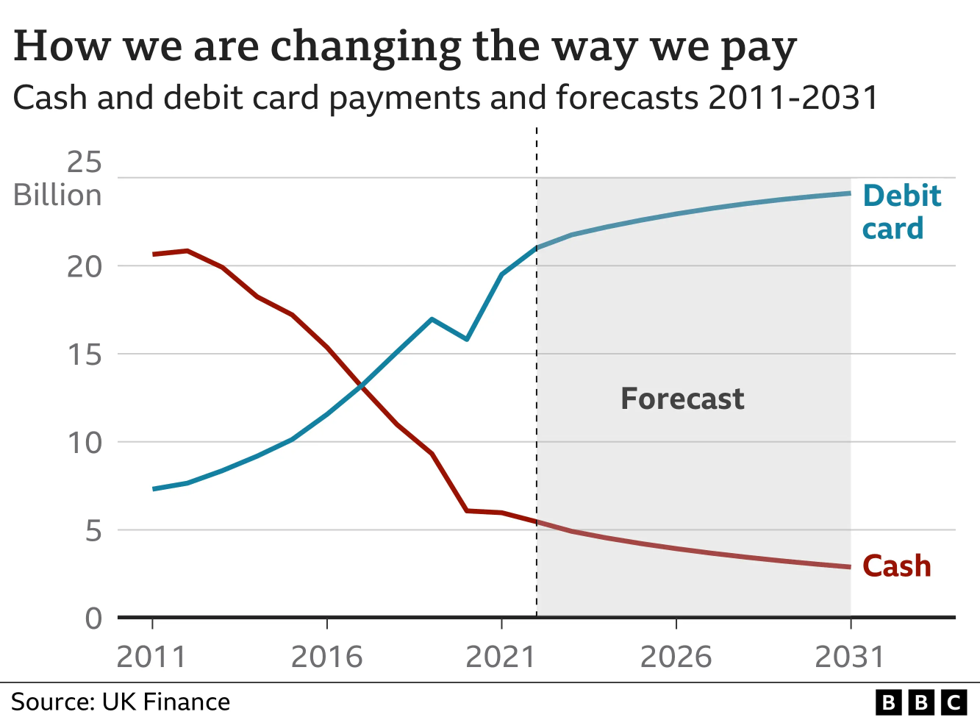

For over twenty years, I’ve predicted the end of the ATM, cash and cards. Finally, many of those predictions appear to be coming true. It is certainly true of cash versus card …

