I say there is no next big thing, just the evolution of what we have right now, but there are two areas highlighted by the Future Today Institute in their Tech Trends Report 2024, which you might claim are the major changes on the horizon, rather than the next big thing. These are namely AI and Web3.

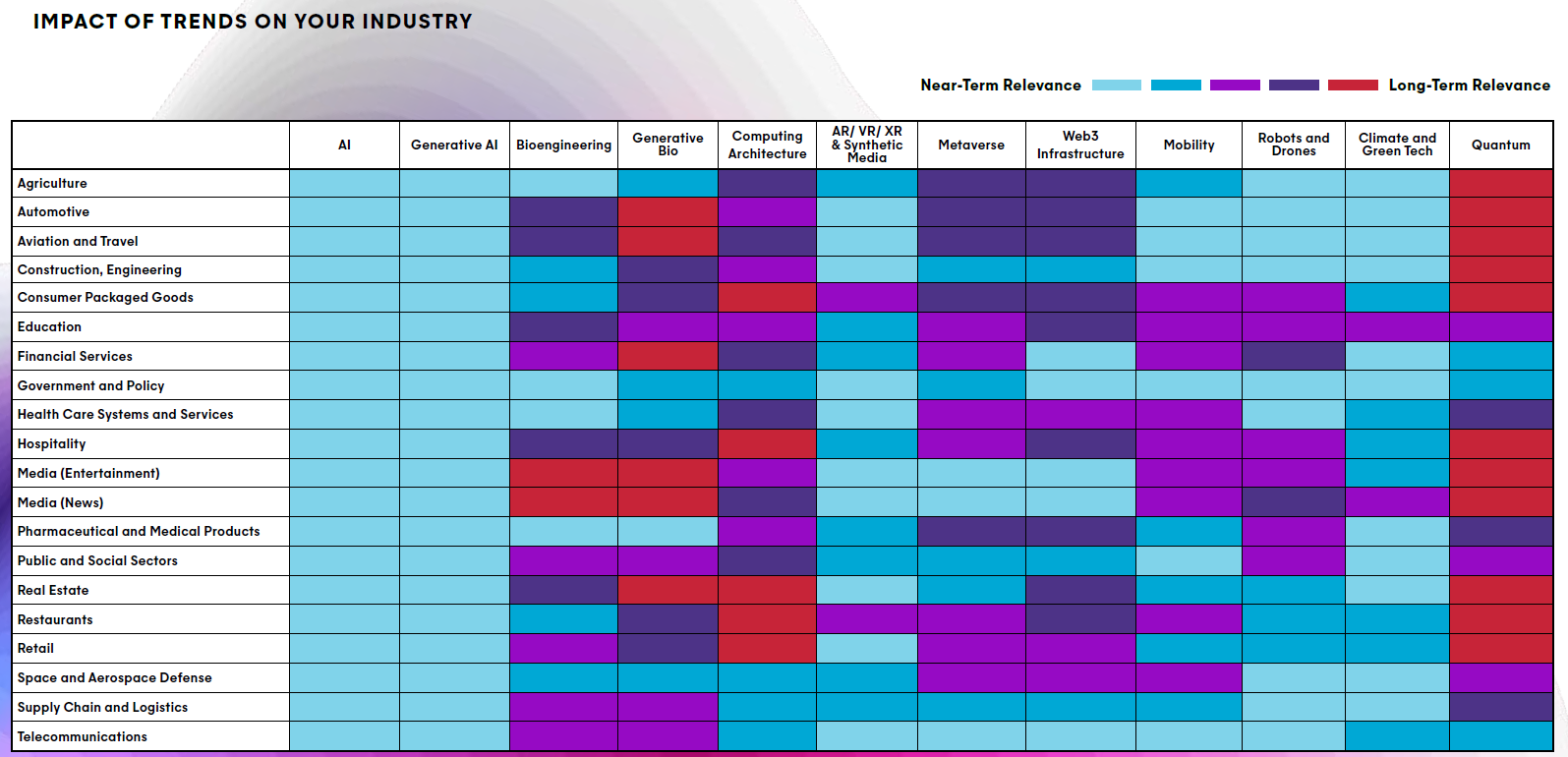

In a near 1,000 page report, they talk through these areas both at high level and industry by industry where financial services can see lots of technologies making a near-term impact.

The five main headlines for financial services (pages 687-730) this year include:

Banks Battle to Keep Digital Pace Amid Tech Evolution

Financial institutions are finding it increasingly difficult to keep pace with the rapid evolution of technology despite ongoing efforts in digital transformation.

2023 Bank Failures Eclipse 2008, Signalling Shift to Megabanks

The fall of Silicon Valley Bank, Signature Bank, and First Republic Bank marked a more significant disruption than the 2008 crisis, creating uncertainty for regional banks.

Financial Firms Must Revamp KYC in Digital Identity Push

As digital identity technologies advance, financial institutions must overhaul “Know Your Customer” (KYC) policies to make banking interactions and transactions more fluid and secure.

Instant Payments Get Closer to Reality with FedNow’s Launch

With the introduction of FedNow in 2023, the financial industry is one step closer to instantaneous payments and real-time financial processing.

Banking Infrastructure Enters Its Blockchain Era

Orchestration, routing, and data security are poised to become the most exciting battlegrounds in finance, driven by leading banks’ innovative use of blockchain.

Interestingly, from my side, I actually disagree with most of these headlines!

First, banks are keeping pace with digital. It ain’t easy, but they’re doing it. Not every bank, but the big boys are doing pretty well generally. The thing they find difficult is being part of an ecosystem and not just being a big fish in a small pond.

Second, smaller bank failures did worry the markets in 2023 with the biggest crash being Credit Suisse. Interestingly the report doesn’t mention that, but this is because it’s an American report. What really got my goat with this headline however is that they think the failure of a few small American banks was a bigger issue than what happened in 2008, when the whole financial system in America and Europe almost failed. Duh?

Third, KYC has been an issue for all of my life in banking, and continues to be so. In fact, it’s getting worse, as demonstrated by my recent blogging. Therefore, it would have been4 better to rephrase this as Banks Battle to Keep Digital Pace Amid An Identity Evolution.

Fourth, well FedNow has finally caught up with the rest of the world for instant payments which, fyi, were introduced into the UK markets in 2008 … so, it’s only fifteen years later.

Finally, it may be that I’ve missed a trick somewhere but blockchain is still a bit of an enigma. The technology has been around for around fifteen years now, and yet there still seems to be little mainstream market infrastructure that uses it. Sure, that is changing thanks to CBDC (Central Bank Digital Currency) developments but, if that’s what the report was getting at, it’s not blockchain but digital currencies that are on the rise now. Therefore, again, this trend seems a bit off but, having said that, here’s a useful link to 37 other real-life uses of blockchain today if you’re interested.

All in all, the report is long and detailed but hits a bit wide of the mark, as it is too US-domestic focused and misses key nuances of these developments. Nevertheless, if you want to pick up a few ideas, it’s worth a read and hat-tip to Theo Lau for recommending it to me.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...