I often say in speeches that you now have the ability to pay anytime, anywhere from your pocket or purse. Now I realise that the mention of pocket or purse is no longer relevant. It’s pay anytime, anywhere from your device, and soon it will be pay anytime, anywhere, with your body as a token. I am the token.

But this might feel very destablising for many people who have grown up with cash, cards, cheques, wallets and purses. Forget the physicality of your tokens, as you are now the token.

The reason this comes to mind is that a growing majority of the population no longer carry wallets or purses, as evidenced by the headline below:

In some ways, it causes me to be nostalgic and feel a little bit upset about the loss of so many things I felt were special when I was growing up. I no longer need a wallet, but I no longer need a watch. A watch, when I was growing up, was a special thing. A designer watch – a Rolex or Patek Philippe – is no longer needed. A Gucci or Prada bag is no longer necessary. In fact, so many things are no longer necessary. A CD or Vinyl collection. A Nikon or Canon camera. A Blockbuster or Woolworths store. A cinema or bank branch.

The internet has replaced everything and we are seeing the revolution of everything as a result.

The reconstruction of the main street; the disappearance of branded goods; the rise of new brands; the invention of the digital street.

This is good news for most of us, but bad news for folks like LVMH, the largest luxury brand company, and Blackstone, who claim to be the largest commercial real estate owner in the world. Or is it?

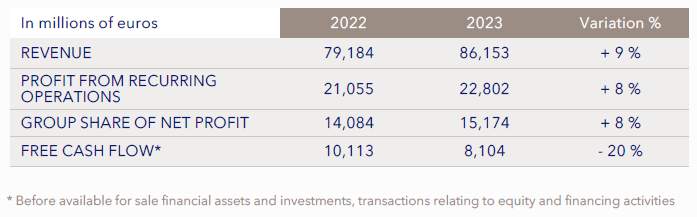

Well, LVMH seem to be doing pretty well …

Source: LVMH 2024 Investor Presentation

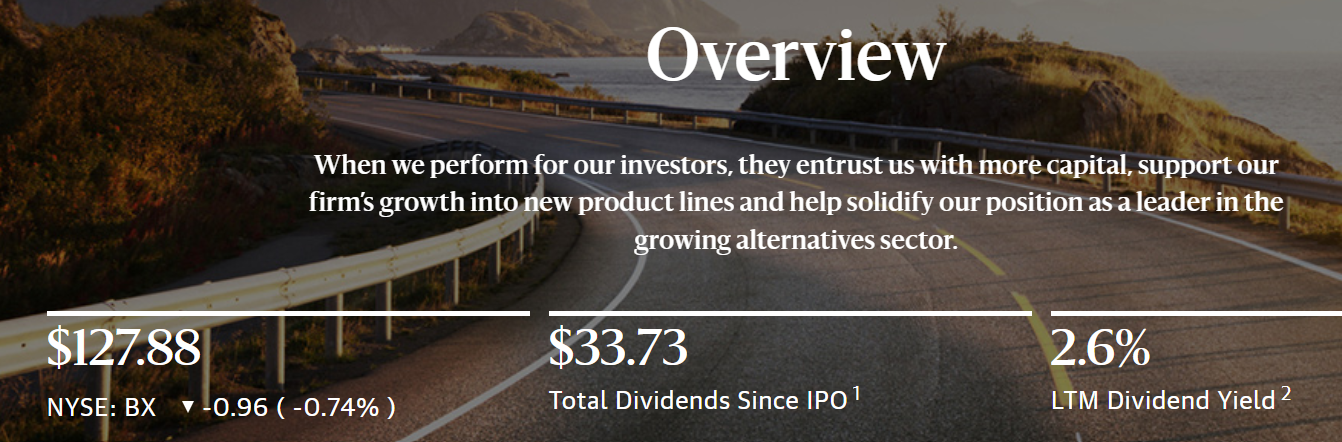

… as are Blackstone …

Source: Blackstone

So, how are these companies dealing with the digital squeeze?

In the case of LVMH, it’s all about maintaining the aspiration. You may not need a watch or a bag, but you need the brand and the label. This is what motivates everyone, a bit like diamonds ...

“Diamonds, along with many other materials, do not have an intrinsic value” … they are worthless but … “the value comes from the value we assign to them as a society”.

… and you need to be digital. According to Cegid, 20% of luxury goods sales are now online which is why “various luxury fashion brands are turning to state-of-the-art technology. Louis Vuitton unveiled a new online chatbot service at VivaTech in 2021, claiming that, thanks to artificial intelligence, over 60% of customer requests can be processed 24/7. Gucci offers customers access to online sales advisors, and Chanel has been developing a virtual fitting-room service in association with Farfetch.”

Similarly, commercial real estate is changing.

Capital is tightened and, according to Deloitte, property sales volumes dropped by 59% globally, 63% in the United States, 62% in Europe, and 50% in Asia/Pacific so far through 2023 although, interestingly, participants in their survey said that the most attractive risk-adjusted opportunity are digital economy properties (defined as data centers and cell towers). It’s a pivot.

I guess that’s the message: pivot.

Sell digital, market digital and invest in digital economy services, products, offices and properties.

Good message.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...