I’ve been surprised recently by non-stop news updates about how well Revolut is doing. From getting its UK banking license, which was suspect for a while, to achieving the milestone of 50 million customers, 2024 has been a pretty phenomenal year for the company. Then they announce next years plans which include AI-driven finance, super ATMs and more, here’s a quick overview of what’s happening.

First, I’ve written quite a lot about Revolut and, specifically, their need to be licensed in order to lend. A license to lend is more important than a license to kill for a bank.

Well, that one was sorted (eventually).

There was another dark cloud on the horizon which was also sorted out recently. This one was former employees and investors in Revolut via a crowdfunding platform called Republic Europe. Over three thousand Republic users were early stage investors in Revolut, but struggled to get payback.

Nicely, as an early Christmas present, Revolut has agreed they can now get their money back in a move that has staved off potential legal action. Good news!

Then there is more good news as the company has just announced big plans for 2025. The Paypers summarise it nicely:

An AI-powered financial assistant designed to help users manage their finances more effectively. The tool will adapt to individual needs, offering personalised financial advice and simplifying administrative tasks.

A fully digital mortgage solution in Lithuania, followed by rollouts in Ireland and France by 2025.

Revolut branded ATMs will dispense both cash and cards, with long-term plans to enable cash deposits. Security will be enhanced through facial recognition technology.

The list goes on but the main headline related to moving from 1 customer to 50 million in under ten years. How did they do that? Antoine Le Nel, Chief Growth and Marketing Officer explains on the Revolut Insider podcast (18 minute listen).

Key points covered include:

- Reaching 50 million customers and what it means for Revolut

- Key factors behind Revolut’s success and strategies for growth

- Why this milestone motivates us to continue pushing boundaries

- How customer engagement varies across locations

- Antoine’s snackable product analogy that leads to building trust

- What’s next for Revolut and going beyond banking

- The rationale behind the 50 million customer event in London

- Why the revolutionary guests were chosen to take part

- Why companies like Candy Crush and Revolut experience such growth

I particularly liked the comments from Antoine about where Revolut is at today. Sure, it’s doing well in some markets, but has hardly dented Spain, Germany, Poland and Italy. That means the company expects to reach 100 million users within the next year or so. Oh, and Antoine believes that their secret sauce is delivering what the customer wants in the way they want through a smorgasbord of services, rather than trying grab all of their business in one big gulp like traditional banks do. Oh, and it probably helped that they began with an EU license in Lithuania.

Alternatively, if you are really into this, checkout this 45 minute interview with Revolut founder Nik Stronosky on how they will achieve $100 billion valuation:

Fascinating.

You may agree or disagree but I’ll leave you with this:

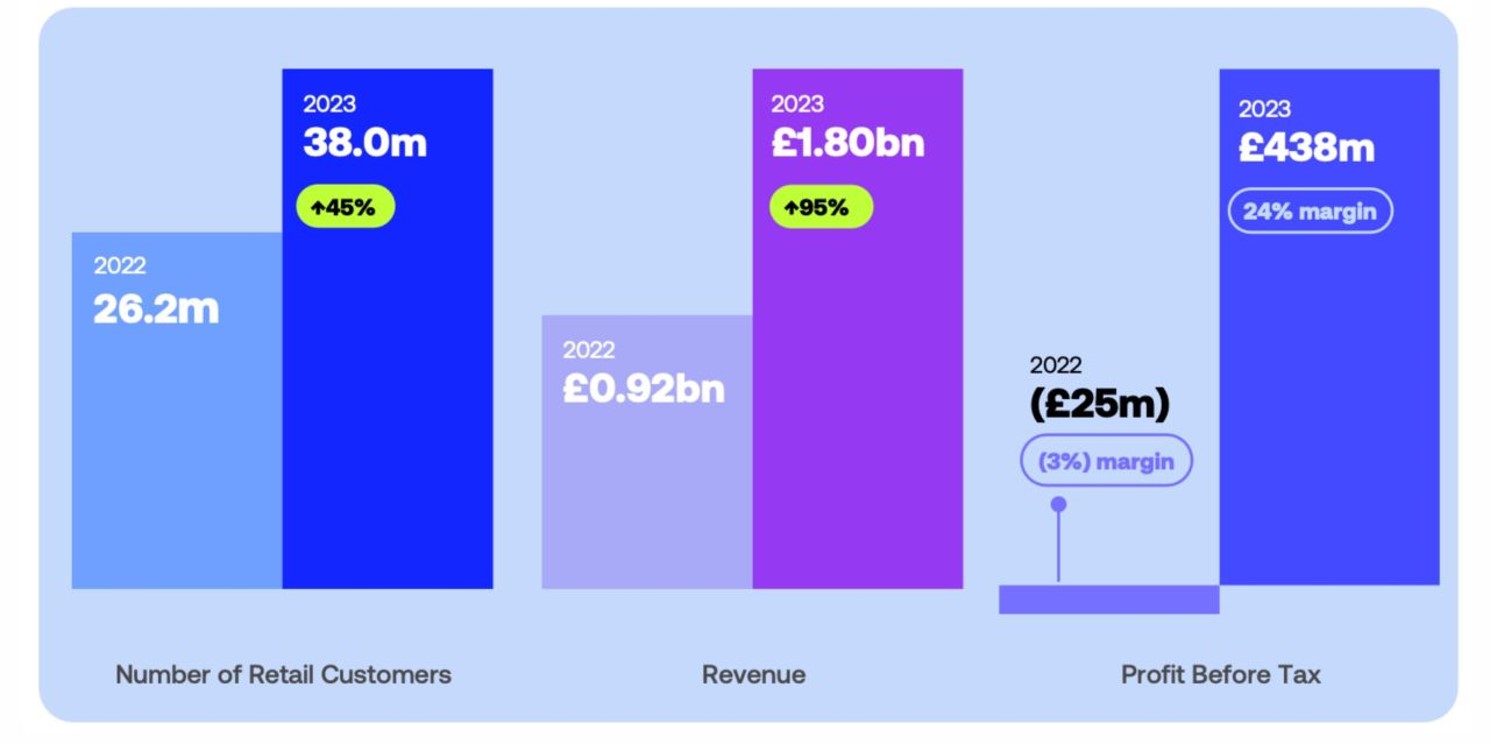

So, Revolut crushed 2023, rocked 2024 and look like exploding in 2025. Hard to disagree with numbers.

#Watchthisspace

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...