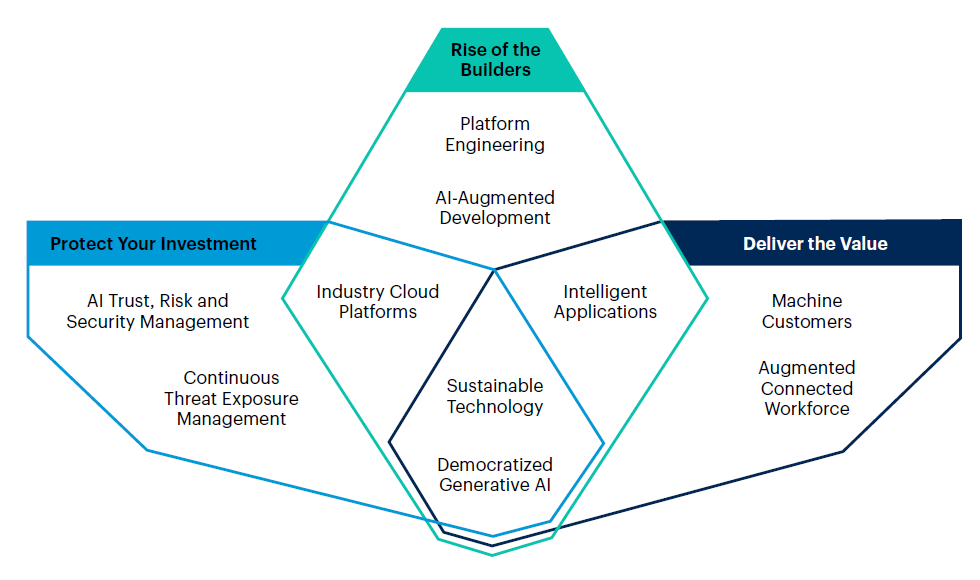

I was looking for the top trends in technology in 2024 and started with this Gartner report. As usual, it’s full of Gartner trying to create acronyms like AI TRiSM and CTEM. Lot of confusion there, but this chart did stand out:

Each area is explained in more depth in their presentation deck, but here’s the key things:

- AI as Partner: AI Trust, Risk and Security Management (AI TRiSM)

- Be Safe: Continuous Threat Exposure Management (CTEM)

- Protect the Future: Sustainable Technology

- Developer-Driven Self-Service: Platform Engineering

- Accelerate Creation: AI-Augmented Development

- Tailor Your Tailor’s Work: Industry Cloud Platforms

- Optimize Decision-Making: Intelligent Applications

- Power AND Responsibility: Democratized Generative AI

- Push the Pioneers: Augmented Connected Workforce

- Buyers With Byte(s): Machine Customers

My summation? Poor report but some key thinking about how to work in platforms, ecosystems, partnerships and new world paradigms.

Luckily there are some other firms out there like Deloitte, who produced their 2024 tech trends report. This made a lot more sense – even though they cite a Chief Futurist, Mike Bechtel – and focuses upon generative AI as the key to developments this year.

“While generative AI feels at once unprecedented and revolutionary, the technology itself is actually a surprisingly straightforward evolution of machine intelligence capabilities that we’ve been tracking and chronicling since Tech Trends’ inception. Organizations have employed mechanical muscles (industrial robotics) for nearly 70 years, and mechanical minds (machine learning systems) for the last 25. That our inorganic colleagues can now paint a picture, write a product description, or sling Python is neither random nor unexpected—they’re the next page in a book that future computer scientists might one day call Cognitive Automation: The Early Years. Indeed, the best companies have been engaged in this quest to reduce the cost of decision-making for at least the last 15 years.”

Now, there’s a healthy dose of reality check right there.

Another report from All Things Distributed continues those themes around AI and more. Their top thoughts are:

Generative AI becomes culturally aware

Large language models (LLMs) trained on culturally diverse data will gain a more nuanced understanding of human experience and complex societal challenges. This cultural fluency promises to make generative AI more accessible to users worldwide.

