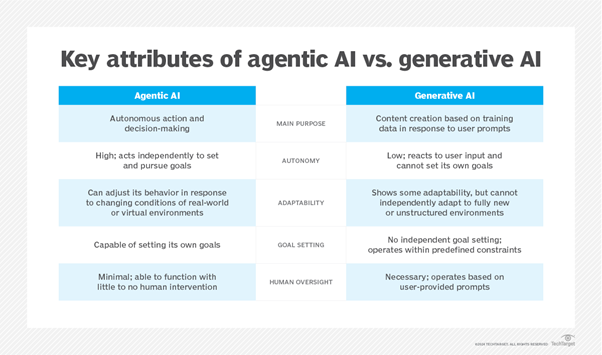

I wanted to make this a short blog update on tech changes in 2025, but it’s incredibly long and, unsurprisingly, nearly all about AI. If 2023 was the year of ChatGPT and 2024 AI, this is the year of Agentic AI. What’s the difference? Well AI has so far been pretty much a pull technology. You ask questions and get answers or pictures, videos and more. 2025 is the year of the Agentic AI, where the systems do the work for you. No questions asked.

Source: Tech Target

There are other nuances around AI, such as physical AI and digital AI. Physical AI is robotics - which still seems to be a long way away from a consumer perspective - whilst digital is becoming agentic agents. The world is developing fast. In fact, PwC reckon that Agentic AI could contribute between US$2.6 trillion and US$4.4 trillion annually to global GDP by 2030. That’s something to take note of!

Maybe the best way to introduce this is through NVIDIA, the leading AI platform provider. Their experts made a number of key predictions for 2025, including AI that can harness data at the edge and deliver near-instantaneous insights is coming to hospitals, factories, customer service centres, cars and mobile devices near you.

Interestingly, they asked Perplexity and ChatGPT 4.0: “What will be the top trends in AI in 2025 for industries?”, and both responded that agentic AI sits at the top the list alongside edge AI, AI cybersecurity and AI-driven robots. If you’re wondering what that’s all about, checkout their blog on the subject.

This sets the foundation for 2025’s tech focus as evidenced by the five big trends that IBM’s Institute of Business Value cite, which are:

- Agentic AI will transform your business—but first you must reskill your people.

- In the age of AI, location is everything.

- The rapid pivot to AI has upended IT budgets, but self-funding is imminent.

- AI product and service innovation is the Number 1 goal for CEO, yet business models aren’t keeping up.

- Despite efforts to slow its growth, technical debt – the cost of maintaining legacy code and systems – continues to increase.

The IBM report is only available to IBM users, but you can see a shareable version here, thanks to my friend Theo Lau.

As you can see, 2025 will be all about AI and this is reinforced by Andreessen Horowitz’s investment fund, a16z, who shared a report on the big ideas for tech in 2025. I was intrigued that, amongst their big ideas is that AI systems will manage their own crypto wallets and assets, as well as AI companions who have their own personalities and develop their own social networks.

Sounds like fun!

What does this mean for banking and finance? Well, McKinsey released a view on becoming an AI-driven bank in December. Panagiotis Kriaris summed it up well on LinkedIn, saying that to be an AI-first bank, you need to:

- Reimagine the customer experience (personalisation, frictionless journeys)

- Use AI to help with decision making

- Modernise core technologies

- Set up a platform operating model

… and banks excelling in AI do four things extraordinarily well by:

- Setting a bold, bank-wide vision for the value AI can create

- Transforming entire domains, processes, and journeys rather than just deploying narrow use cases

- Building a comprehensive stack of AI capabilities powered by multiagent systems

- Setting up critical enablers of the AI transformation

What this means in practice is a fundamental rewiring of how a company operates. This involves six critical enterprise capabilities:

- A business-led digital road map

- Talent with the right skills

- A fit-for-purpose operating model

- Technology that’s easy for teams to use

- Data that’s continually enriched and easily accessible across the enterprise

- Adoption and scaling of digital solutions

You can find out a lot more by reading the report.

