I wrote in April about debanking my bank before they debanked me, which is a theme regularly popping up in UK media. The debanking process is where, without notice, a bank decides that your account is suspicious and blocks it for no apparent reason. You cannot get it reopened and often find it difficult to move the account elsewhere, as evidenced by many big groups on Facebook that argue about this, the two most prominent being related to Monzo (over 20,000 members) and NatWest (11,000 members).

The whole thing has now blown up again, but this time in the USA thanks to Marc Andreessen. In a podcast with Joe Rogan last week, Andreesen went on a rant about how Biden’s administration forced the banks to exclude cryptocurrency firms access to the financial markets.

He claims that the US government sanctioned over thirty tech startups, including crypto companies, in the past four years. The interview is over three hours long, but you can see the highlights in this X thread created by Ben Averbook.

The gist of it is that the US government has cracked down on banks who deal with doubtful companies and people. The result is that, under threat of fines, the banks just dump those companies and people, close their accounts without notice and with no discussion or comeback.

Andreessen believes debanking suspect firms has its origins dating back over fifteen years ago to the Obama administration. Banks that provided services to ‘unconventional startups’, such as marijuana businesses, were asked to debank them or be faced with potential fines and regulatory breaches.

The exercise became more popular during “Operation Choke Point” in 2013 which investigated banks in the United States, and the businesses they dealt with. Suspect firms included firearm dealers, payday lenders and others that were considered a high risk for fraud and money laundering … even though they were operating legally.

Andreessen claims the Biden administration extended that practice over the past four years to include tech founders, especially crypto startups, with Elizabeth Warren’s nose all over it.

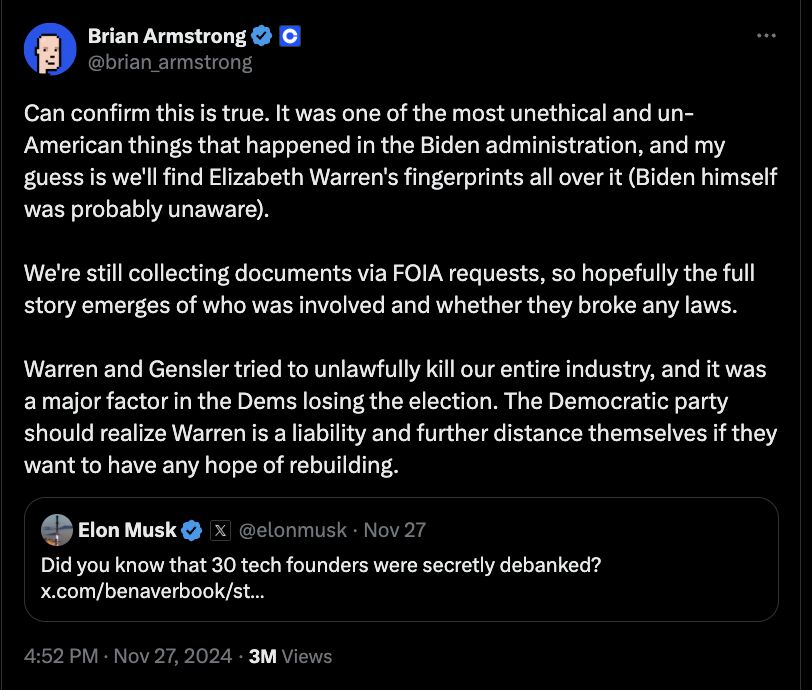

Well, the Rogan interview has opened the barn door for everyone to chip in from Elon Musk (the Tesla/SpaceX guy) to Brian Armstrong (founder of Coinbase).

In fact stories started appearing everywhere online with crypto founders flocking to the social media platform X to recount their debanking ordeals. Stories poured in, gaining momentum as more users chimed in. Some even began rallying behind the hashtag “#debankthebanks,” urging others to pull their money out of major financial institutions.

A good example is Dinesh D’Souza, an Indian-American conservative commentator, author, and filmmaker, who shared his own story of being debanked.

I was debanked by Chase. Walked in one day to discover they had closed my account. The local branch couldn’t understand it since I was a good and known customer. They said the order came from the top with no explanation given or even available!

Sasha Hodder, founder of Hodder Law Firm, shared the story of how her law practice was abruptly dropped by its bank. “My law firm was debanked in 2018 with just a 30-day notice. Many of my clients dealt with the same challenge, forcing them to go full crypto. Hearing Rogan and Andreessen bring this issue into mainstream conversation is good, maybe things are really going to change,” Hodder posted.

Andreessen then doubled-down during the weekend, posting a lengthy thread packed with links to stories about debanking from prominent outlets like The New York Times, The Wall Street Journal, Financial Times, Pirate Wires, Politico, and others. He even revealed that President-elect Donald Trump’s wife and son had been debanked. There are many updates @pmarca you can read if you want to know more.

Thing is that, for all of this shouting and moaning, why would the government and banks debank companies and people? It is not due to the fact they don’t like them but more to do with the fact that they are too risky.

Innovation moves faster than regulation which creates risks. Many fintech and crypto firms have been caught out by ignoring the strict know your customer (KYC) and anti-money laundering (AML) standards set by government and regulators, as well as heightened fraud risks as seen by Revolut over the weekend with authorised push payment (APP) fraud scams, in which criminals dupe people into sending money online to an account beyond their control.

As pymnts.com points out, the real issue here is “the lack of a clear, comprehensive regulatory framework to address the unique risks posed by the FinTech and cryptocurrency industries. Financial institutions, tasked with navigating a labyrinth of overlapping and often contradictory rules themselves, can commonly be left with little incentive to take on high-risk clients when the compliance burden could outweigh any potential gains”.

I guess the danger now is that the new administration under Donald Trump, who revels in being seen as the Crypto-President, and Elon Musk who has promoted himself to Chief DOGE in government and on X, will result in a Wild West of cryptocurrency scams supported by the US government for the next four years. Bear in mind that Andreessen, Armstrong and co will all be along for the bandwagon ride, it will be interesting to see where this goes. After all, don’t forget Synapse, FTX and such like.

This is not a stable market or a stablecoin. It is a burgeoning market fuelled by an awful lot of snake-oil salesman, as my friend Jeffrey Robinson likes to point out. Oh! Maybe he’s right …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...