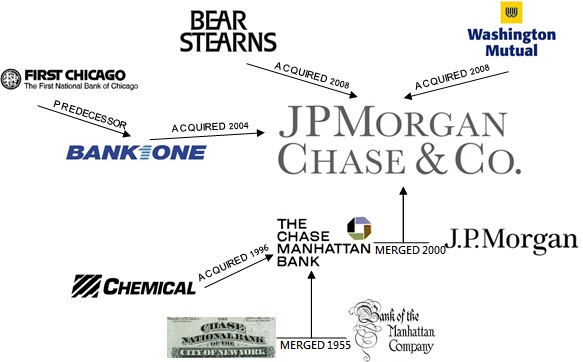

Since I started in finance, there’s been an interesting debate around whether firms can grow through organic growth or acquisitive growth. Most banks have consolidated over time to become the behemoths they are today. By way of example, just look at the history of JPMorgan Chase:

Source: The Brand Hopper

Or, as it surprises many of my frineds in Britain, Lloyds Banking Group is actually the Bank of Scotland, Halifax, Cheltenham & Gloucestor, Scottish Widows and more.

In other words, most country’s big banks grew up by merging and acquiring most country’s small banks. That causes problem #1: most country’s big banks have a shambolic mixture of back office systems based upon systems built by a smorgasbord of most country’s small banks.

This makes me wonder about life in 100 years. Will Revolut have acquired Chime, Nubank and others … or vice versa of course. Will JPMorgan Chase acquire Stripe? Could PayTM become part of the State Bank of India?

Well, all of those things are possible but not probable. It is possible that Revolut will work with Chime, Nubank and others; it is probable that JPMorgan Chase will work with Stripe and that the State Bank of India will co-operate with PayTM … but acquisitions of these mega players are unlikely because they rarely work out well due to cultural differences.

The main issue is the cultural differences. There is the cultural difference of a start-up versus an incumbent – just look at BPCE and Fidor – and then there is the issue of borders. Language and technology differences are the greatest barriers to any merger and acquisition, which is why most rarely succeed. Add to this the challenge of staff and executive retention and change management, and any M&A (merger and acquisition) in the financial industry is always a big wall to climb.

So, it intrigued me when my friend Jason Henrichs highlighted this in a couple of recent LinkedIn posts. Here are a few lines I liked:

- “Merging two inefficient operations just creates a bigger inefficient operation”

- “The old playbook: gather deposits, make loans, buy a competitor, repeat. Growth meant more branches, more people, more overhead. The new playbook? Use technology to reduce friction, increase productivity, and create scalable processes that don't require an army of people.”

- “M&A isn't dead, but technology is the new scale game. The winners won't be determined by asset size but by operational efficiency.”

- “This isn't about having fancy tools … it's about fundamentally rethinking how banking works”

Jason finishes by saying that he has “heard time and again from CEO’s they spent millions of dollars integrating two ‘complementary’ banks, only to discover they'd created a bigger version of the same problems.”

I totally agree with this sentiment so just beware – or be aware – the new banks and Nubanks of this world, that as you target global expansion, it will not be easy.

Oh, and just to finish this point, I noted many years ago that there were zero bank mergers in Europe that worked, primarily due to culture, language and technological differences. Although language was not the issue, just look at the idea that Deutsche Bank and Commerzbank would merge a few years ago. Why did it not work? Too much risk and cost, even with a domestic merger, even though this discussion keeps coming back because both banks have weakened substantially over the last decade, since the financial crisis of 2008.

Therefore, I just googled this and asked: why don’t European bank mergers work. Here’s the AI answer I got back:

Cross-border bank mergers in Europe are difficult due to legal, regulatory, and cultural differences.

Legal differences

- Capital waivers: EU law does not allow banking groups to move capital freely between subsidiaries in different jurisdictions.

- Deposit insurance: Deposit insurance is still national, which is important for consumers.

- Tax and accounting: There are disparities in tax and accounting regimes across Europe.

- Insolvency: There are differences in insolvency regimes across Europe.

Regulatory differences

- Banking rules: There is no single set of banking rules across Europe.

- National supervisors: National supervisors still have some influence, even if it is waning.

Cultural differences

- Linguistic differences: There are national linguistic differences across Europe.

- Cultural barriers: Cultural barriers can hamper cross-border consolidation.

Other factors

- National protectionism: National protectionism can hinder cross-border mergers.

- Cost savings: It can be difficult to achieve the cost savings that investors expect from a merger.

Yep.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...