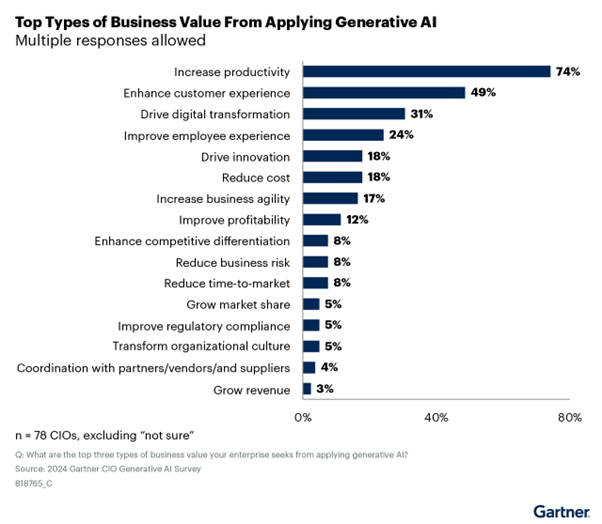

There is then a very interesting in-depth report on how AI will develop in 2025 produced by Gartner and focused upon Agentic AI, where AI thinks for you. Gartner’s report is pretty good and, whilst highlighting all the ways that Agentic AI will help improve processes, operations and service, also highlights the dangers it brings.

Agentic AI will make decisions based on its analysis of your organisation’s data, making plans based on that analysis. From there, it’ll act on those plans. This will be dangerous unless you invest in the skills, practices and technologies to deliver trustworthy AI agents. Your organisation’s data may be of poor quality, further increasing the risk. As well as creating risk, poor data quality and architecture will also inhibit agentic AI’s development.

Although it should help customers, agentic AI could also alienate them if the customer experience is poorly designed. This is where human intelligence is needed. Humans must create customer journey maps to design the ideal customer experience and define guardrails before handing over to AI agents for execution. It’ll be a case of trial and error to adjust the agents’ settings to achieve optimal results.

As always with automation, some employees will likely resent agentic AI, still feeling the need to be in control. Understandably, they may be worried about job security and the perceived value of their contributions.

Agentic AI will drive advanced cyberattacks that give rise to “smart malware.” This will require innovations to address the unique risks and threats of systems that depend on LLMs and GenAI. Agentic AI will be at risk from prompt injections, jailbreaks, data security attacks and cyberattacks — including those that other AI agents create and execute.

The continued growth of agentic AI will also raise serious governance concerns for your organisation as you try to control a technology that operates autonomously. Orchestration and governance will require advanced tools and strict guardrails.

This is interesting and expanded upon by the World Economic Forum (WEF) who point out Agentic AI includes technical risks, such as AI agents increasing fraud and scams in both volume and sophistication, and socioeconomic risks as increasing the autonomy of AI agents could reduce human oversight and increase the reliance on AI agents to carry out complex tasks. Then there are ethical risks on top of those. Lots of AI risks in the future, the question being: how to keep the system good and not bad? But then that is the perennial question about innovation and progress.

Finally, you cannot ignore Google when it comes to 2025’s tech trends. Zac Maufe, Global Head of Regulated Industries at Google Cloud, predicts that there are FIVE big things happening with AI in finance in 2025, summarising all of the above well for our financially focused firms:

Intuitive search

“Intuitive search will give banks a big boost on reducing data friction. Financial institutions are drowning in data, but struggling to extract its true value. Generative AI-powered intuitive search is the key to unlocking this potential. By streamlining workflows and boosting productivity, generative AI will empower experts to focus on what matters most: deriving insights and delivering better outcomes”.

AI agents

“AI agents will usher in an era of productivity in banking. By supporting routine tasks like organizing data needed to underwrite loans and quickly understanding claims cases, these digital assistants are poised to not only boost efficiency but also free employees to focus on more complex and strategic work, adding value where only human expertise can”.

Multimodal AI

“Multimodal AI will simplify the banking experience for customers. One of the most powerful features of multimodal AI is its ability to connect information from different sources. This means your banking app can access your transaction history, recognize images of your receipts, and even understand your voice commands to provide you with complete and accurate answers to your financial questions.

Security

“Financial institutions are increasingly using AI to combat the rising threat of fraud, including AI-generated attacks, which are on the rise. By analyzing unstructured data, identifying complex patterns, and automating threat detection, AI will become the ultimate shield against financial fraud, and crucial in detecting and preventing cyber-attacks, protecting sensitive customer data, and maintaining trust”.

Data

“The success of AI initiatives within banks will hinge on one critical factor: data. Banks with robust data platforms will have a significant advantage because they’d be able to aggregate data from various sources, ensure data quality, and make it readily available for AI applications to scale”.

Then, in another noteworthy announcement, Google let slip the details of their work with quantum computing. In case you missed it, Google announced a chip called Willow the other day that claims it can process a challenge in less than five minutes that would take today’s fastest supercomputers ten quadrillion (10 to the power of 25) years to do process. WTF???

By the end of 2025, it looks like Agentic AI and quantum computing will allow us to move from human being to superhuman beings … well, some of us anyway. Meanwhile, it is interesting that there is no mention of blockchain, cryptocurrencies, open banking systems and other areas. 2025 will no just be about AI, even though it is the dominant subject.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...