Lots of discussions these days are about AI. AI this, AI that, AI movie, AI influencers, even AI pop.

(the K-pop group Mave do not exist – they are generated by AI)

Every day, these developments shock and intrigue me. But what does this mean for banking and finance?

Well, I guess there are some who are thinking about this. I am – my next book is called Intelligent Money: when money thinks for you …

… but so are many others and I particularly liked a new report from Evident Insights who highlight the top ten use cases of AI in banking.

What could they be? Here you go:

Pushing the AI Frontier: While all banks are harnessing AI for operational efficiency, a select few are leading the innovation front. These frontrunners invest heavily in both pure and applied AI research, file significant AI patents, actively participate in the open-source community, and foster partnerships with academic institutions and start-ups. This approach, however, comes with a high price tag in terms of talent and resources.

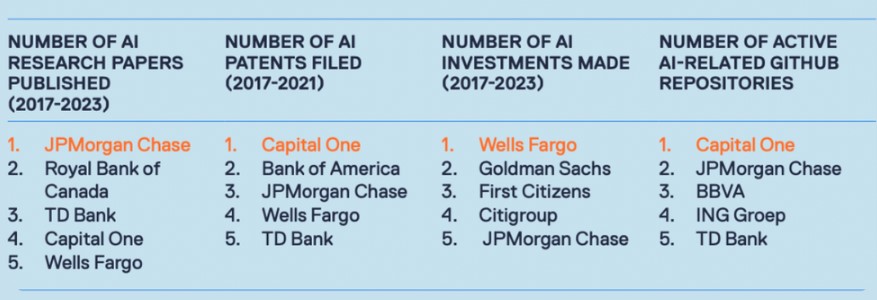

Dominance by the Few: A stark concentration in AI capabilities is evident. The leading five banks are responsible for 67% of all published AI research, 94% of AI patent filings, and 51% of all AI investments.

