I was thinking about whether we need another digital bank in Britain the other day. I know that’s UK-focused and am very aware of digital banking developments in other countries, but the UK kind of led the way with the launch of Monzo, Starling, Wise and Revolut a decade ago.

They may be the headline grabbers, but there are a whole load more challengers other than the headline grabbers. There’s Aldermore, Allica, Griffin, Tide, OakNorth, Zopa … the list goes on.

Then there are the traditional banks who are catching up fast. Lloyds, Barclays, NatWest and HSBC have been hiring ex Monzo, Starling, Wise and Revolut developers and engineers and have been adapting and upgrading their apps to include the best features of the challengers as fast as they can.

As a customer, you sit there bewildered and think: do I need another bank? Equally, you get to the stage of saying the market is saturated. There are too many suppliers and not enough buyers. The neobank, challenger bank, digital bank marketplace is done …

… or is it?

Certainly the consumer retail banking market is now over-served by challengers but, in the SME and B2B markets, are there opportunities? Bear in mind that we all know how retail banking feels, but what about private banking, commercial banking, investment banking and the rest?

Well, the rest offers clear openings for those who know what they’re doing. That’s why I was interested in hearing about LoopFX, a brand new fintech focused upon the seven trillion dollars worth of trading made every single day in the wholesale banking markets. Here’s how they describe themselves:

LoopFX is a dark pool pioneering a new protocol in Foreign Exchange called PeerToBank matching. LoopFX allows Asset Managers and Banks to match large offsetting trades with zero information leakage at a mid-market rate. Asset Managers access LoopFX within their existing workflows through collaborations with market leading platforms like FX Connect. Banks are paid for liquidity matched in LoopFX, completely reversing the paradigm.

This may sound a bit exotic for those unfamiliar, so let’s start with clarifying a few terms. A dark pool allows firms to trade with each other without revealing their trade details to other companies. Therefore you can quietly make a bid for a trade to be completed and no one else knows how much you bid or who you are until your bid is filled by a seller. Those bids and orders are matched and completed in the dark pool. A bit like bidding for items on eBay without giving your username away in public, the world’s financial markets work this way.

If you wnat a more formal definition, here's the one I picked up from Investopedia:

Dark pools of liquidity are private stock exchanges designed for trading large blocks of securities away from the public eye. These trading venues are called "dark" because of their complete lack of transparency, which benefits the big players but may leave the retail investor at a disadvantage.

So, LoopFX is a new start-up trying to get into the two trillion dollar trading in FX in dark pools every single day. Amazing.

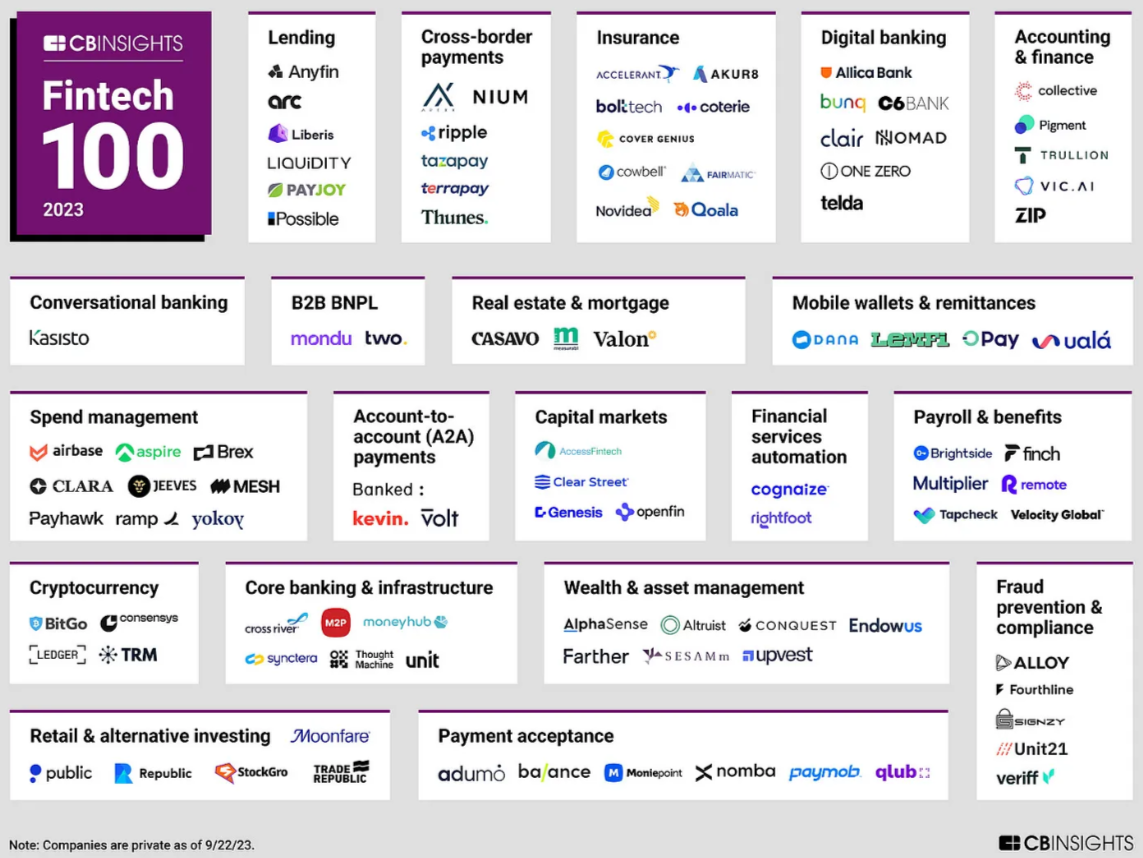

That’s just one example of disruption taking place outside the consumer space, but there are many more. By way of example, you may think roboadvisors and such like are done and dusted, but there are clear startups in the B2B wealth management space that are interesting. In fact, there are clear startups in almost all B2B financial spaces that are interesting.

So, for those who think digital banking is done, think again. It’s only 1% done so far …

Postscript: the only reason I mentioned LoopFX is that I met their founder, Blair, the other day who presented their pitch with the opening line: “there is over seven trillion dollars of money exchanged every single day by just 1,000 people who represent assert managers and banks. We don’t know why we trade with each other this way, we just do. It’s based upon relationships rather than knowledge. LoopFX aims to change that.”

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...