Everyone seems to be talking about CBDCs: Central Bank Digital Currencies. They are being launched to stem the tide of cryptocurrencies, but it makes you ask: what’s the difference. A CBDC is backed by a government; a cryptocurrency is backed by decentralised democracy. Not much difference there then.

The Bank of England defines CBDC as “money that a country’s central bank can issue. It’s called digital (or electronic) because it isn’t physical money like notes and coins. It is in the form of an amount on a computer or similar device”. They then issued a consultation paper if you want to know more.

So why do we need a CBDC?

There are many views, and the core one is that it is underwritten by a central authority. A central bank and a state government. But then the next question is whether a CBDC should be available as only G2C or G2B2C. What? Government to consumer, like cash; or Government to Bank to Consumer. Most governments have settled on the latter model, so as to avoid disrupting the existing system, but there is still a debate about whether CBDCs should be issued through commercial banks or direct to consumer.

McKinsey explain the different approaches well:

There’s no one type of CBDC; a wide variety of approaches are being piloted in various countries. One type of CBDC is an account-based model, such as DCash, which is being implemented in the Eastern Caribbean. With DCash, consumers hold deposit accounts directly with the central bank. At the opposite end of the spectrum is China’s e-CNY, a CBDC pilot that relies on private-sector banks to distribute and maintain digital-currency accounts for their customers. China showcased e-CNY during the 2022 Olympic Games in Beijing. Visitors and athletes could use the currency to make purchases within the Olympic Village.

Another model is the one under consideration by the European Central Bank in which licensed financial institutions each operate a permissioned node of the blockchain network as a conduit for the distribution of a digital euro. A final model, popular with “cryptophiles” but not yet fully trialled by central banks, is where fiat currency (currency that is government issued but not backed by a commodity) would be issued as anonymous fungible tokens to protect users’ privacy.

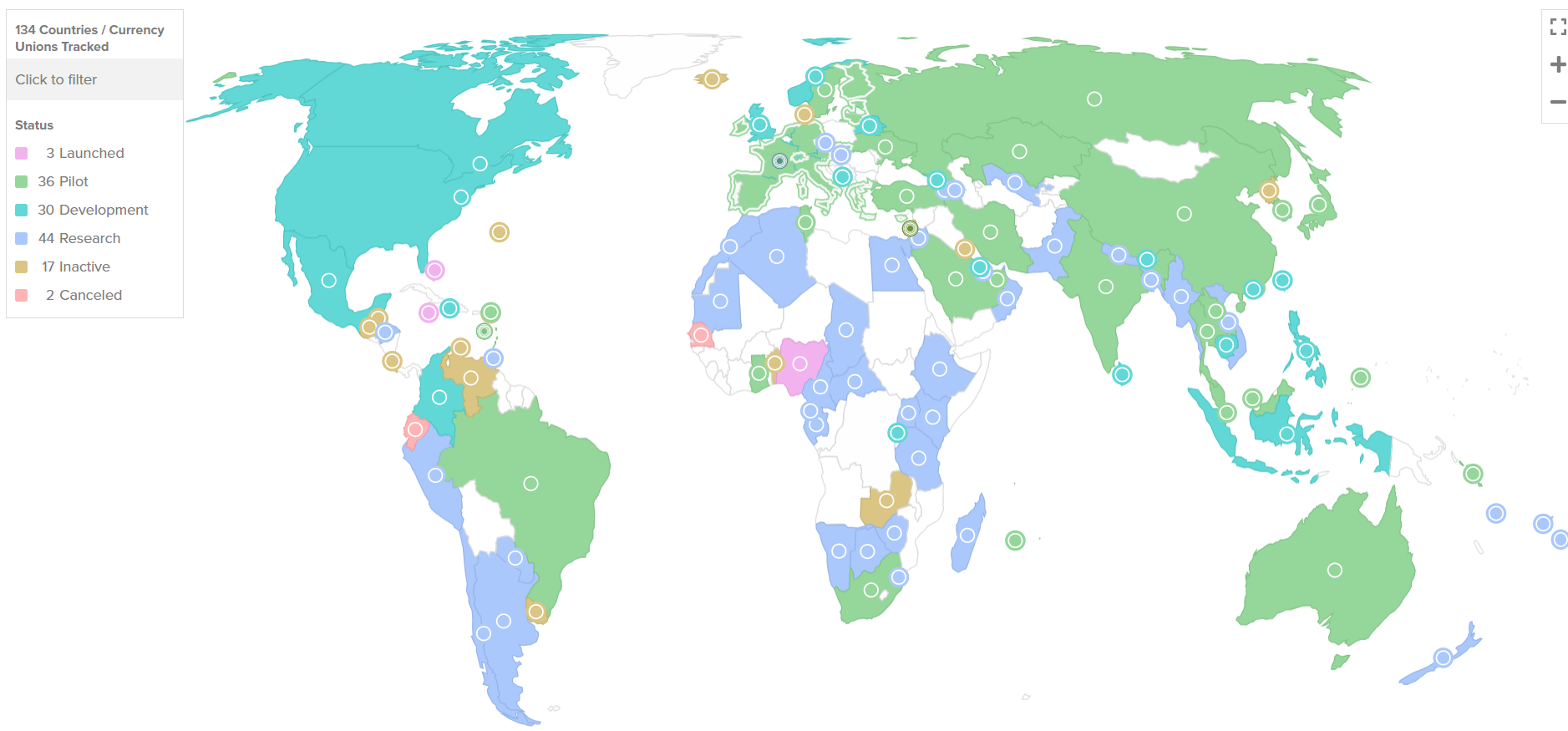

Interestingly, my favourite CBDC tracker with the Atlantic Council shows that almost every country in the world is developing, experimenting, piloting and maybe even implementing CBDCs.

The thing is: do we actually need CBDCs and what are the risks?

Well, the Bank of England and HM Treasury identify a number of motivations for doing this. The primary motivations for the digital pound are the availability of central bank money as an anchor for confidence and safety in money, and promoting innovation, choice, and efficiency in payments.

Whilst there are societal and economic benefits to the digital pound, potential risks have also been voiced. The House of Commons Treasury Committee, for example, note it could bring new risks and challenges, including risks to financial stability if consumers en masse were to switch bank deposits into digital pounds during periods of financial market stress.

There are also concerns about financial inclusion, which could suffer if the digital pound were to accelerate the decline of cash, causing potential difficulties for those reliant on physical cash.

From a European standpoint the motivations and risks are rather different and possibly more extreme. They note that consumers are abandoning cash in favour of digital payments and are worried about the consequences:

Are consumers too reliant on US card networks, which recently withdrew their services from Russia, demonstrating that even private payment systems can become drawn into international conflicts?

Are alternative systems needed to improve the economy’s resilience to system outages, natural disasters or cyberattacks?

Does it matter if there is no longer a public alternative to private payment services like card payments?

Will consumers who value the privacy of cash adopt riskier alternatives like Bitcoin or stablecoins, some of which have been recently proven to be unsafe stores of value?

Whatever your view, your country, your operation and your needs, there is an inevitable movement towards digital currencies, whether you like it or not. Many countries are researching or developing central bank digital currencies, and three have implemented them.

In particular, it is seen as important for financial inclusion, because many people have no access to bank accounts, so a CBDC would give them a way to be paid, hold their money, and pay bills digitally … unless they don’t have a mobile phone.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...