There are several regular discussions in finance that come and go on a perennial basis. The idea that everything will become cashless and branchless is one of the main ones, but is that real? It seems to be if you believe what you read but, under the hood, there are some interesting developments. For example, in Japan, cash is still key. In the USA, the J.D. Power 2023 U.S. Retail Banking Satisfaction Study, 38% of customers describe branches as essential, and banks see branches as a key channel for:

- Branding and marketing

- Customer acquisition and onboarding

- Customer service

- Local community engagement

- Showcasing new products and technologies

- Expert advice and support

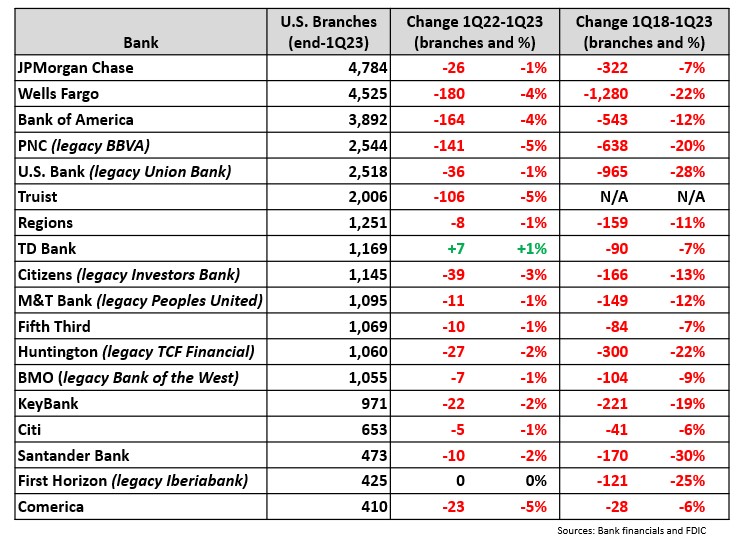

Yet they are still closing branches across the board.

Source: EMI Boston

But let’s not bore you with that perennial discussion. Let’s look at another regular one instead: identity.

To be more exact, the whole debate around authentication, verification, onboarding, money laundering and anti-money laundering, digital identity and so on and so forth. This is a huge bucket for so many issues in banking and I’ve written more about digital identity (D-iD), anti-money laundering (AML), know your client (KYC) and related areas than I care to think about. Yet all of these areas are interlinked. Banks run in fear of regulators over KYC and AML, and just hope that D-iD’s will be the solution. Yet, Politically Exposed Persons (PEPs) and bad actors are rife in the system.

The most recent debate is how Nigel Farage got thrown out of the system for his political views, and is really angry that he can be debanked when serial killers like Rose West are no

Houston, we have a problem.

The problem is identity, and so how do we solve an unsolvable problem?

I’ve no idea.

There are many people who have ideas and yet, for all the people with ideas, I’ve yet to find any of them who can solve the unsolvable problem. My friend Dave Birch has worked on this for centuries, and is still confused:

All of the complexity of payments is to do with authentication, fraud, risk management, all of these. It’s because we don’t know who everyone is. If the identity side is sorted out, payments are easy.

And so we come back to how to authenticate. Passports, driving licenses, utility bills and such like. Passwords, FaceID, fingerprint and eyeballs. Whatever we use, we always seem to come up short.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...