I just found an interesting blog by Plaid:

10 fintech trends for 2024 that define the industry's future

What are the 10 fintech trends?

Trend #1: Consumers will use more fintech apps than ever

Trend #2: Fintech increasingly provides financial stability during uncertain times

Trend #3: Emerging payment technologies will become as normalized as the credit card

Trend #4: Credit score alternatives will revolutionize consumer credit

Trend #5: Bank payment usage will continue to grow.

Trend #6: Embedded finance revenues expected to triple by 2029

Trend #7: Financial identity fraud attempts will grow, but identity verification solutions are stepping up to fight it

Trend #8: Loan volumes begin to trickle back up

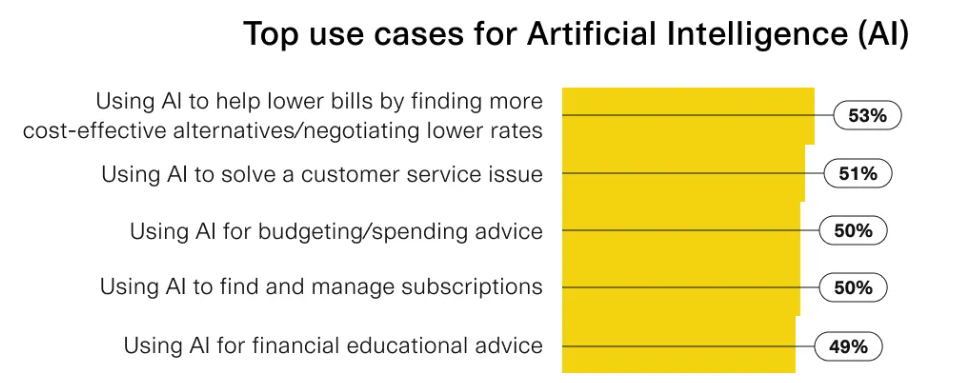

Trend #9: AI will revolutionize the way consumers manage money

Trend #10: Consumers lean into traditional investing as crypto interest cools

There’s obviously much more detail on their blog page, but it’s more than just a blog, it’s a whole in-depth 50 page report that you can download. What’s in the report? Well, here’s a few key results:

- 70% of consumers prefer A2A payments than debit or credit cards

- 63% of consumers say that credit scores are not good enough

- 66% of consumers want fintechs to teach them more about how to manage money

- 91% of consumers have key financial goals

- Four out of five consumers are happy to open accounts with fintechs

- The average consumer has three or more fintech apps

The report is based on a late 2023 survey of over 2,000 Americans.

#Recommended

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...