A new Pew Research report documents that, in 2021, 68% of 25-year-olds were living outside their parents’ home, 22% were married and 17% had a child, according to a Pew Research Centre analysis of the most recently available Census Bureau data. In 1980, 84% were living on their own, 63% were married and 39% had a child, the report said.

I find this interesting as, back in the day, the expectation was that you grow up, get a job, get married, have children and the job would last you your whole life. How life has changed. These days, it is far more likely that you grow up, get a job, create a start-up, find a partner who you live with until the day you don’t want to live with them.

The demographics and, more importantly, the psychographics of life have also changed immensely in the last half century.

Strangely enough, even with all of these changes, the situation with money is not much different. Pew found that 60% of 25-year-olds were “financially independent” in 2021, compared to 63% in 1980. Most intriguing is how male and female finances have changed. 56% of 25-year-old women were financially independent in 2021 compared to 50% in 1980. Men are faring worse — only 64% are financially independent, compared to 77% in 1980.

Interestingly, about 63% of 18 to 29-year-old men reported being alone in 2022, a 12 percent increase from 2019, whilst only 34% of women in the same age group reported being single, a small 2% rise from the pre-pandemic era. Experts have warned about this trend, suggesting the end of traditional male roles, with porn and COVID lockdowns being blamed as responsible for this trend.

It then raises the question around what is a traditional male role versus female?

My father was the breadwinner and my mum was the homemaker. These days, some of that traditional view is still around but more and more women are doing their own thing (and good for them).

In other words, what these reports make clear is a movement in several directions.

First, women are more independent, which is fantastic.

Almost half of Americans over 18 are single according to the U.S. Census Bureau but, for women, 52% of them are unmarried or separated as of 2021 and the share of never-married women increased 20% over the past decade, according to according to a recent report from Wells Fargo.

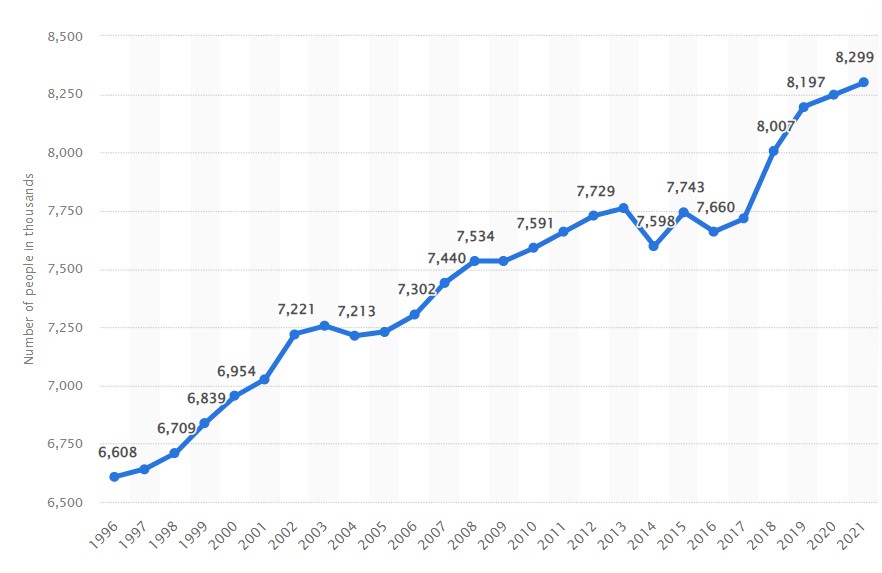

Second, many of these women are living alone. In a UK study by the UK’s Office of National Statistics , the number of people living alone in the UK in 2022 was 8.3 million, or 30% of all households, and the majority (53%) of these households were women living alone.

This has changed a lot over the past years:

Source: Statista

Third, with the rise of LBGTQ+, the choice of relationship and home has changed. For example, an estimated 3.1% of the UK population aged 16 years and over identified as lesbian, gay or bisexual (LGB) in 2020, an increase from 2.7% in 2019 and almost double the percentage from 2014 (1.6%).

Finally, it means that there are big implications on those who have no kids or are lone parents. Today, one-in-four children live in a lone-parent family compared to just one 1-in-20 in the late 1970s.

What this means, if you are a financial provider, is a recognition that things have changed dramatically. It is no longer Mr and Mrs but he/him and she/her. It is a world where single homes with no children are growing, and mortgages and lending need to change to reflect this. It is a world where the views of the past must move to the views of the future.

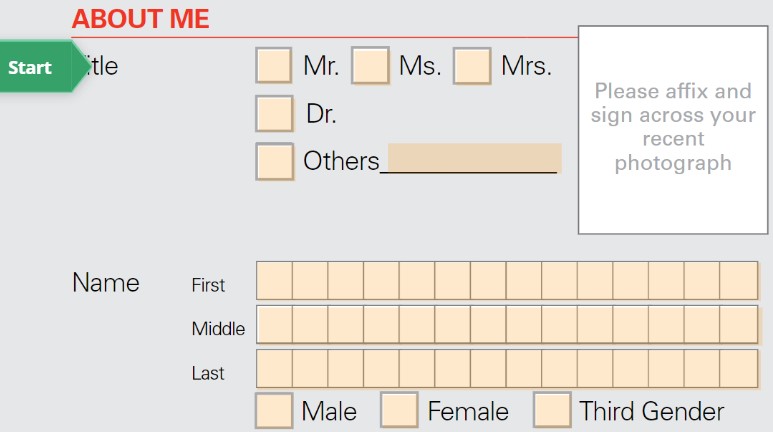

That’s why I find it weird to visit a bank credit form and see this:

I think it shows some schizophrenia as the form first asks me if I am a Mr, Mrs or Ms, and then offer the opportunity to identify as a third gender. It's 2023, so surely they should be asked how I want to be addressed? He/him, she/her or they/them?

Banks need to think about how the world is changing, how the needs for finance are changing and how young people will live their lives which is 1000% different to how most people marketing finance have lived theirs … maybe.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...