I’ve known some companies around the fintech space for years, one of which is Backbase who have kindly invited me to speak at a couple of their events in Q4 (Amsterdam, Bangkok). The theme they are promoting is to dream big or, as Backbase's CEO, Jouk Pleiter, puts it: “the idea is a big endorsement and encouragement to our banking clients to think big and bite the bullet”.

Hmmm … I would love this to be true. It is the message I’ve been sharing for over a decade or more. In fact, when looking back at my books of the last decade, the theme has progressed and evolved, but always comes back to the same thing: you cannot build a digital bank on a physical bank’s business model.

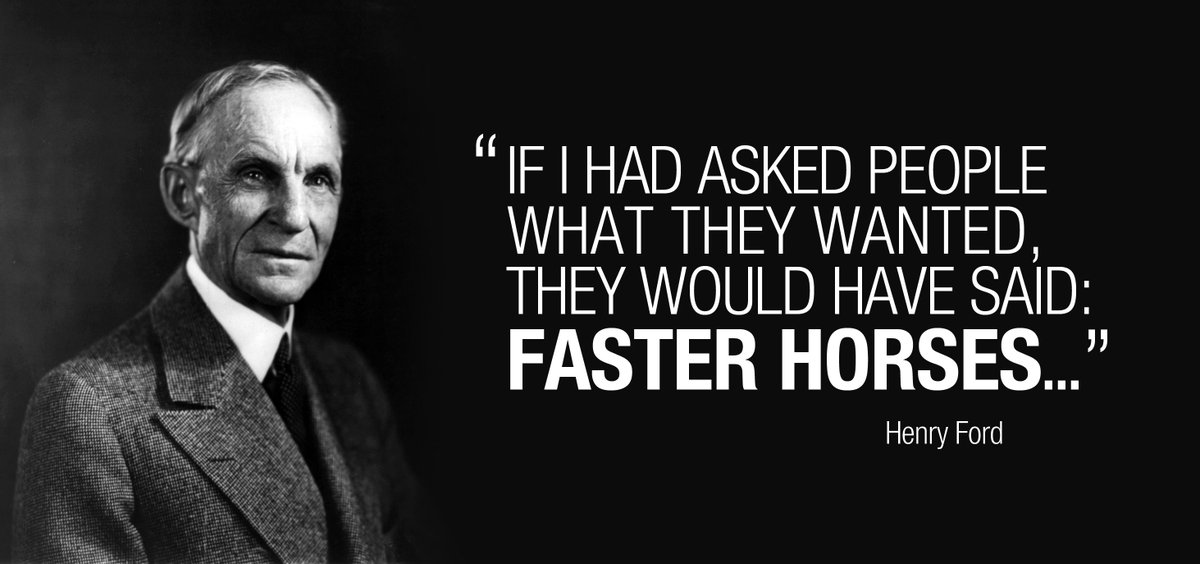

Funnily enough, there is a reference in several books to the whole Henry Ford quote about faster horses. The key to that quote is stop trying to add technology to what worked before. Start thinking about what could work in the future instead. For example, I stumbled across this image the other day …

… and really liked it, as did my LinkedIn friends.

The message? I offered to help, but the bank told me they were fine doing their own digital transformation project.

So, what’s the big deal here?

The big deal is that, even now, many financial firms are trying to bastardize their old structures to accommodate the demands of new digital media, and it’s not working. Some are doing better than others, but any firm that layers digital on top of physical is failing. You can see this in every industry from retail to manufacturing, but banking and finance, as it is so reliant upon technology, is the industry that really highlights when things do and don’t work.

These themes were explored in depth when I wrote Doing Digital and a review that stands out on Amazon kinda repeats the themes above:

Are traditional banks just producing faster horses?

According to Skinner, many banks are changing but in the wrong way, because they are trying to evolve its old way of doing things from industrial to digital without fundamental rethinking. They have not realized there is a need for drastic, transformational change, not just an evolution of what has been around before.

Anyways, if you want to know more, I’ll be at Backbase Engage on October 11 (Amsterdam) and November 8 (Bangkok). Register and join now.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...