I was asked to come onto a news channel this week to talk about the state of banking. The latest Q3 results have come in, and most of the banks have stonking results thanks to interest rates rising. Increasing rates rapidly on loans, whilst dragging feet on savings rates, created a basis points differential that delivered excellent profits and returns to shareholders. A few examples:

- Revenue at Chase was up 34%;

- Citi revenue was up 10% and net income up 2%;

- Wells Fargo's revenue was up 6.5%, net income up 6%;

- Bank of America revenue was up 3% and profit 10%;

The American banks have done pretty well.

The same is true in Europe where Santander’s quarterly net profit leapt by 20%, year on year, based upon charging its borrowers higher interest on their debts. Meanwhile, UniCredit’s profit was up by 36%. The Italian lender said it would set aside €1.1bn ($1.2bn) as “non- distributable reserves”, which allows it to avoid paying the government’s windfall tax on bank profits. Deutsche Bank stock rose almost 7% on the back of their Q3 results, but this was due to a forward looking statement that strong earnings means the bank is likely to could pay out more cash to shareholders over the next two years than previously anticipated. In Q3, net profit fell 3% to €1.2 billion, equivalent to about $1.27 billion, but it beat consensus forecasts for €1.1 billion.

As for HSBC, who announced results on Monday, profit after tax came in at $6.26 billion in the three months ended September, jumping 235% compared to the $2.66 billion in the same period last year. As a result, the bank announced a $3 billion share buyback program and everyone should be happy.

But then their share price dipped. Why? Because analysts and investors expected more.

Taking HSBC as an example, there are a number of challenges, especially credit impairments as shown in their Q2 results. Those results also showed increasing lower expenses but this will change as the bank's expenses are projected to rise, due to its strategy of expanding its market share in the UK and China and improving its digital capabilities worldwide.

The bank's investment banking revenues look to be subdued due to geopolitical tensions, persistent inflation, and an economic slowdown that affected deal-making activities and advisory revenues. This is illustrated by the fact that bank handled 26 IPO raising $7.7 billion, and yet the bank's equity and debt underwriting fees did not significantly grow. However, bond issuance volumes improved year-over-year and, like the other banks, higher interest rates will inflate profits for the quarter.

Having said all of the above, all of these banks are seeing an eroding stock price over time, because banks are basically less relevant in the financial services ecosystem.

- Citi revenue was up 10% and stock is down 8% YoY

- Wells Fargo's revenue was up 6.5% and stock is down 1.3% YoY

- Bank of America revenue was up 3% and #stock is down 5% YoY

What’s going on?

What’s going on is that banks can create shareholder returns and good growth, but it is all fragile and purely tied to economic developments like interest rates rising. In general however, investors see banks as a dying breed.

