I’ve blogged several times that, as people move to online everything, the retail main street stores and shopping malls are dying. In a similar fashion, bank branches are closing faster than ever and becoming restaurants or coffee houses

So, inevitably the question has to come up: what about the post-pandemic City?

Bloomberg reports that “oversized financial centres like Canary Wharf, La Defense and Frankfurt’s US-style downtown are facing massive, high-risk investment to avoid becoming ghost towns”. This is because there is a reversal trend from having massive high rise head quarters to more boutique, smaller offices. The aim is to make the bank office more desirable to attract employees to spend time there and see high-end desirable properties in London’s Mayfair and Paris’s 7th arrondissement — home to the Eiffel Tower — booming, whilst the steel and glass edifices of the past quarter century of emptied.

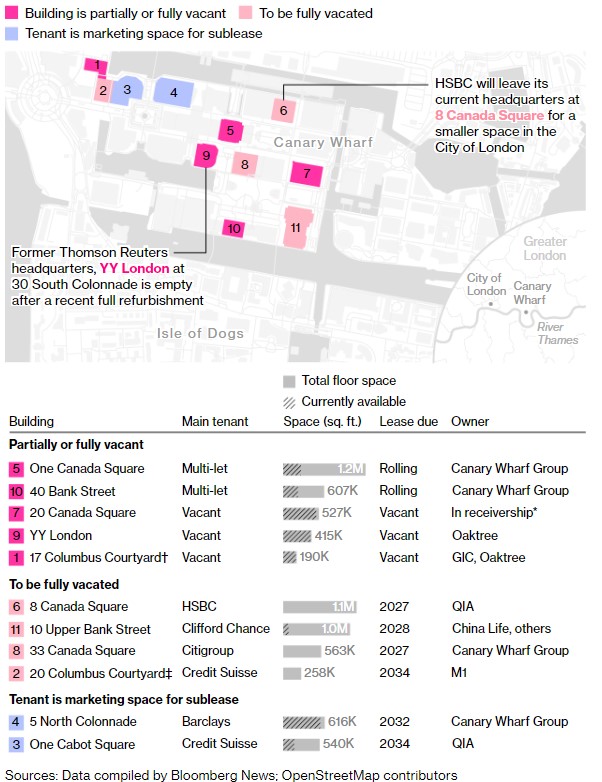

Canary Wharf is a good example. Millions of square feet of office space in several of the main buildings in the district are empty.

Is this the canary in the coalmine*?

About 15% of the office space in Canary Wharf is empty, well over double the 6% rate in London’s West End, according to CoStar Group. figures from the real estate data provider show. Similarly, over one million square meters of space lies vacant in Germany’s financial centre. That’s equivalent to more than eight times the space in the Commerzbank tower, Frankfurt’s largest office building. In La Defense – 5 kilometres (3 miles) from the Arc de Triomphe – vacancy rates hit 20% at the end of the first quarter 2023, compared to 3% in central Paris. The owners of the Tour Eqho in La Defense must be nervous as they wait to see if KPMG, which occupies almost 60% of the building, decide to vacate. Nervous? Well, of couse as a loan used to finance the purchase of the building matures in 2026, and upgrades are looming for the 40-floor tower built in 1988.

What’s the strategy going forward?

Well, it seems more restaurants and hotels is one priority, but turning a bank’s old HQ into a hotel won’t be sustainable if no-one wants to be in the area?

“HSBC’s global headquarters at 8 Canada Square faces uncertainty after the bank decided to leave in favour of a smaller office space in the City of London. The 1.1 million-square-foot building is in need of significant upgrades to meet energy-efficiency rules and lure new users. But the bigger the building, the higher the cost of modernising. Applying similar costs per square foot as the proposed 20 Canada Square project, upgrading HSBC’s 45-storey building would run about £250 million. The question is whether such undertakings will ultimately pay off when even fully refurbished buildings in Canary Wharf are struggling. The recently completed YY building — a total overhaul of the former Thomson Reuters headquarters — has yet to secure tenants.” [Bloomberg]

They say property is always gold, but if you have an empty building with high costs and zero tenants, well, that isn’t positive.

Will the new world of working from an office rather than working from home or in a nice office become the norm?

* coal miners used to take canaries down with them so that if there was any gas emissions, the canary would die first and warn the miners of danger. The analogy has been used ever since as an early predictor of danger.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...