I talk a lot about the platform economy where the network joins us all together. In that economy, like life on Earth, there are many players. 1000's of companies, millions of people and billions of capital. The question is: how to connect them? The answer is to be a connector in the connected economy, and this is something that has been discussed here often.

The main way to connect would be to partner but that’s a challenge, particularly for boring old banks. Banks don’t have a partnership culture. The culture is to own everything and do everything internally.

That may be changing – in fact, for some banks, they clearly are leading at changing that attitude – but it’s a fairly tough call. So, it made me wonder about how the world could change and I stumbled across Stripe’s pitch deck from a few years ago, and noted that Stripe’s vision is very different to these.

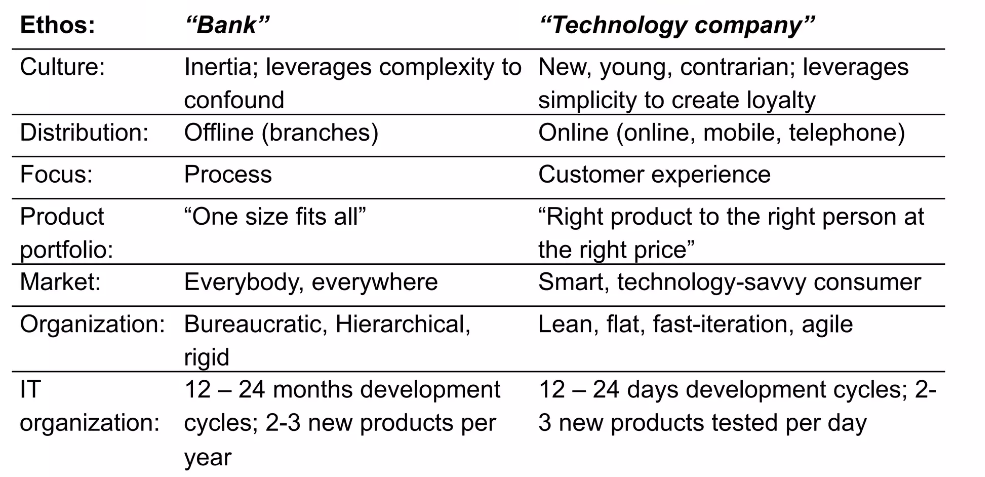

In fact, extending on this, I then went and looked at NuBank’s pitch deck from a few years ago and noted the critical difference between a bank and a startup fintech’s culture.

The core of both of these propositions is that bank’s don’t get today’s world … is that true?

I work with banks a lot and, imho, they do get today’s world. It’s easy to portray old banks as dumb, stupid and stuck in the past. The challenge is therefore how to change that thinking and there are plenty of banks with younger, visionary, leaders who are doing just that. The thing is that it is not easy.

You may immediately think that I mean legacy systems, but that’s just a piece of the problem. There’s legacy rewards, legacy structures, legacy lines of business, legacy people and more. This is why I feel a huge affinity with anyone in a CxO role in boring old bank. Sure, you’ve gotta change the systems, but how do you change the thinking? How do you become a partnering, inclusive bank that has lost all that inertia? How do you become hip and cool?

Well, I’m not sure a traditional bank could ever be hip or cool, but it can be engaging and this is the key. How can a boring old bank create fantastic customer engagement?

What seems to be happening is that boring old banks are copying an awful lot of what hip and cool banks do. That’s fine, but it would be so much better if boring old banks engaged partners, not just customers. Banks really should be at the core of the ecosystem of finance on our networked platform to grow the internet economy together. That’s Stripe’s vision. What’s yours?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...