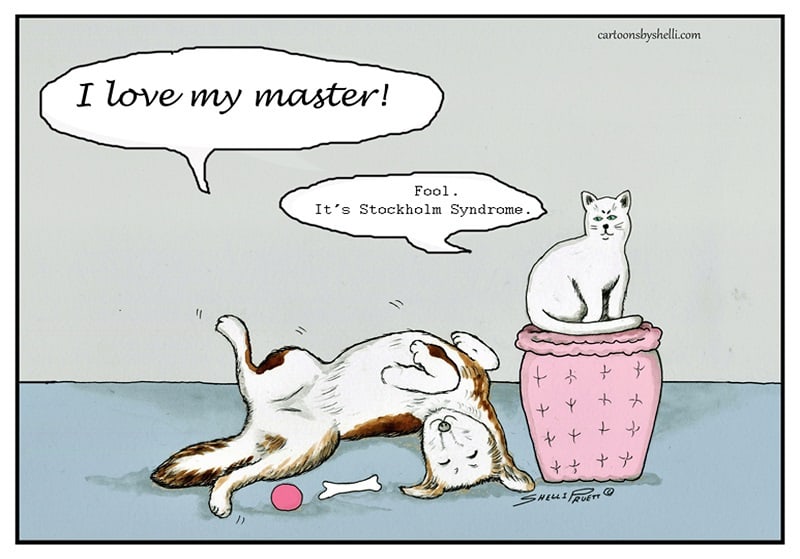

I have a dog and am worried he has Stockholm Syndrome. He seems to love me, but it’s only because I feed and walk him every day. By nature, the dog should be free.

Thing is that, now that he’s three years old, he’s developed into a beautiful animal who is dedicated to me. As a pup, he would run riot, scratching and biting everything, running away as soon as he was off the lead, and disappearing for hours. Now, as a three year old – in his 30’s in dog years dependent upon which calculator you use – he is really well behaved and stays with me on walks, no longer bites or scratches things, and spends most of the time sleeping.

Why am I sharing this here? What has this got to do with fintech or banking?

Well, it has a lot to do with banking, as I wonder whether bankers have Stockholm Syndrome too. What is Stockholm Syndrome, just in case you don’t know. Stockholm Syndrome is where hostages develop a psychological bond with their captors. It is named after a bank raid in the 1970s, where the bank workers ended up being more loyal to the bank robbers than to the police and authorities, when push came to shove.

Specifically, in 1973, a convict named Jan-Erik Olsson took four employees of Kreditbanken, one of the largest banks in Sweden, hostage. He held them hostage for six days. When they were released, none of them would testify against him in court. Instead, they began raising money for his defence.

Weird?

Not really. A bit like my dog, if you’re held captive for long enough, you start to feel an emotion for your captor that one could not call love, but it is something like it.

So what is this discussion of Stockholm Syndrome in business?

Well, it is the assimilation of your personality and thinking into the corporate machine. This applies just as much to banking as to technology firms or the wider community. Whoever you work for, you end up loving them and conforming. You believe in them and want them to succeed. The result is that you would do anything to continue to fit in with their culture and, in so doing, suppress the things you really think to avoid breaking with the groupthink mentality.

The reason this is important in today’s world is how to convince a management that all think the same thing, and no one is willing to break the groupthink mentality?

What do the management think? That digitalisation is a project and can be done over time? That technology has changed the organisation, but the organisation can adapt to incorporate the technology? That radical change is not necessary as radical change is too risky? That you are out of order for challenging the groupthink mentality?

TBH, all of the above is the reason why I’ve ended up working for myself and being a troublemaker. It is not because I want to be on my own, watching from the outside. It is much more to do with the fact that I cannot stand the groupthink mentality. In fact, the more employees and management end up with Stockholm Syndrome for their organisation’s culture, the more I want to challenge their thinking and see if it stands up to scrutiny in the light of real intelligence, whether artificial or not.

Always ask why, and always challenge thinking. Otherwise, you just end up being a dog who loves their master because he feeds, waters and walks you every day … also known as Stockholm Syndrome.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...