I’m not going to make any political statements, but have been watching UK political activity for the past few months, as has Elon Musk and others.

In particular, there have been two milestone budget events in the last two years, both of which damaged the UK economy massively. Add on to this all the Brexit mistakes that have been made, and Britain is in pretty dire straits these days thanks to all of these political shenanigans. However, I’m going to focus on two recent particular events which have turbo-charged Britain’s decline (it would be three, but I’ve already written too much about Brexit).

First, there was Liz Truss, the 49 day Prime Minister and competitor with a lettuce, whose downfall was determined by the budget Kwasi Kwarteng presented to the world on 23rd September 2022.

Why was this mini budget so disastrous? Mainly because the new administration ignored advisors, and underestimated the power of the Bank of England, the Office for Budget Responsibility (OBR) and the consequential impact on global markets.

Off the back of the mini-budget, the Bank of England was about to cease its emergency purchases of government bonds - these are a form of debt that the government sells to raise money it needs for public spending. As a result, Ms Truss' team felt she had no choice but to U-turn on a corporation tax cut announced in the mini-budget. The Bank's Governor Andrew Bailey [says] that this was not designed to pressure the government - but to ensure financial stability.

And then, with the OBR, she just didn’t realise the “sheer level of power an organisation like the OBR has” before she got to Downing Street.

It’s history now, but the Truss mini-budget revealed that the UK needed an extra £72 billion in funding from the markets – without details of how it calculated the number – and the market reacted badly. It simply did not believe the plans.

So, it’s strange that, two years later, the new Labour government seems to have fall into the same hole and messed up their plans.

At first, the budget didn’t seem so bad but, as people digested its contents, it revealed massive structural issues. A £22 billion black hole left by the conservatives increased to a £45 billion hole under Labour’s first budget. But, more than this, the policies have once again introduced instability. First, a rise in National Insurnace will constrain hiring policies resulting in greater redundancies and increasing unemployment benefit dependents; second, the UK depends upon the kindness of strangers to buy their government’s debts and the policies of the Labour government call these into question.

This is nicely explained by Sky News:

Other countries have as poor prospects for growth as the UK or as bad a debt situation. The US national debt, for example, is 123% of US GDP while Japan has a debt to GDP ratio of 250%. The UK, with a debt to GDP ratio of just under 99%, doesn't look so bad by comparison. However, as the market in US Treasuries is the biggest and most liquid in the world and the US dollar is the global reserve currency, investors seldom have hesitation about lending to the US government. Similarly, in the case of Japan, most of its government debt is owned by Japanese savers - encapsulated by the mythical figure of 'Mrs Watanabe'. The UK does not have that luxury and, accordingly, has to rely on what Mark Carney, the former governor of the Bank of England, memorably described in a 2017 speech as "the kindness of strangers" to fund its borrowing.

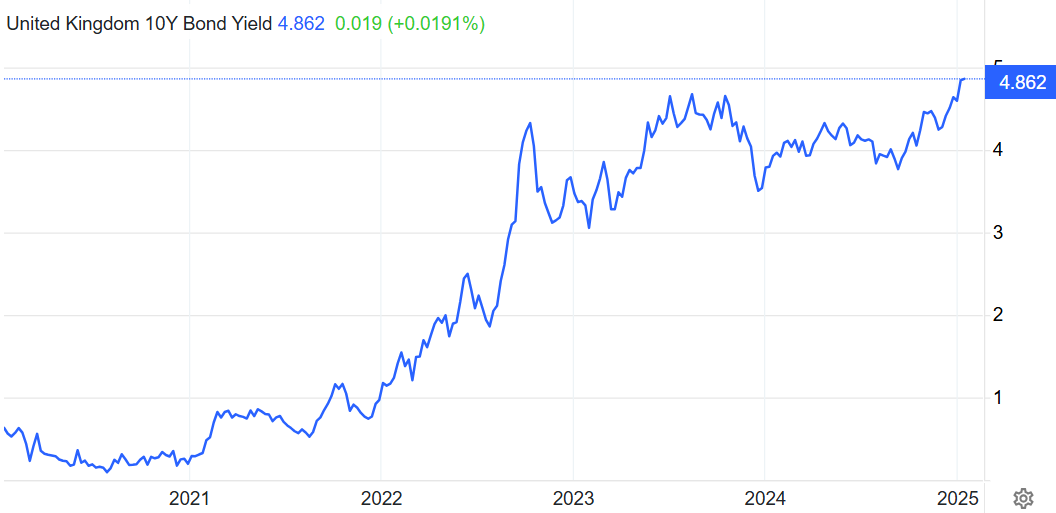

This then created a big focus upon UK government bonds and gilt yields. A gilt yield is the annual return an investor can expect from holding a government bond, otherwise known as a gilt. It's the amount of money an investor earns from a gilt, paid as a percentage of what they paid for it.

The problem Reeves has is that her budget, as with Truss’s, has made the market lose confidence in the UK’s economy and outlook, and placed a spotlight on gilts and the probable lack of future returns. The result is higher costs for government borrowing as investors are asking for higher returns – a higher yield – for every government bond – the gilt – issued.

Source: Trading Economics

It's kind of like your mortgage, if you have one. You sail along nicely at a few percent per annum and then suddenly the bank doubles the interest and you wonder what’s going on. That’s the UK but, instead of the banks, it’s the market that are nervous about the ability to payback the loans so they’ve doubled the interest rates.

A number of websites break this down further but the bottom-line is that the Labour budget delivered on 30th October 2024, looks to have cost the UK £50 billion in increased interest rates (yields) on government bonds (gilts), and some think the cost will be even greater. Bearing in mind that the government was already saying they could not afford what needs to be funded, their black hole is twice as large. This is a huge issue, particularly when the NHS, police and defence services, schools and almost every other area of the country’s national services are under-funded.

Putting all of this in context, the UK government's borrowing totals £2.7 trillion and, due to the budget, soared last week paired with the price of sterling falling fast too. Oh, and the UK’s GDP has also appeared to flatline.

Solution?

Higher taxes, lower investments and housing no longer affordable for most. Sounds like a plan doesn’t it?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...