When Open Banking launched in the UK, it got a drubbing from the media (I blogged about it). The issue is that the media and banks believe that sharing your financial data will compromise your security. That attitude still persists today, which is why Open Banking hasn’t really taken off.

By way of example, five years after Open Banking launched in the UK, the FCA (Financial Conduct Authority) reports that only seven million people are active users of Open Banking. But what does that statement mean? I ask myself this question as an active user of Open Banking could mean someone who registered with Google Chrome or Microsoft Edge with their credit card autofill. Is that really what Open Banking is all about?

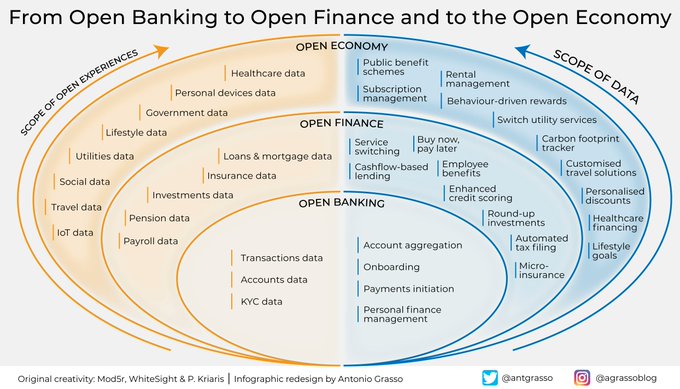

For me, Open Banking is about building data values into financial values. It means that, as I spend and save, data is enriched about financial transactions. It means that I can be immersed in understanding how my life is influenced by money. It’s about creating intelligent money.

So, we can see the detailed stats about Open Banking (checkout the Open Banking Limited’s report) but the challenge is still the same: do people want it?

Answer: no.

The reason being that it is called Open Banking. The very label implies that your are opening your most secret service – your bank account – to others to plunder.

A recent Raconteur report makes clear: the term ‘open banking’ has not helped when it comes to encouraging take-up. This is because people don’t understand what open banking is. Tony Craddock, Director General of the Payments Association, is quoted as saying that: “there are two main factors preventing the widespread adoption of open banking. First, there’s no strong incentive for consumers to use account-to-account payments instead of card payments. Second, there are concerns about the degree of consumer protection in open banking payments.”

This has been the issue from the start: can you trust Open Banking?

The answer is obviously yes as, otherwise, the regulator would not have allowed it, but people just don’t like it. Why? Because it sounds insecure.

The core issue is that banking and finance is being ripped open by technologies to ensure better service, data enrichment, machine learning, more knowledge … but to achieve this, the service is no longer delivered by one company: a bank. It is delivered by multiple service providers through apps, APIs and analytics. That’s what Open Banking is all about. It just has the wrong name. We don’t want Open Banking. We want Closed Banking.

We want banking that is bulletproof, secure and completely closed to access from anyone but me.

There’s the rub. Open Banking is called the wrong thing. We need to rebrand it. To be honest, if we had called it Better Banking, that would be the way to go.

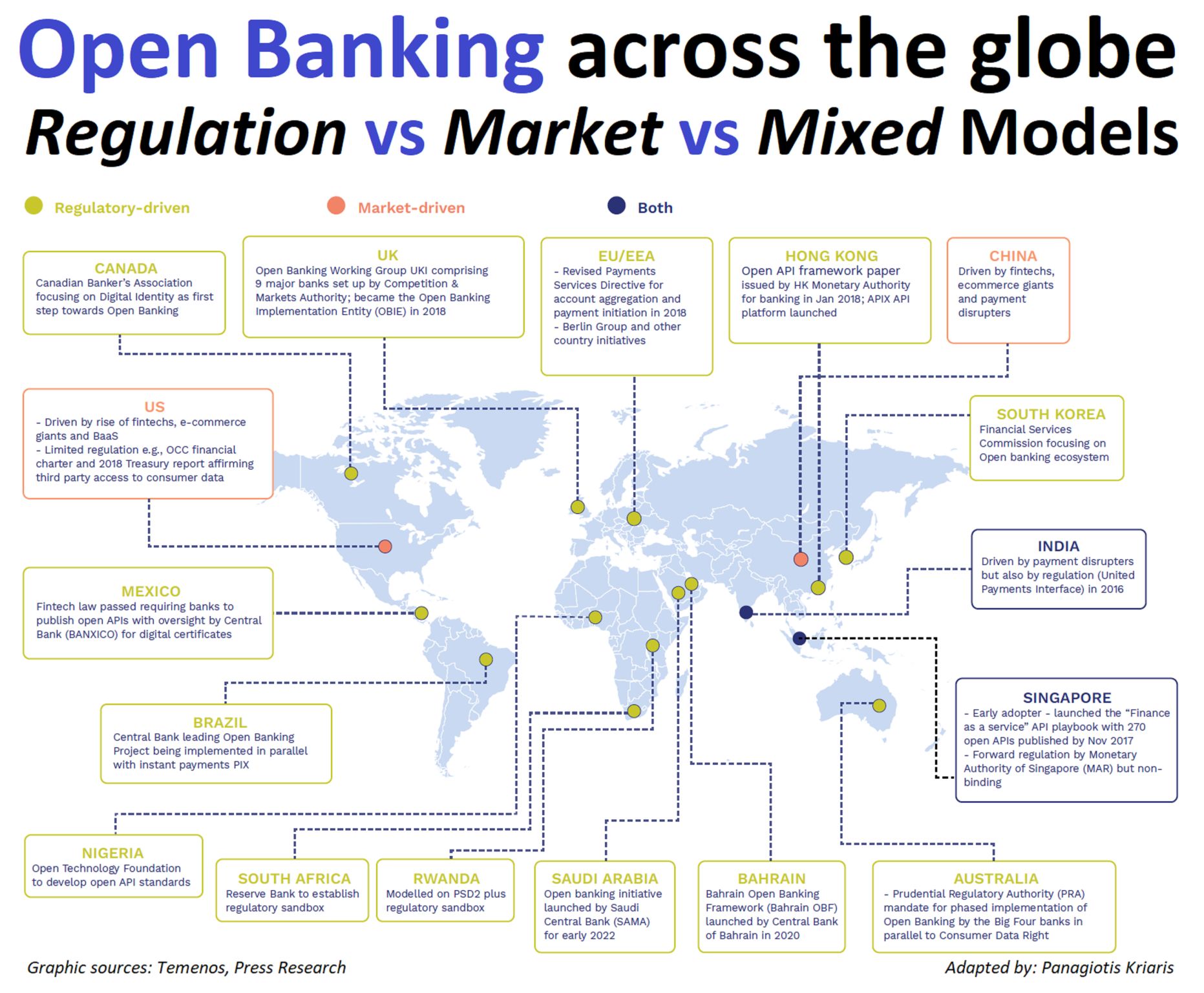

Anyways, meantime, here is a nice chart from a couple of friends (Panagiotis Kriaris and Antonio Grasso) ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...