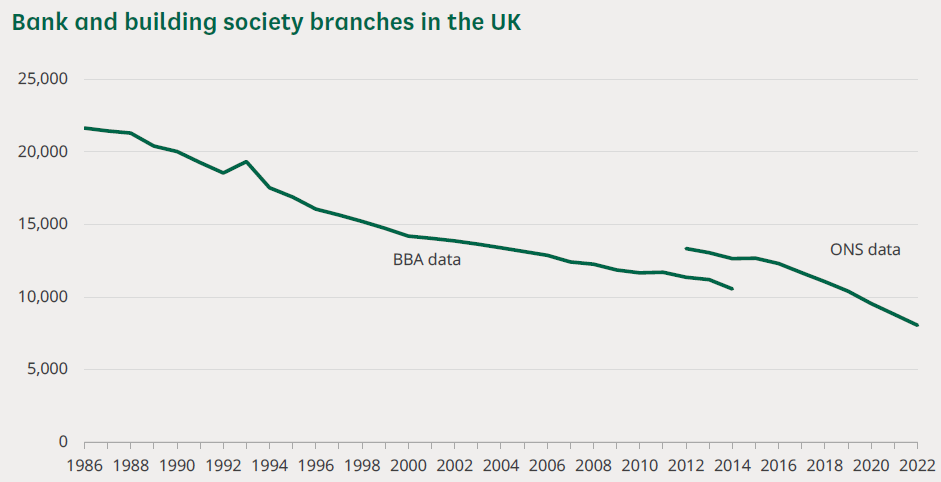

I was reading stories over the weekend of hundreds of branch closures planned by banks. This has been forecast for years – back in the 1990s, it was clear that branch based distribution was unsustainable and costly – but it has finally hit.

When I was a lad, for example, there were over 20,000 bank branches in Britain and I claimed only 2,000 were needed. Now in Britain, according to Which?, over 5,764 branches have shut their doors since 2015. At best estimate, there are only around 5,000 left.

Source: UK Government*

This is the devastation created by the digital reformation, as everyone moves away from physical distribution to data connectivity.

What intrigued me in particular was this article from The Telegraph in the UK, explaining that even where branches have closed, and a banking hub has replaced it, it doesn’t work.

A banking hub is run by the postal service to offer cash, cheque processing and other banking services. Typically the hub is offering bank services, changing each day of the week between the main providers. Monday it’s Barclays; Tuesday is HSBC; Wednesday is NatWest; Thursday is Lloyds; and Friday is SpongeBob SquarePants. You get the idea.

So the Telegraph explained how they went to a banking hub and only five people turned up. Why only five? Because people do not need branches anymore as they have apps, but it goes further than that. People don’t need branches anymore because they don’t need cash.

According to an access to cash report by the House of Commons published in September 2022, three-quarters of adults (74%) used cash occasionally or rarely, whilst 6% used cash for most things or everything.

And yes, I know that I blog about this space regularly, but it’s because the end of branch has been predicted for soooooo long. Now it has come true.

So do banks need branches?

Yes or no but, if they do, it’s not for transactions or advice; it’s for trust. Because banks deal with value and act as a value store of deposits, customers still need branches to trust that the bank is looking after their assets and store. That’s why banks find customers standing outside their branches when they don’t trust them.

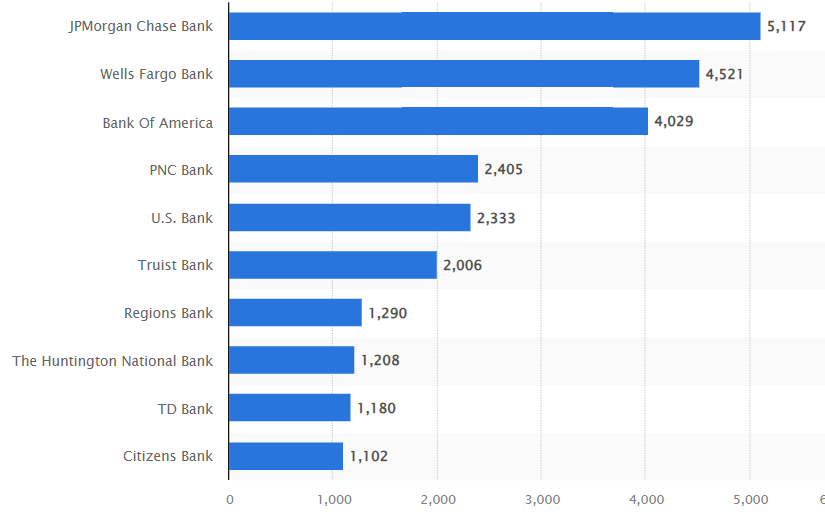

* By comparison, the USA has far more branches – it’s a bigger country …

Source: Statista

Although, as the FDIC notes, branches peaked in 2012 (82,9675) but has fallen rapidly (69,905 in 2022).

Postscript:

Just an fyi, I'm running a series of immersive workshops on banking, fintech and tech so, just mentioning that it may be a good time to consider this for your 2024 kickoff planning!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...