AI assistants redefine developer productivity

AI assistants will evolve from basic code generators into teachers and tireless collaborators that provide support throughout the software development lifecycle. They will explain complex systems in simple language, suggest targeted improvements, and take on repetitive tasks, allowing developers to focus on the parts of their work that have the most impact.

Education evolves to match the speed of tech innovation

Higher education alone cannot keep up with the rate of technological change. Industry-led skills-based training programs will emerge that more closely resemble the journeys of skilled tradespeople. This shift to continuous learning will benefit individuals and businesses alike.

FemTech finally takes off

Women’s healthcare reaches an inflection point as FemTech investment surges, care goes hybrid, and an abundance of data unlocks improved diagnoses and patient outcomes. The rise of FemTech will not only benefit women, but lift the entire healthcare system.

But I guess my favourite tech trends predictions came from Monica Eaton at Chargebacks911, a firm dedicated to sorting out chargebacks and eliminating first-party fraud and misuse. Here are here their top ten tech things in banking:

Artificial Intelligence (AI)

As perhaps the hottest topic in technology right now, this one is a no-brainer. AI tools like chatbots swiftly address queries, while biometric solutions bolster security and refine AML and KYC processes. From streamlining document analysis with computer vision to leveraging machine learning for improved lending and investment decisions, AI stands as a transformative pillar in banking.

Banking Process Automation

Banking process automation (or “BPA”) streamlines a myriad of banking operations. Through robotic process automation (RPA), tasks like invoice processing and payment approvals become more efficient. This automation extends to credit card fraud detection and mortgage processing, ensuring faster responses, enhanced compliance, and data-driven insights.

Blockchain & DeFi

Blockchain's inherent transparency and security can reshape financial transactions. Its ability to streamline trade, automate via smart contracts, and facilitate rapid peer-to-peer payments makes it a game-changer. Especially with the rise of decentralized finance (DeFi), blockchain promises more inclusive and efficient financial services.

Advances in Cybersecurity

As custodians of vast data troves, banks prioritize cybersecurity. Tailored protocols, encryption tools, and AI-driven fraud detection mechanisms guard against threats. Anti-hacking software further strengthens banks' defences, ensuring both data integrity and customer trust. As hackers come to embrace new technologies like AI, financial institutions must respond in kind.

Hyper-Personalized Banking

Banks today emphasize tailoring experiences. They can offer bespoke services by leveraging strategies like omnichannel banking and AI-driven financial recommendations. Tools from wealth management to buy now pay later (BNPL) projects heighten customer engagement and satisfaction.

Immersive Technologies in Banking

Augmented and virtual reality redefine customer and employee interactions. From VR-driven training modules to virtual showrooms for loan applications, immersive technologies captivate users. The emergence of Metaverse banks further signals an era of deeply engaging banking experiences.

Neobanking

Digital-first neobanks champion convenience and efficiency. They operate without traditional brick-and-mortar constraints and can provide integrated services, from automated reconciliation to workflow management. All this can be done at no cost, or potentially even reduced costs to customers, as they require less overhead spending.

Open Banking

Open banking bridges banks with non-banking financial companies (NBFCs). Third-party developers access data securely through banking APIs, fostering innovations like embedded banking. The rise of banking-as-a-service (BaaS) further expands banks’ outreach and potential revenue streams.

Quantum Computing in Banking

Quantum computing offers a leap in processing prowess by tackling the limitations of classical computing. It may aid banks in tasks ranging from portfolio optimization to accurate financial forecasting, heralding a new age of computational finance. Emerging startups are at the forefront of crafting cost-effective quantum computers tailored for the banking sector. These quantum solutions will play pivotal roles, from refining derivative pricing to bolstering cybersecurity measures.

Transition to the Cloud

The shift to cloud computing facilitates agility and scalability in banking. By harnessing the cloud's flexibility, banks can swiftly adapt to market changes, drive innovations, and better cater to evolving customer needs. They are also insulated from disruptions or potential security breaches resulting from the failure of a single static server.

None of these are that new, but 2024 is the year where all of these things are happening I guess, so have a great outlook for 2025 and beyond!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...