Thinking about money being inside my head, it already is in many ways. When I go around paying for things, I’m not focused upon my balances but on living my life. In the back of my head is that awareness that debits are going down and credits up, but the actual numbers are generic and not specific.

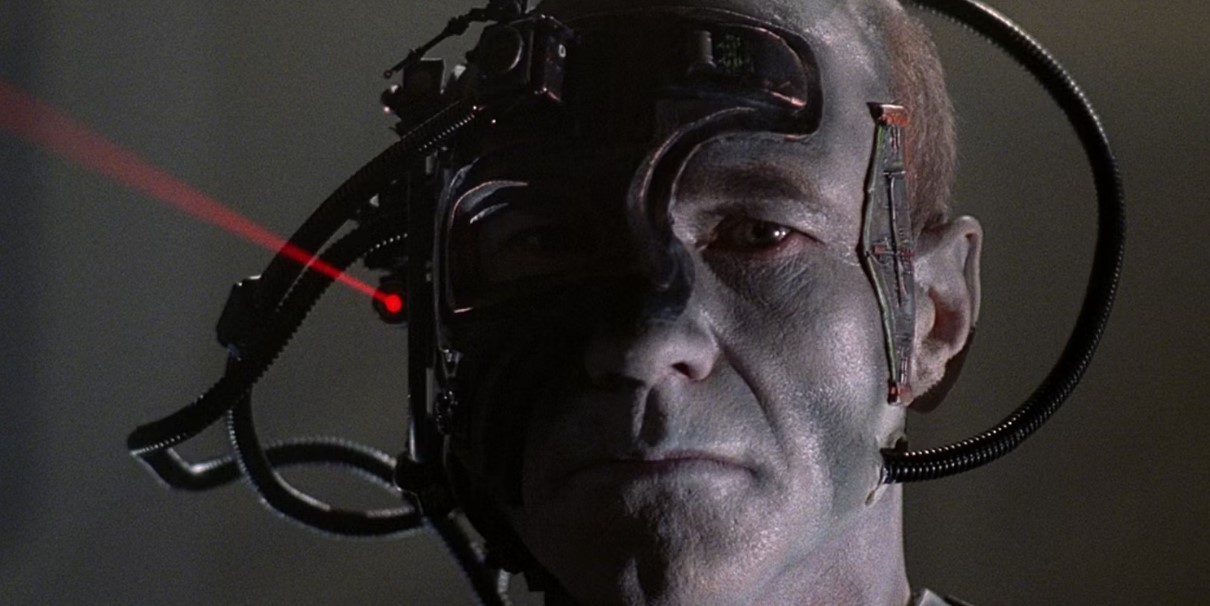

What if the future world makes it far more specific so, in the back of my mind, I can see every account balance increasing and decreasing in real-time. What if the system then takes this a step further and starts giving me red, amber and green lights for my financial lifestyle? We already have these of course – it’s called credit checks – but what happens if my lifestyle is adjusted during these checks on my brain and my spending? What if I’m a gambling addict and, rather than selecting to block gambling platforms, the bank decides to do it for me based upon forward projections of my lifestyle spending? What if I’m an alcoholic, and the embedded, invisible, monetary system decides to block my ability to buy alcohol? What if I have cancer, and so all unhealthy activities are switched off, including access to the food I love, which the system has decided are bad for me?

You get the picture.

Take another angle: authentication and verification. Now that the financial service is embedded in my brain and, therefore, my body, what if the system needs an authentication? It no longer needs a biometric based upon face or finger. It can use blood pressure, blood flow, heart rate and even my DNA!

The positives of embedded, intelligent finance are clear but so are the negatives, and they are all the same negatives as the current system, namely, how intrusive is this? Is Big Brother here and now or is it just a gradually developing process of assimilating us all?

This argument has raged for years, and the truth of the argument is balance. The balance between ease of living, convenience of money and the benefits of not having to think about things; versus the centralising tracking of who we are, what we are doing and how we live.

In other words, intelligent, embedded finance might appear to assume that the centralised authorities – banks and governments – can track and trace our real-time lives, 24*7. But that would be an incorrect assumption as my brain implant that embeds me may just as easily be my decentralised pocket of the networked universe.

The future is both exciting and scary but, as always, the key thing to remember is that it is you and me creating it. The future is the only thing you can change. Make it your change.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...