Sorry to keep blogging about APP (Authorised Push Payments) fraud, but it’s a big topic of my friends right now in Britain, and Jeremy Light just published a great post on LinkedIn that provides more insight. Here’s his thoughts:

The PSR’s Authorised push payment (APP) scams performance report for 2023 contains some extraordinary data. Published last month, it covers 14 banks that have signed up voluntarily to a code which sets criteria for reimbursing victims of scams who have been tricked into sending money to a fraudster over the Faster Payments system.

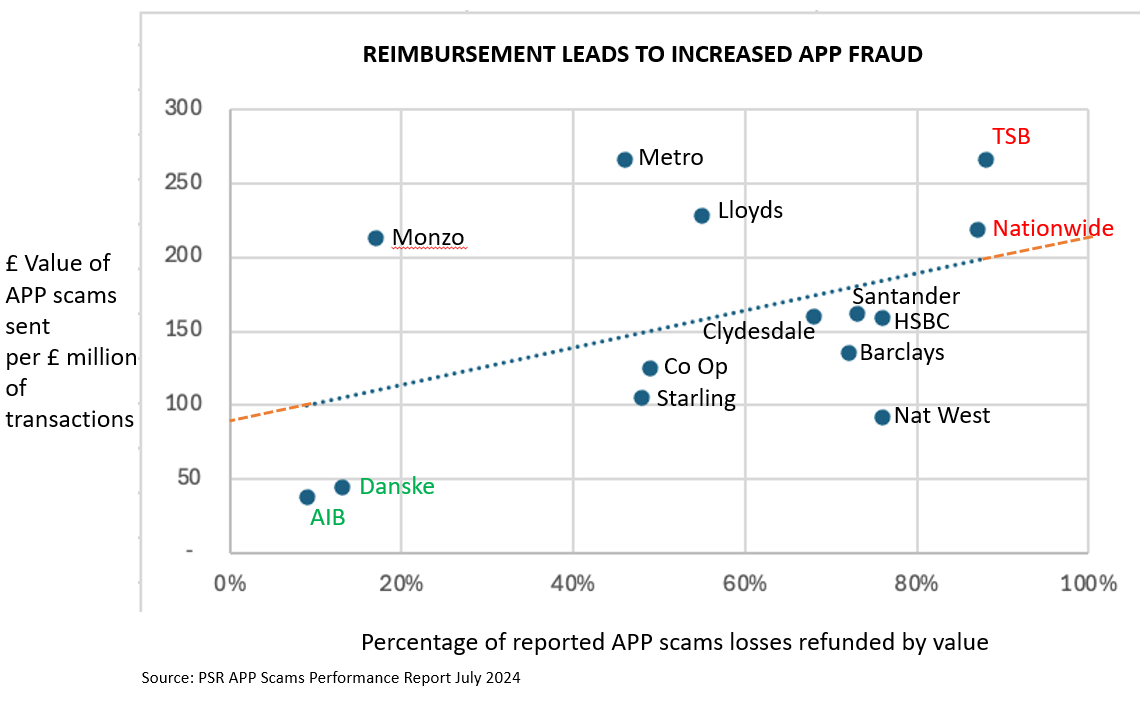

This report fuels fears that reimbursing APP victims encourages APP fraud. The report does not make this claim, but analysis of its metrics supports it. A plot of “Value of APP scams sent per £ million of transactions” against the “Percentage of reported APP scams losses refunded by value” for each bank shows a clear correlation that the more a bank reimburses its customers, the greater the rate of fraud they suffer.

TSB and Nationwide have the highest reimbursement rates at 88% and 87% respectively, but TSB has the joint highest customer losses at £266/£m of transactions and Nationwide the fourth highest at £219/£m. In contrast, Danske and AIB look stingy, reimbursing just 9% and 13% of their customer losses, but their loss rates are only £44/£m and £38/£m, less than one sixth TSB’s rate.

Extrapolating the least squares line in the graph suggests an industry average loss rate of about £90/£m if no victims were reimbursed, compared to the actual total loss rate across the 14 banks of £138/£m (my estimate).

Thus, £48/£m, £137m in total, or a third of APP fraud could be due to reimbursement.

The PSR requires all PSPs to reimburse APP fraud from 7th October 2024. This is around 1,403 organisations rather than the current 14 volunteer banks – and they have five business days to reimburse (rather than 15 days currently), with an upper limit of £415,000 (way in excess of last year’s average fraud of £1,350).

Extrapolating in the other direction where 100% of fraud is reimbursed, the industry average loss rate is about £210/£m, a 52% increase in APP fraud, an extra £200m.

As things stand, these new rules will be open season for criminals.

If the PSR wishes APP fraud to spiral out of control, eroding the integrity, speed and utility of the UK Faster Payment system and public trust in it, while curbing innovation and new entrants, then their reimbursement mandate will do the job.

I expect otherwise, in which case the new rules for October should be suspended, pending a rethink using the PSR’s own data as evidence.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...