Sitting down to blog today, I wondered what was the difference between A2A and P2P. I’m sure you know that A2A is Account-to-Account and P2P is Peer-to-Peer, but surely they are one and the same thing? Ahem, no.

According to Brite, a player in the open banking space:

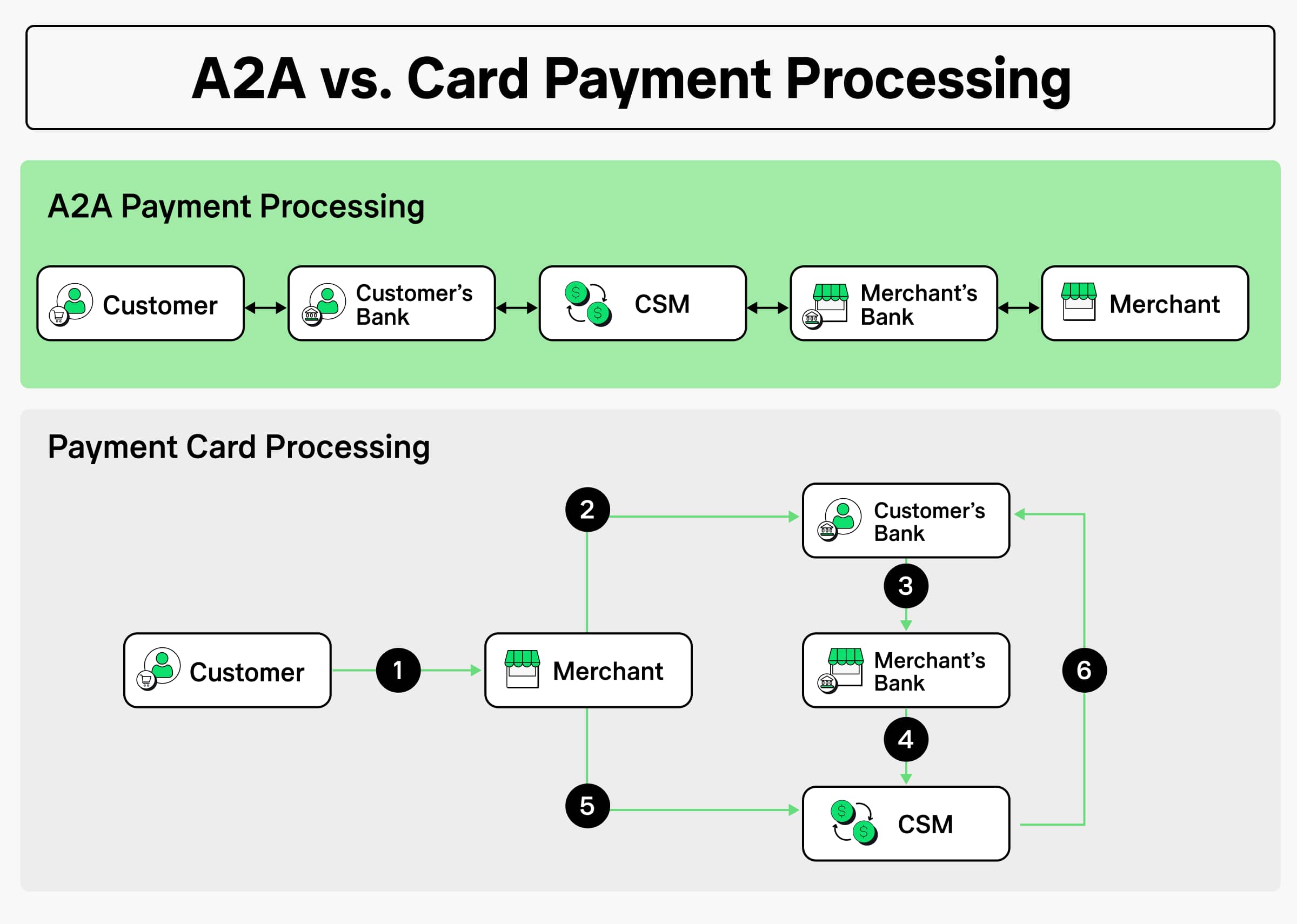

Account-to-account payments are direct transfers of funds from one bank account to another account bank account. They effectively bypass the need for any middlemen or payment tools like cards, reducing the number of parties involved who will take a portion of the transaction.

Got that.

So, isn’t that P2P? No. According to Stax, another payments player:

Peer-to-peer payments are digital payments between two individuals … transferred directly from one person’s bank account, checking account, credit or debit card, or payment app, to another person’s bank account, or app.

So yes, there is a subtle difference between A2A and P2P. Subtle but important, as P2P can be open to fraud, misuse and abuse. A2A is meant to be more trusted as it uses open banking links and structures to transact. As McKinsey puts it:

Use of A2A can significantly reduce fraud and charge-backs, as well as eliminate interchange fees. These benefits accrue because every transaction is authenticated by a consumer’s online banking credentials and uses real-time rails.

Well, I guess the real importance of A2A is all about embedded payments where you no longer need to think about how the payment is made. That’s why Visa acquired Tink and Mastercard acquired Finicity which, based on recent conferences like Money2020 Europe, are a pretty big deal for these firms. In fact, specifically, I was surprised to see the Visa booth at Money2020 stating that it was Tink powered by Visa, rather than the other way around.

Visa Open Banking Solutions help clients build data-driven financial services and move money more seamlessly by connecting financial accounts. In 2022, Visa acquired Tink, a leading open banking platform in Europe, to accelerate the development and adoption of open banking. We are now bringing these services to the U.S. under Visa Open Banking Solutions–extending the power of our network and enabling innovation at scale.

In other words A2A embedded payments is a big deal. Forget P2P. Well, don’t. Do both. Meanwhile, try to avoid taking the PIS. What? Oh yes, Payment Initiaton Services (PIS). As this article from Tink outlines:

PIS can be embedded anywhere, which means it can integrate seamlessly into a merchant’s existing payment flows. There’s no need for a user to leave the app and enter their banking environment to initiate a payment.

In other words, P2P is a direct payment made to a contact that you send specifically to them; A2A is the same, but made direct from my account to your account; and PIS integrates both ideas so that I can pay you in-app on a mobile without having to think about it. It’s fully embedded.

Between P2P, A2A and PIS, the payments world is being transformed rapidly. Are you keeping up?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...