For some reason, I’ve just been bombarded with emails about the secret memo from venture capital firm Sequoia, about their investment twenty years ago in YouTube. Maybe it’s because it’s only just come to light or maybe it’s because it provides the secret sauce of how to achieve a successful early funding round. For me, it’s the latter, which is why I’m sharing it here for all my early start-up friends.

Most of the updates are about the internal memo that Roelof Botha*, partner with Sequoia Capital, shared back in 2005 when the company made a $3.5 million investment in YouTube especially as, a year later, YouTube was sold to Google for $1.5 billion. That wasn’t a bad ROI (Return on Investment)*.

The reason people are talking about it is that it provides a transparent insight into how VC investors think. Equally it shows how to build a pitch deck that works. For those two reasons, it’s a great insight into the start-up world and came out of the court case in 2007 between Viacom and YouTube over copyright (which Viacom lost).

The story of YouTube's early days and its rise to become one of the internet's most dominant platforms is a fascinating one, filled with valuable lessons for new founders. Actually, the confidential investment memo from Sequoia Capital, one of YouTube's earliest investors, was made public as part of a lawsuit. This memo provides a unique window into how one of the most successful venture capital firms viewed the potential of YouTube back in 2005.

In the memo, Sequoia partner Roelof Botha outlined the rationale for investing in YouTube, highlighting the company's goal of becoming "the primary outlet of user-generated video content on the Internet." This focus on empowering ordinary users to create and share video content was a key differentiator for YouTube at the time.

But what I really liked was the simplicity of YouTube’s pitch deck which you can see in full here with commentary, but here is the deck (bear in mind it was 2005):

Pretty ugly, huh? But good enough to get Sequoia to invest.

Why? Because, as Roelof puts it, YouTube can become the ‘primary outlet of user-generated video content.’ This is supported by calling out several ‘strong veins’ (macro trends) that Youtube taps into including specifically the rise of broadband internet. This is articulated in just nine lines in the memo which, today, seems obvious in hindsight but, at the time, video was basically non-existent on the web.

You can see and download the whole details of Roelof’s testimony and memo here which, if you are an investor or start-up, I can thoroughly recommend. Additionally, if you cannot be bothered reading a boring court statement, this blog breaks it down nicely into a much more digestible form.

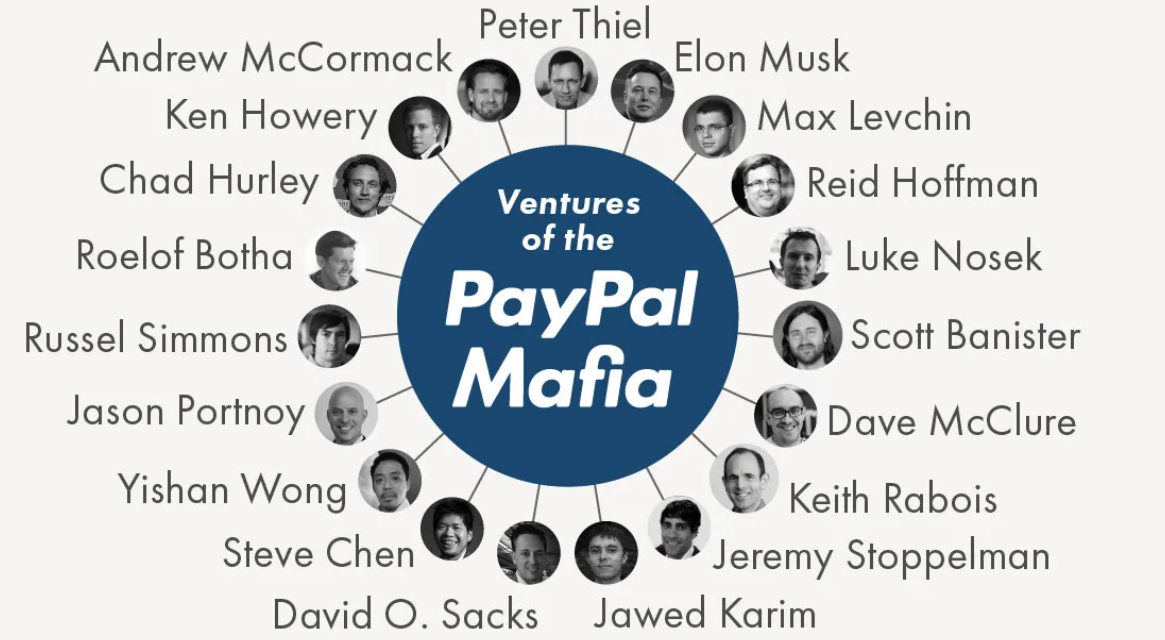

* Roelof Botha, like Elon Musk and Peter Thiel, is part of the PayPal mafia (former CFO)

** Here's Revolut's pitch deck for their early £1.5m seed investment: https://www.linkedin.com/posts/linasbeliunas_revoluts-pitch-deck-ugcPost-7232465572997849089-g-6d

*** One of my favourite anecdotes is a true story about McKinsey not knowing who the hell YouTube was. This was back in October 2006, and a massive amount was paid to buy a fledgling company back then. The CEO of McKinsey called his direct reports into the office and asked: “What the hell is a YouTube?” No-one knew the answer as, back then, the internet was still nascent and McKinsey were not leading the analytics around that space. So, the CEO entered YouTube into Google search on desktop PC – yes, we had PC’s back then – and the answer came back: this website is blocked by our firewall; contact the company’s server administration if you want access. Funnily enough, I heard the same story about Facebook from HSBC.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...