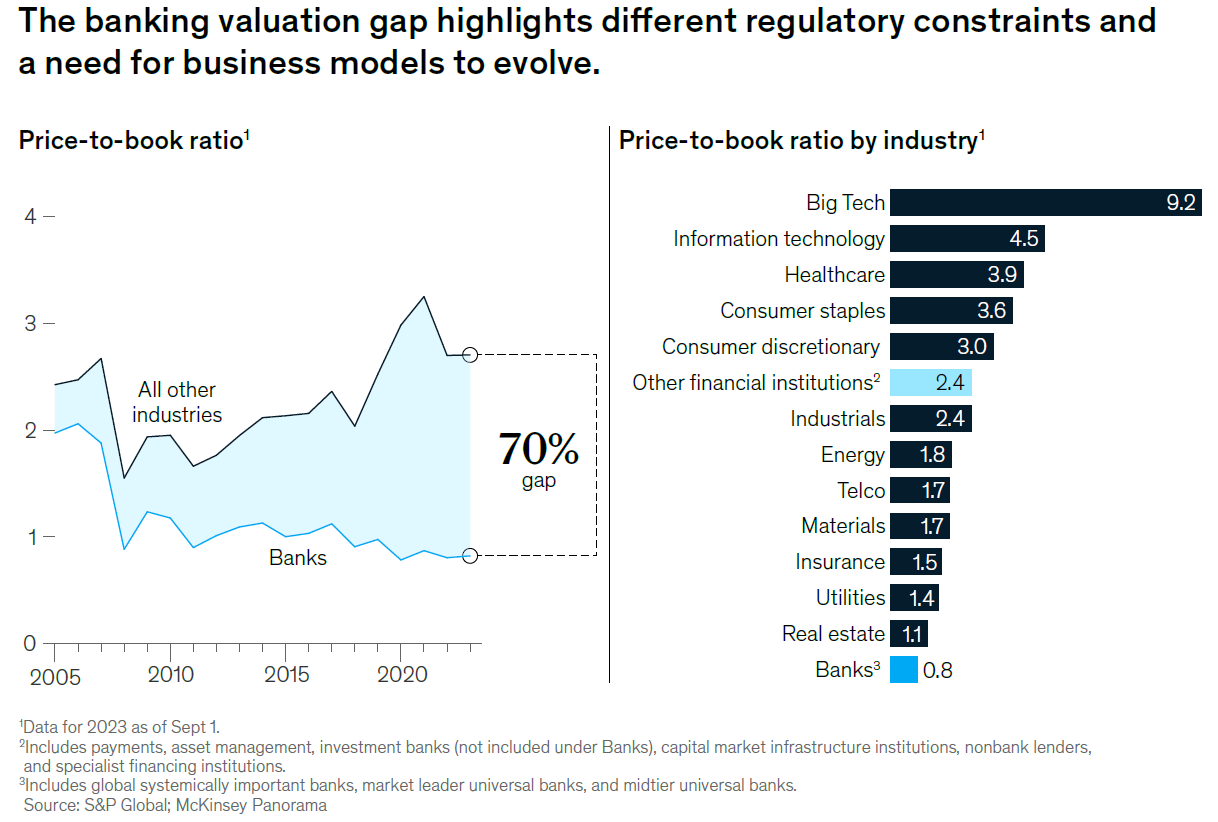

This is shown by a new report by McKinsey who are good with facts but not vision. McKinsey notes that the largest banks lose value at a rate of 1% to 2% per year. As a sector, they're underperforming all other industries by 70% on a "price-to-book" ratio.

What’s price-to-book? It is basically the price of investing in a bank – their stock price and market capitalisation – versus the stock issued – the number of shares available on their balance sheets. Banks are hugely undervalued generally. In fact, they are valued the worst of any industry, according to McKinsey.

Why?

Because banks are not rising to the challenges of the future. In fact, I find it interesting how the tech industry has the highest price-to-book value. Why? Because tech is the future.

This combination is why FinTech firms see their valuations far exceeding their delivery, and why banks like Goldman Sachs get frustrated with their poor delivery.

In 2019 David Solomon, the then new CEO of Goldman Sachs following in the footsteps of Lloyd Blankfein, spoke at an awards ceremony and said the following:

“If we were out in Silicon Valley and made 20 percent of the progress that we’ve made, we would get a lot of credit and people would be throwing money at us to own a piece of this business. But nestled inside little old Goldman Sachs, we’re just going to have to prove it over time.”

Four years later, Marcus has been a bug-bear in David Solomon’s operation. It has failed. Losing money hand over fist after massive marketing investments, huge costs of customer acquisition and little success, it has all been cutback. In the latest results round, Solomon noted that “it was clear we lacked [a] certain competitive advantage and we did too much too quickly, which affected our execution … there were some clear successes but there were also some clear stumbles. ... we could have done a better job.”

Too right, mate.

What went wrong at Marcus?

The Apple partnership, where analysts estimate the average cost to acquire a card customer is $350 or the millions of dollars invested in failed marketing campaigns?

CNBC believes it was actually the failed leadership of Solomon himself where, according to their reports, Marcus leaders had disagreed with Solomon over products, acquisitions and branding, and that many of the decisions made by Solomon made led to the collapse of its consumer ambitions.

Either way, Marcus is a good example of why bank’s price-to-book ratios are far below those of fintech and tech firms. It’s all about execution and, in this case, execution failed because banks really are not fit for digital.

As Simon Taylor notes on his brainfood newsletter:

I was on a flight to Frankfurt last week from London and saw countless middle-aged men in suits with their printed-out airline tickets in a plastic wallet. First of all, who prints things these days? And did they print that at home? If so, they actually own a printer. If not, did their EA do it? They live in the early 2000s.

Yep. Anyhow, I need to finish this blog to print my notes for my next meeting and make sure that I have my Filofax at the ready …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...