I often come back to the trough of banking licenses, but if banks didn’t have banking licenses, why would we need them?

A banking license is not just about compensation and insurance schemes, but about trust, trade, risk, regulation and returns. More than this, once a bank has a license it can lend, something an e-money institution (EMI) cannot because they have to safeguard funds.

I blogged about this the other day with regards to Revolut, and they themselves make the difference clear:

When you keep money with an e-money institution, it's safeguarded instead of having FSCS protection (sometimes called “deposit insurance”).

The main difference between FSCS protection and safeguarding is that FSCS protection is covered by an independent statutory organisation, while safeguarding protection is provided by the e-money institution itself. If a FSCS protected firm were to fail, this independent organisation is legally obliged to pay back their funds to eligible customers up to the maximum compensation amount (normally £85,000 for consumers). This will happen whether or not the FSCS protected firm actually has that money itself. This payout will normally happen within seven days.

If an e-money institution (like Revolut) fails, the customers’ claims will be paid from the safeguarding account. This is because the e-money institution cannot lend the money it has received from one person to another, so it should have enough money in its safeguarding accounts to cover its debts to its customers.

Now that I’ve shined a light on this specific area, it shows why Revolut needs a banking license, as holding money on their own account to safeguard any customer losses is not very efficient.

Think about it.

A bank with a banking license can provide trade finance, mortgages, loans and more, but an EMI cannot. The EMI is holding the funds that could be used for lending on their own account. How much?

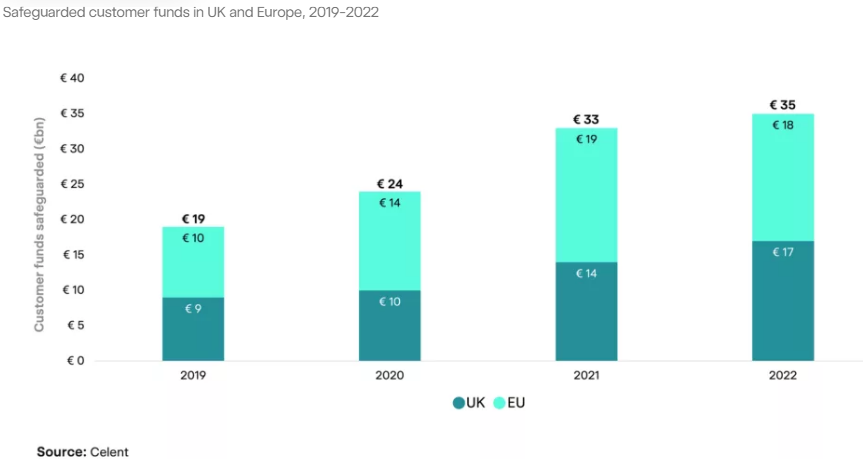

According to this Celent report, commissioned by Clearbank, it’s growing all the time and, by the end of 2022, amounted to £35 billion across the UK and Europe with 600 EMIs.

Unlike a bank, that means the funds are tied to safeguard customers, rather than being loaned to create growth. That’s why we need banks. We may not like them*, but they provide a whole range of services that enable progress, expansion, economic growth, prosperity and more, all by managing risk, keeping just a small part of their funds to cover failure (under Basel III, it’s 10.5% of Tier 1 Capital), and allowing the movement of monies to be transacted with certainty and with an insurance back-up scheme.

So yes, we do need banks. We don’t need banks purely to do lending and manage risk, although that’s pretty useful, but we need banks to ensure growth, trade and trust because they are licensed to bill.

The name’s Bond … Bank Bond.

* I’m sure you know the claim that banks sell you umbrellas on sunny days and take them off you when it rains, but this is why people don’t like banks. They give you credit when you don’t need it, and pull the plug when you do. But, think about it. If you load up with loans, your risk grows. The higher the risk, the less likely they are to lend to you. Having said that, if you owe the bank $1,000 they’re going to be far warier than if you owed them $1 billion. Someone with a billion owed to the bank is far more difficult to deal with. Just watch the Donald Trump inspired A Man in Full if you want to know more.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...