… and now it is turning out to be true for card versus wallet …

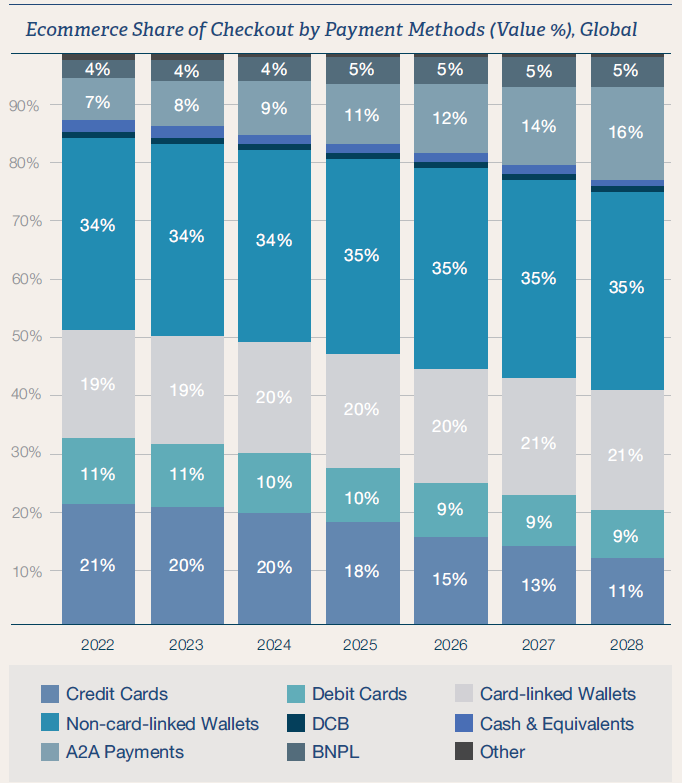

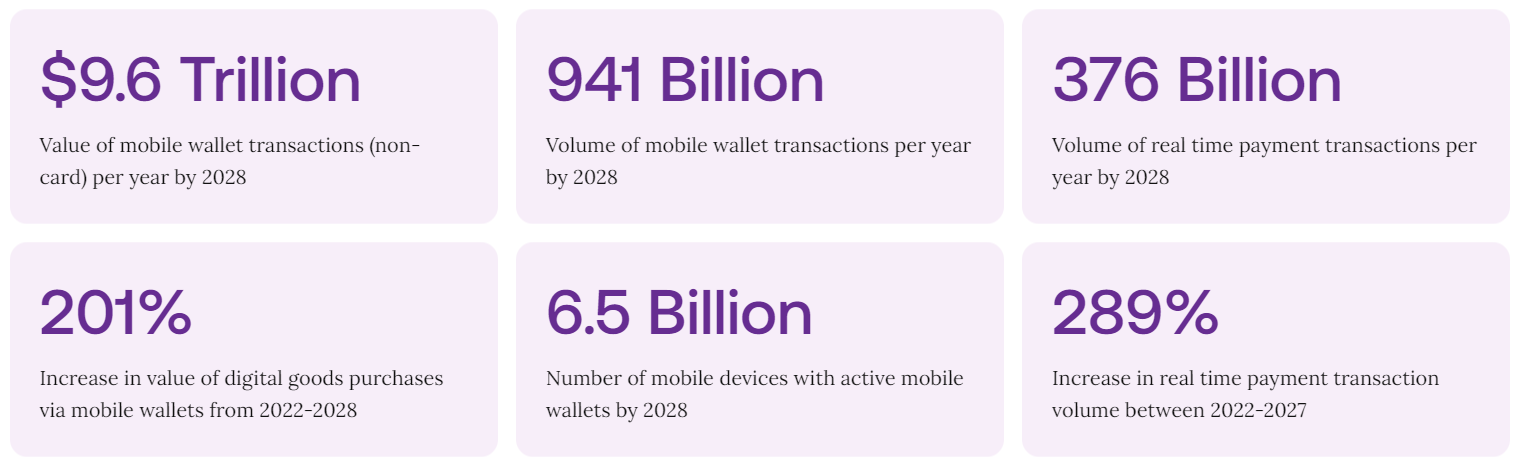

Admittedly, the second picture is from a mobile payments provider and promoter called Boku, but their research does create a stark context and glum future for the big card network providers, namely Visa and MasterCard.

The report highlights that against a backdrop of continued strong growth in ecommerce, the global card schemes continue to lose share of checkout to regional and local payment methods such as digital wallets, account-to-account payments, carrier billing and BNPL offerings. This is a trend seen at an aggregate global level but also repeated in every region across the world.

The key developments in the report is a massive shift over the next five years from credit and debit card to wallet and account-to-account (A2A) payments. Their report reckons that 58% of all ecommerce transaction value globally will be processed by local payment methods by 2028. In fact, they forecast that almost $10 trillion of payments will be made via mobiles by 2028.

That’s great, but let’s narrow it down to Europe. Their specific proposition is that Europeans will move away from credit cards. Credit card payments online (mobile and internet) will drop from 31% in 2022 to just 15% in 2028. To be clear, Europeans will halve their payments by credit card. Similarly, debit card payments will drop from 13% online to just 8%, a near halving of debit card payments.

This is because cards are being replaced by wallets and A2A payments.

Admitting the bias in this report – it is an online payments enabling company that did it – I find myself a bit bemused. Why? Because I’ve been forecasting the end of cards and cash for years. Now, I am forecasting the end of wallets and A2A payments. That’s the problem when you focus on the future. You can always see a cycle of birth, growth, doom and gloom.

So, what’s the issue with mobile wallets? The issue is that they’re mobile wallets. They need to be embedded wallets usable everywhere, everytime for everyone. That’s where we’re going folks.

As we move to the augmented, embedded world of money, we would just manage everything via devices connected 24*7. Forget cash, cards and wallets, it’s just everywhere.

Another factor is that, even if cards are dead, they will still be around. Mobile wallets are usually backed by a card number and expiry date. The card issuer and acquirer are still involved. So cards as a physical object may be dead, but card acquisition is still very much alive.

Therefore, although Boku’s research claims that Visa and MasterCard are on their last legs, I don’t agree. In fact, I would go as far as saying that, in twenty years, there will be no cards or cash around, except in exceptional circumstances, but there will still be card issuers and acquirers who back IoT embedded finance and, most likely, their names will be Visa and MasterCard and not Boku.

Debate?

Postscript: hat tip to my friend Efi for this report.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...