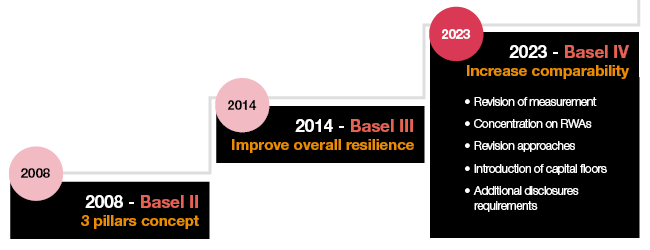

During 2023 a change has taken place in banking that has been little reported or, at least in my circles, little discussed. The change is Basel IV. A bit like most regulations, the Basel Committee on Banking Supervision (BCBS) review and update their rules every five to ten years or so, and gradually introduce more and more strict structures for all of us to adhere to. What’s in Basel IV? Mainly it is do with much more restrictions around capital allocated and risk-weighted assets (RWA).

According to the text of the BCBS, the main aim of Basel IV is to “restore credibility in the calculation of RWAs and improve the comparability of banks' capital ratios”. In order to achieve this, there are specific obligations around capital and risk, including:

- Harmonising the earlier Basel accords with a standardised approach to credit and operational risk.

- Tightening the way in which banks use their internal models for capital requirements.

- Further limits on the ability of a systemically important bank to leverage by forcing banks to keep additional capital in reserve. The new rules would require banks to hold capital equal to at least 72.5% of the amount indicated by the standardised model, regardless of what their internal model suggests, by the start of 2027.

So, what’s that got to do with technology?

In my view, it means that Basel V or VI will start to mandate real-time regulatory reporting of risk and capital assets. There has already been some developments in this direction, but if the government’s regulator could assess a bank’s position in real-time, it could be a game-changer.

This came to mind after the failures of several banks in 2023, the largest of which has been Credit Suisse. Why do these things come as a surprise?

A little like a bank knows when a customer is in credit or not, a regulator would know if a bank was stable or not. Isn’t that the ultimate dream?

In fact, as a future forecaster, it is my expectation that systems for systemically important institutions will be connected through Open Banking to those that monitor and regulate such institutions. This will enable real-time monitoring and oversight, and banks will be called to account far earlier than we have seen this year in the case of Signature Bank, Silicon Valley Bank and others.

The upside will be that the forecasting of risk will be far better; the downside will be that a bank cannot make decisions without regulatory approvals. Is that a good or bad thing?

Obviously, it is positive if we can avoid a sudden bank collapse; but, equally, it is a bad thing if banks cannot take risk, invest in progress, and get a greater return on investments by leveraging the markets.

The core question is transparency. How transparent should banks system and operations be?

This question has been asked many times over the past fifteen years, and I can remember distinctly the Austrian authorities requiring banks to offer open access to their systems. At that time, it was quite difficult to link-up regulatory systems and bank systems but, as time goes on, it is becoming simpler and easier, particularly because of Open Banking.

Open Banking can allow Regtech to link with Banktech and Fintech to create a completely connected network, with data shared in real-time across the network. The question is what the connected, transparent, open network means for risk, regulation and compliance. In some ways, it begs the question of regulators and their understanding of integration of systems; in other ways, it challenges those who are regulated to understand that their historical sovereign territories are no longer private. In fact, the more that regulators require bank transparency, the harder it will be for banks to operate, leverage, take risks and gain ROI.

In the middle of all of this, is the role of technology and, specifically, the use of customer data. After all, banks are custodians of customer data. If the regulators demand access, does this mean customer data is compromised? How would regulatory access to customer data comply with GDPR for example?

To be clear, the regulators will say that it is all part and parcel of the same thing as, in the same way that banks want to track and trace the risk of customers, whether retail or corporate, using their digital footprint; regulators and governments want to track and trace the risk of banks, using their digital footprint and the digital footprint of their customers, whether retail or corporate. Therefore, expect a lot more regulatory control and systematic oversight for any organisation that is systematically important.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...