Times change.

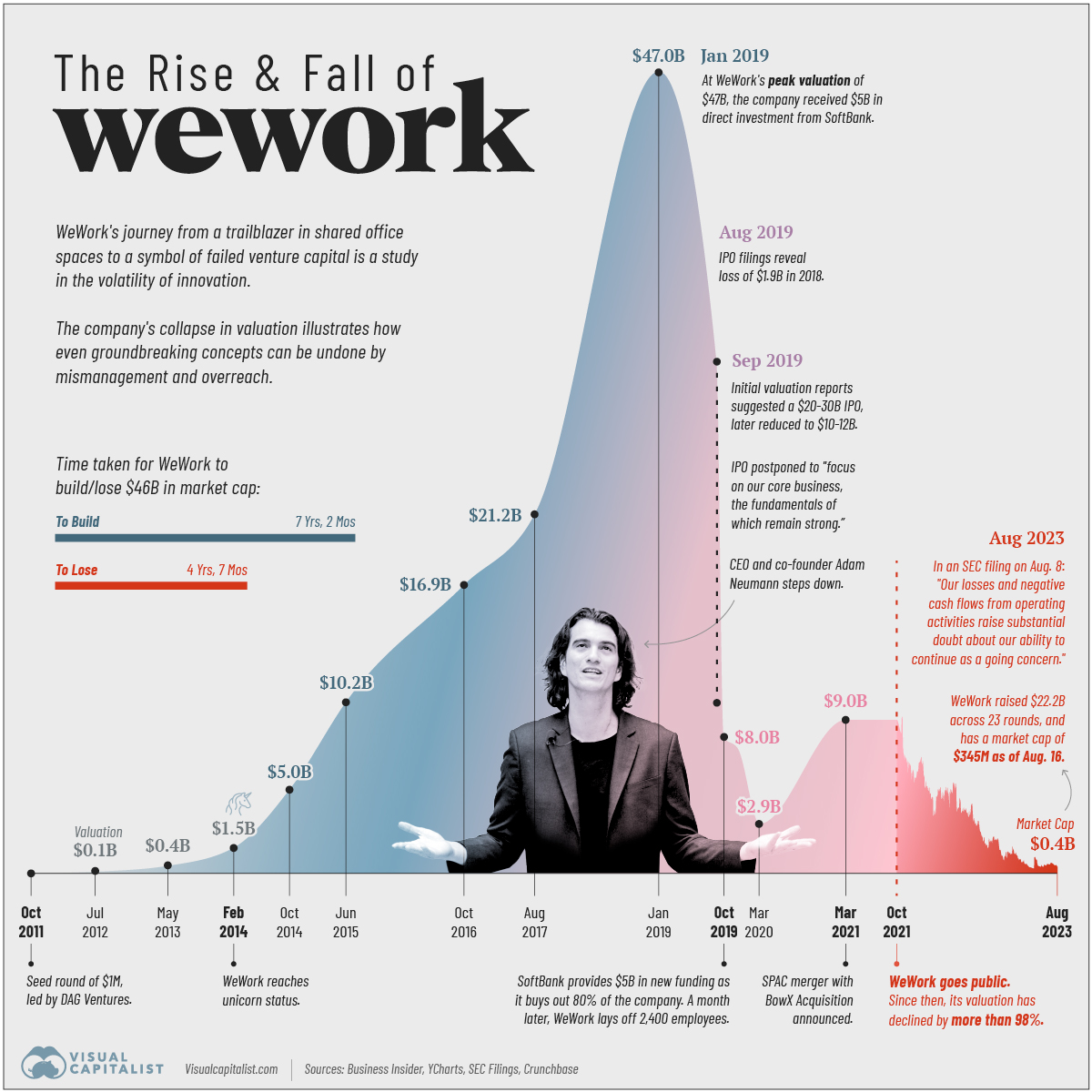

We can see that from the massive success of some firms, like NuBank, that there is good news out there in some parts of the world. Having said that, 2023 seems to be blighted by an awful lot of bad news. A company regularly picked over by the media is the massive failure of companies like WeWorks, who have seen their valuation go from stellar to bellar in the period of months.

Source: Visual Capitalist

In FinTech, there have been a few similar instances. Maybe one of the biggest ones is Adyen, whose share price sank 40 percent the other day, wiping over $20 billion off the value of the company. I guess people realised that it was 'just' a payments company, and making money on interchange is not the future (take note PayPal et al).

Equally, I was struck by Aspiration, a company who seemed amazing but has struggled recently. In mid-2021, the company had struck a deal to go public via a special purpose acquisition company (SPAC) that would bring in more than $400 million in fresh capital and value Aspiration at $2.3 billion, creating a tidy gain for its backers who included star names from Leonardo DiCaprio to Drake, Cindy Crawford, Robert Downey Junior and Steve Ballmer.

But then internal feuds abounded, downloads plummeted and investment stalled. The future of Aspiration is now very uncertain.

In a similar fashion, at the end of last week, Mortgage FinTech Better.com launched in a flurry of misery. The share price tanked on launch or, as Fortune describes it: “suffers epic SPAC disaster as shares nose-dive over 90%”. This is a company that two years ago had planned to go public at a $7.7 billion valuation.

It is a little like other areas from cryptocurrencies to the activities of all of those special-purpose acquisition companies (SPACs). There’s hype versus reality.

It kind of reminded me of looking at the Fuxi stair ladder in China. Here is the typical view of this bridge:

It looks epically scary, frightening and amazing. Who would walk up a thing like that? Well, the reality is a little different.

(Photo by Liu Peng/China News Service via Getty Images)

It may still be scary, but nothing like the original. So, what’s the solution? Well, it starts with reality versus fantasy. The fantasy is a company growing fantasmagorically. For example, Aspiration grew from roughly 1.5 million customers in early 2020 to five million “purpose-driven members” in the summer of 2021. But those user numbers weren’t quite what they appeared to be. Like other tech startups eager to tout growth above all, Aspiration was referring to the total number of registered emails it had, regardless of whether the customers ever used the product. As of June 2021, it had just 592,148 funded accounts.

Meanwhile, the startup spent extravagantly on marketing to hit aggressive growth targets. In its pitch to go public, Aspiration planned to spend $149 million on marketing in 2021, even though it expected to take in just $98 million in revenue. All this in the position of laying off large tranches of staff.

Tough times indeed but, with all start-ups from Aspiration to Better, the question is fantasy versus reality.

Postscript:

Ansaf Kareem wrote a good article about this area on Medium earlier this year: The Alchemy of FinTech Valuations

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...