in May:

Boden, who owns 4.9 per cent of the bank she founded in 2014, said she would step down at the end of June following discussions with the board about the risk of a conflict. She said she had initiated those talks about six months ago. “Modern-day governance is all about the board setting the strategy and the chief executive carrying it out,” said Boden. “As a major shareholder, that’s very difficult to do if you’re also chief executive.”

At the time, it seemed like a bit of a weak excuse for stepping down and, in June, a little more insight came out in the wash:

Boden’s decision followed a clash with investors over fund manager Jupiter’s decision in February to sell its holding in the bank at a price that cut Starling’s valuation from £2.5bn to between £1bn and £1.5bn, according to people familiar with the situation.

Now, there’s a little bit more insight appearing:

One former employee of Starling said there was internal scepticism about whether Boden, who some consider a retail banker at heart, could oversee the switch to a tech-focused business.

Having known Anne for a long time, she is a banker at heart. She would admit that. But she created a bank based upon technology to challenge the banks who didn’t get what technology could do. An abrasive character – some would liken Anne to Marmite, you either love her or not – she created a challenger bank that has been incredibly successful. Yet, it is also a schizophrenic bank. On the one hand, it a bank for consumers and small businesses that has found a strong niche in the UK; on the other, it is a bank that has developed its own suite of technologies that are sold to other banks around the world.

It is (a) a bank, and (b) a bank that offers Banking-as-a-Service.

Their BaaS system is called Engine, which they describe as a cloud native, full featured, and flexible SaaS banking platform. Build your financial products on our software.

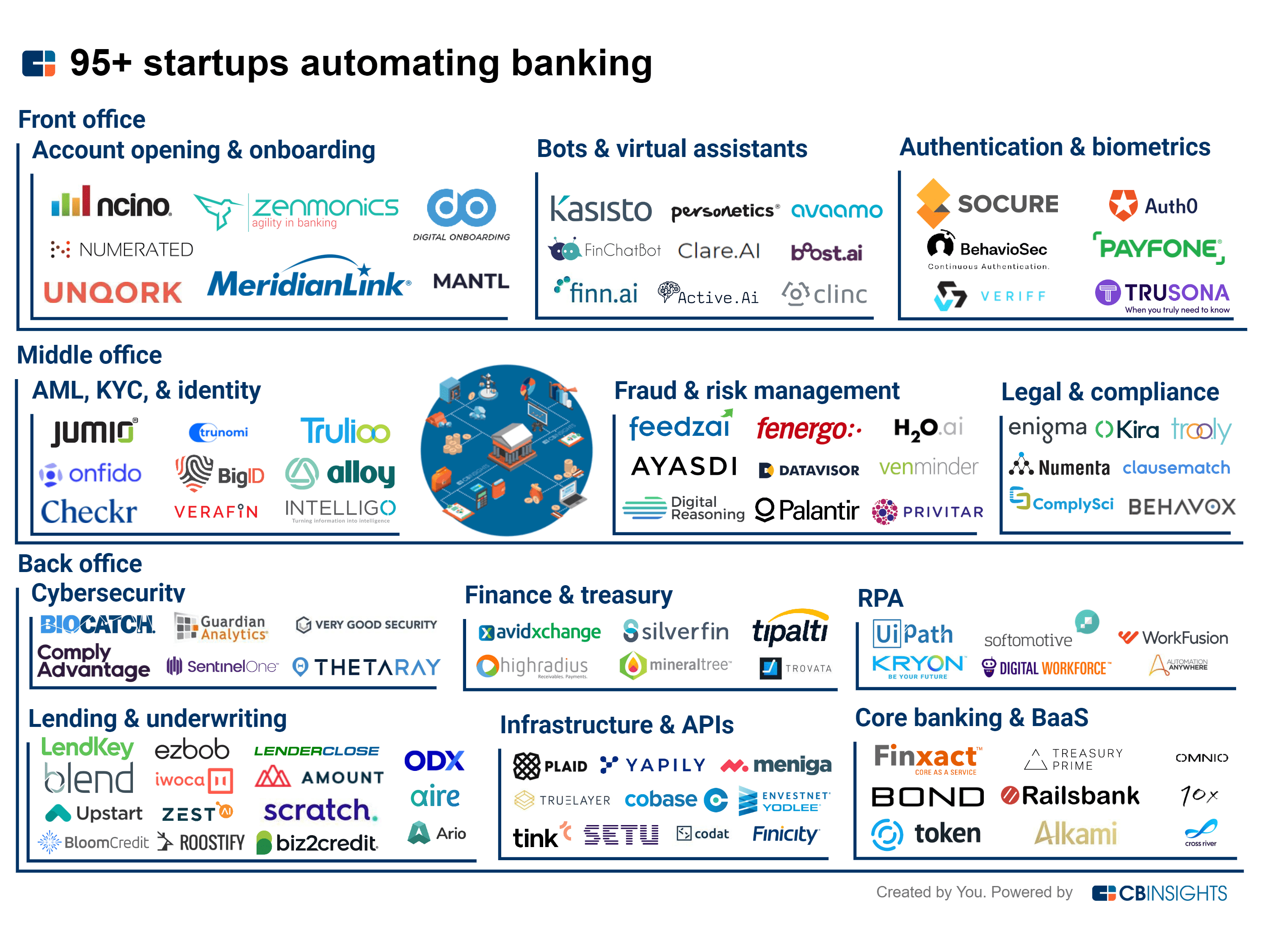

What’s interesting about these developments is that you now have a bank that wants to challenge mainstream banks in Britain – the original intent – and a technology company that wants to challenge all other providers from 10x to FIS. In fact, if we discuss BaaS, it is a very crowded space today:

This makes it clear that either agenda is a big ask. Doing both agendas seems a bit like asking to land on Mars whilst, on the way, dropping a package on the Moon. Surely would it not be better to achieve one and then consider the other? Or maybe, and more likely, the executive of Starling felt they had achieved the challenger status in the late 2010s and decided that international expansion would not be easy so, instead, why not sell their technology assets to overseas banks instead? The Financial Times expands on this question:

The hope is that Starling can recreate itself as a highly valued tech-focused company by licensing its own banking platform, Engine, to other financial groups. “Their long-term strategy is the tech, not the bank,” said one former senior employee. “Starling Bank might become a spin off but the primary business model is to franchise out the tech stack.”

In reading the reports of what is happening, it seems to be that Starling has moved from a clear, laser-focused company determined to build a strong new UK bank to a diffused and more fragmented vision of being a strong UK bank that sells its capabilities to non-UK banks as a technology developer.

For more background, go checkout confused.com.

Postscript: it did amuse me that as I found Starling is looking for Anne's successor, so is Tibet:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...