It’s coming. It’s been talked about for years. It’s finally here. Tokens. Physical and digital assets are being tokenized. In fact, maybe your DNA has been tokenized. Soon, everything will be tokenized.

We talked about this years ago, but it’s notable that VISA, SWIFT, BNY Mellon and JP Morgan are now tokenizing. In a number of recent announcements, these traditional financial institutions have stated their intent to tokenize (whether on purpose or not).

VISA have a website dedicated to the subject: “There’s beauty and power in simple concepts. Like replacing sensitive data with tokens to make digital payments more secure. But scratch beneath the surface and powerful technologies enable tokens to do so much more than reduce payment fraud”.

SWIFT announced that they had performed a series of “experiments that show its infrastructure can seamlessly facilitate the transfer of tokenised value across multiple public and private blockchains. … Swift collaborated with several major financial institutions on the experiments, including Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX) and The Depository Trust & Clearing Corporation. Chainlink was used as an enterprise abstraction layer to securely connect the Swift network to the Ethereum Sepolia network”.

Bloomberg reports that “JPMorgan Chase is in the early stages of exploring a blockchain-based digital deposit token for speeding up cross-border payments and settlement, according to a person familiar with the work. The US’s biggest bank by assets has developed most of the underlying infrastructure needed to run the new form of payment, but wouldn’t create the token unless the project is approved by US regulators”.

And BNY Mellon produced a nice report, where they surveyed over 270 institutional investors about their attitude to digital assets. The result? 97% agree that tokenization will revolutionize the asset management industry.

What this demonstrates is the increasing acceptance of traditional financial firms to move from physical assets to digital assets. This has been noticeable for some time, as banks announce more and more often that they are happy to store digital assets. From State Street to RBS, banks are more and more willing to work with blockchain and digital asset servicing … now using tokenization.

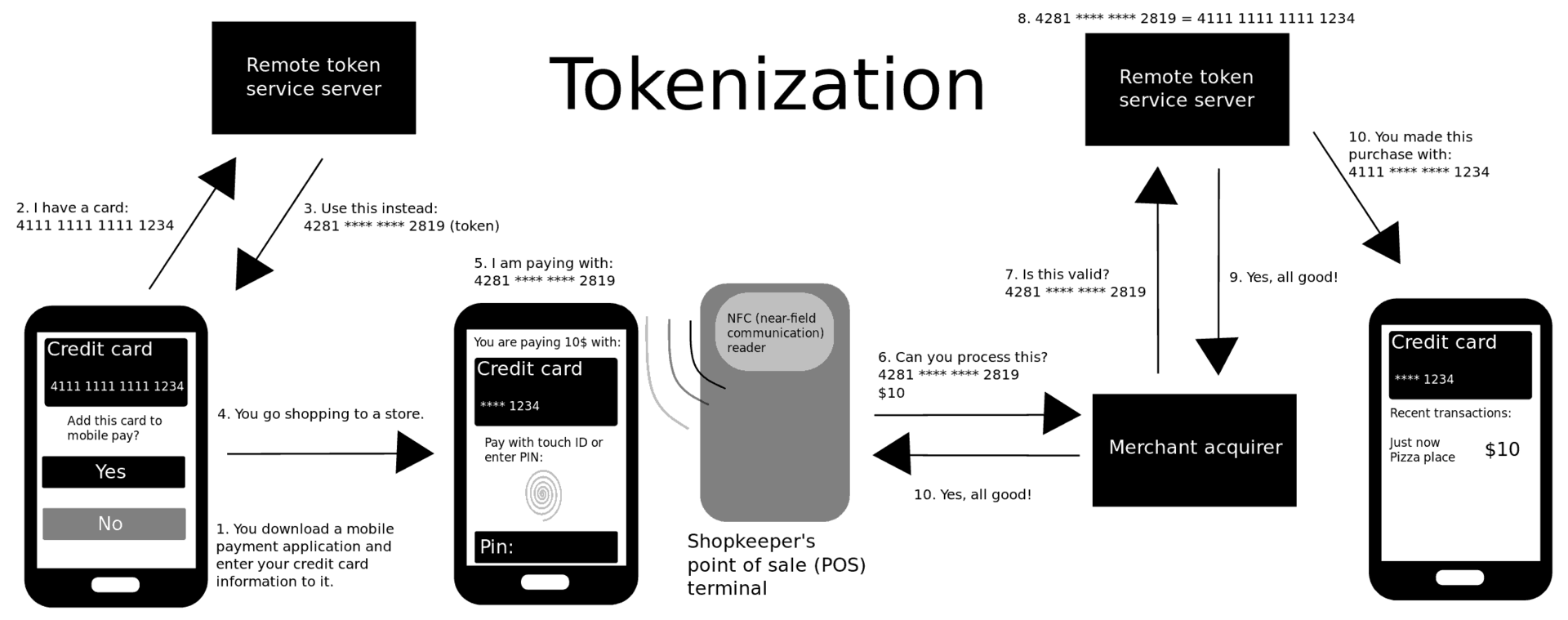

So what is tokenization? Wikipedia says that it is “the process of substituting a sensitive data element with a non-sensitive equivalent, referred to as a token, that has no intrinsic or exploitable meaning or value”. Interesting definition as that means the physical or digital asset you own is now represented by something that has zero value. Wikipedia kindly adds a nice chart to go with that …

So, the thing here is that we are exchanging things around the world that have value. We can now put a tag – a token – on those things, and exchange them digitally globally, in real-time, non-stop, every day, all day, forget intraday.

That’s why the big banks, SWIFT and VISA are all playing big time into tokenization and blockchain. Finally, it is here!

"Disruptive innovation can take time to gain a hold but we have finally reached an inflection point with the tokenisation of securities." Bob Wigley, Chair, UK Finance

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...