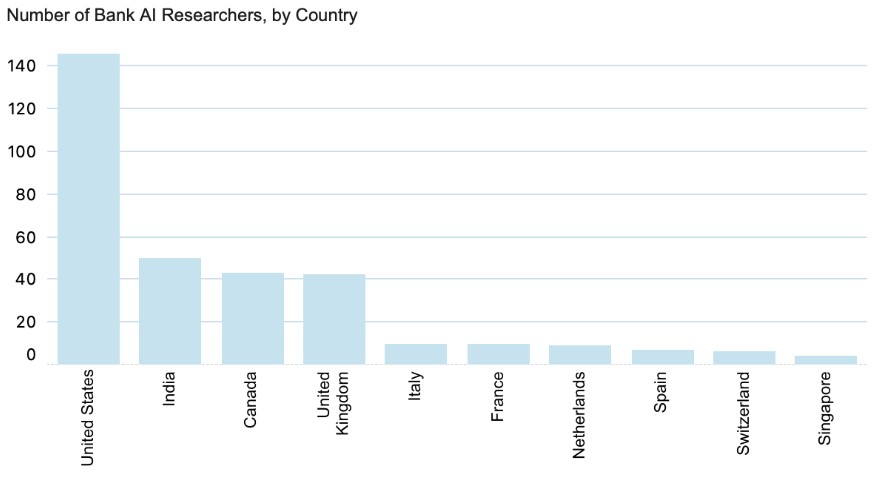

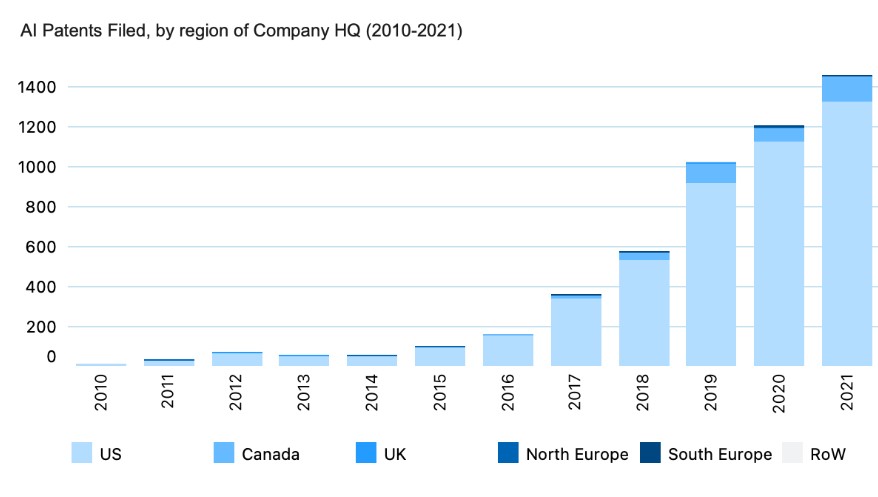

The American AI Edge: North American banks, particularly from the U.S., are outpacing their European counterparts. They have published 80% of all AI research and filed 99% of all AI patents in recent times. Structural limitations in Europe, such as stricter AI patenting rules, partially account for this disparity.

