I realised today that I’ve talked lots and lots about Asia, Africa, Europe and the South Americas banking, fintech and digital state. But I haven’t written much about the USA. So, today’s the day!

With a colossal $176 trillion in Household Financial Assets and $128.5 trillion in non-cash payments, the U.S. banking sector stands as a powerhouse of scale and influence. Banking revenues surged to $2 trillion in 2023, propelled by expansions in retail and corporate banking, highlighting the sector’s resilience and adaptability.

And it is now all going digital.

The digital frontier has redefined consumer interactions, with mobile banking now servicing over 225 million users across the USA (there are 258 million adults in America to give this context). In other words, that’s pretty much every American using mobile banking.

This shift is amplified by the rise of neobanks and FinTech disruptors, who are strategically targeting niche markets such as Latino and Indigenous communities, but encountering significant challenges along the way.

Who are these disruptors, and are they really disrupting?

Well, the names that come to mind include Chime, Varo, Ally, Sofi, Marcus, GO2Bank, Cash App, Greendot, Venmo, Aspiration, LendingClub and Wealthfront. My personal favourtie is Chime, because they seem to be the most successful. Chime's Valuation in 2021 was $25 billion with more than 21 million users in 2023. Chime's user base is 61.24% female and 38.76% male and they are mainly 35-44 years old, according to Prior Data, but all offer some capabilities and differentiation.

In fact, there are around 85 digital-only banks in the USA and some have emerged as pioneers, showcasing positive returns, while others, like Chime and SoFi, continue to invest strategically to overcome profitability challenges.

More than this, there are several digital banks dedicated to serving SMEs (Small and Medium Enterprises) such as Venmo, Square, Brex, Bluevine, Mercury, and LendingClub.

These providers focus upon using fintech to streamline payment solutions, tailor lending products and deliver innovative financial management tools. In other words, these brands are setting new standards in business banking, ensuring they remain competitive in an ever-evolving market.

As with all countries, fintech is changing the landscape of banking … or are they?

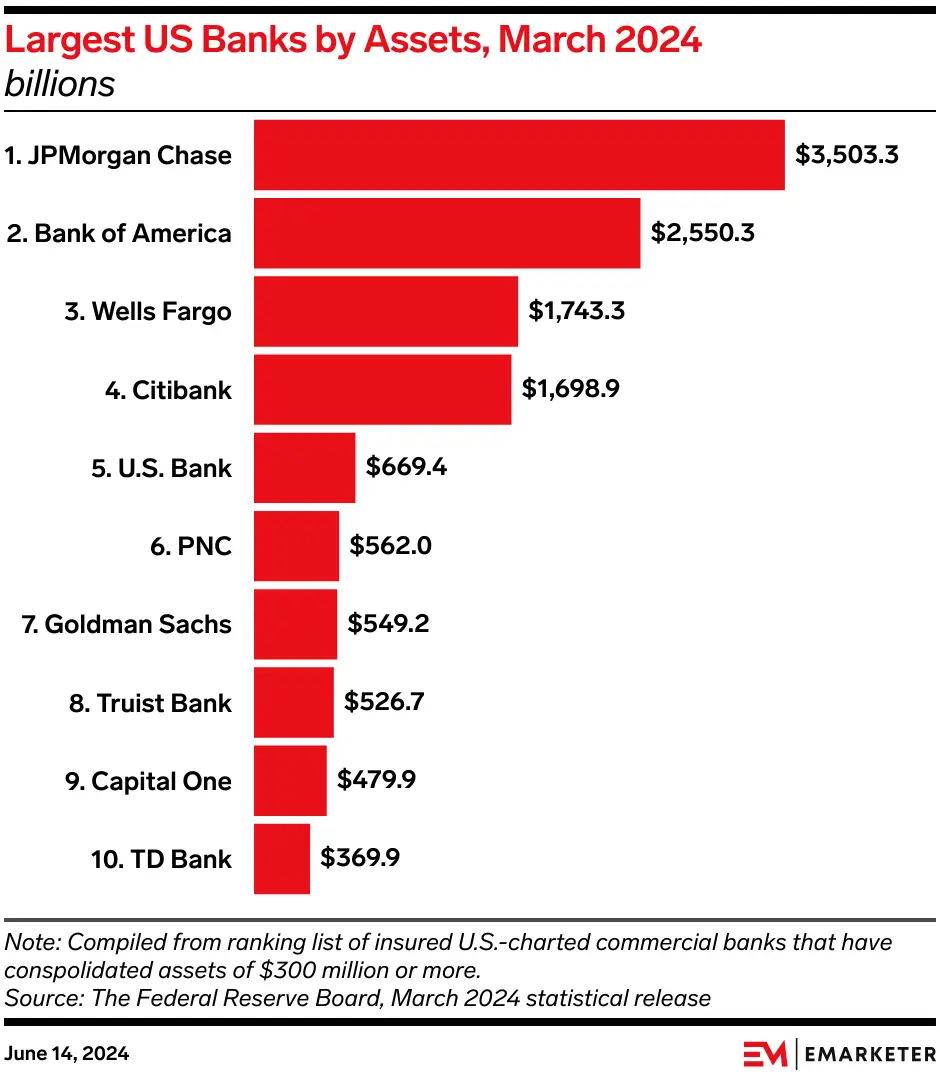

As of Q1 2024, the largest US banks by total assets are:

Source: emarketer

Add those together and the top four American banks are managing near $10 trillion of assets. Ten years ago, the top four banks were the same, and they were managing around $7.5 trillion of assets. Plus ça change.

Either way, there is change happening. It’s just a nice slow burn. Meanwhile, if you have $900 spare, you might find this report interesting if you want to know more. If not, just call me and I can tell you all about it.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...