AI in Banking US

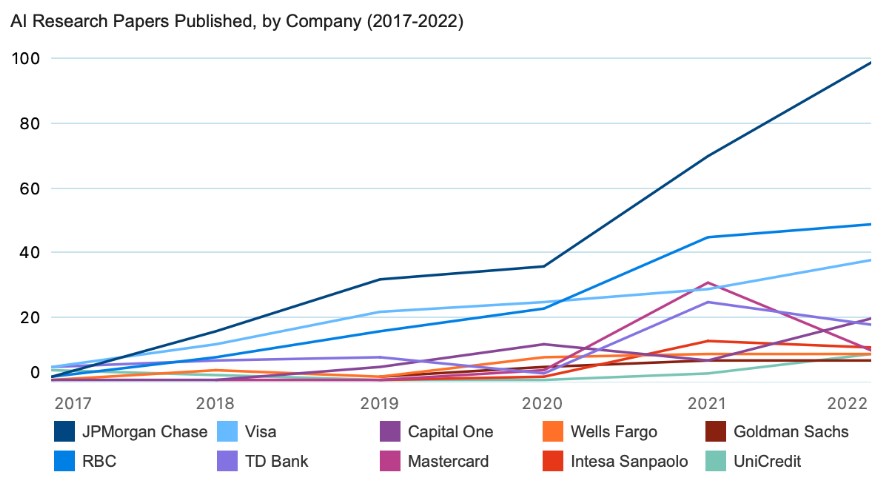

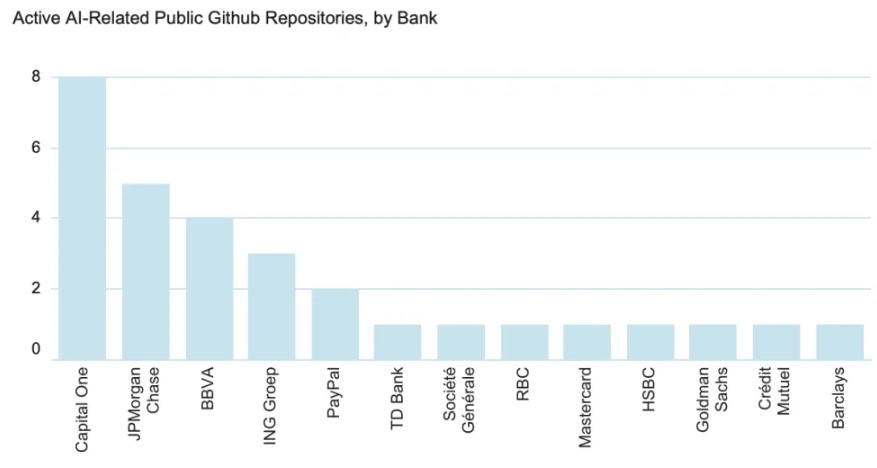

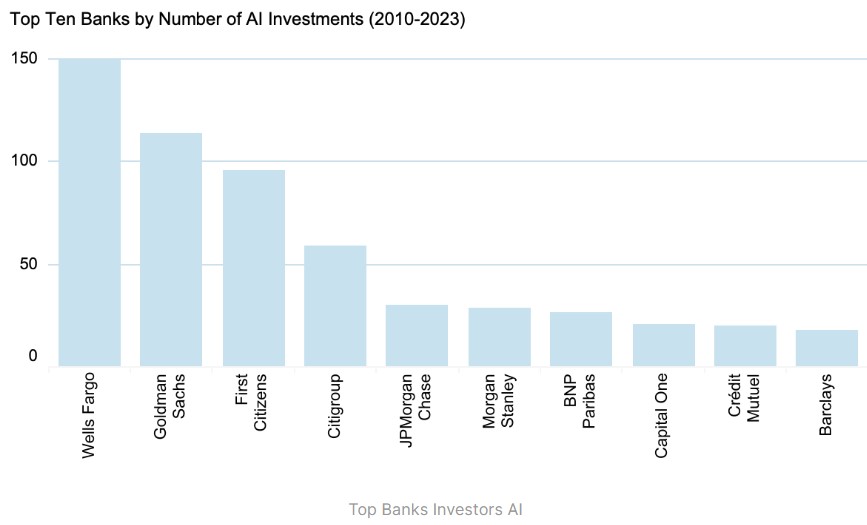

Consistent Leaders Emerge: Notably, JPMorgan Chase, Capital One, Wells Fargo, and Canadian banks like RBC and TD Bank consistently top the charts. Their dominance in AI and talent acquisition suggests they're building a lead that may become insurmountable for others.

AI in Banking US Banks

European AI Landscape: AI innovation in European banks lags significantly. While BNP Paribas is the top French bank in AI, it doesn’t make the global top 10. The UK is even more subdued in its AI prominence, save for Barclays in AI ventures. However, there's a void for a European AI champion, potentially a slot for a Spanish bank like BBVA. APAC banks might be the next big competitors.

AI Research Momentum: From 2017 to 2022, there was a 70% CAGR in AI research publications across banks and payment providers. The U.S. and India lead in AI research talent, with trading being a dominant yet mostly unpublished research area.

AI Researchers at Banks

Patenting AI: Only 10% of the banks are aggressively patenting AI innovations. With a CAGR of 40% in patent filings between 2017-2021, it's evident that these banks are seeking first-mover advantages and protective mechanisms. Trading, payments, and compliance are the main areas of focus.

AI Patents Banks

Building Robust Ecosystems: Successful banks are not just looking inward but are forming collaborations outside. Universities serve as talent pools, research hubs, and innovation catalysts. Brands like Capital One and JPMorgan Chase are deeply involved with open-source communities.

Investments in AI: AI-related investments by banks have grown at a 15% CAGR from 2017 to 2022. While U.S. banks, led by Wells Fargo, dominate, their proportion has dropped from 90% in 2015 to 60% in 2022, with European banks like BNP Paribas and Barclays making headway. Importantly, not all AI investments align with banks' core functions.

Generative AI's Potential: AI in banking has typically been a top-down approach, led by visionaries and AI specialists. The rise of Generative AI, exemplified by tools like ChatGPT, has further emphasized this. However, it also provides an opportunity for grassroots innovation. Banks that can decentralize AI innovation while maintaining central oversight stand to transform into truly adaptive, learning organizations.

These insights underscore a rapidly evolving landscape in AI banking, emphasizing the importance of proactive innovation, collaboration, and adaptability in the global financial ecosystem.

I highly recommend downloading and reading the complete report by Evident Insights. If you can’t be bothered, here’s a copy as an fyi …

H/T to Marcel van Oost

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...