I shared a post the other day by Usman Sheikh, a serial investor based in Dubai. The post is asking the question whether AI can replace consultants although, to be more pointed, specifically McKinsey. How could that happen? McKinsey have the best and brightest minds in the world: they only hire graduates at the top of the class; their partners earn over a million a year; they advise the CEOs of all the greatest companies in the world. How could software replace them?

Well, the software is called Operand.

It’s another AI solution but, for this one, Operand AI uses artificial intelligence to help businesses make data-driven decisions based on deep data analysis. The big difference is that it’s not automated. The data analysis is as Operand uses:

- autonomous agents to process all enterprise data;

- LLMs (Large Language Models) to resolve messy inputs automatically; and

- econometric models to optimise data in real time.

The difference is that they then use former advisors from the Big Three consultancies – McKinsey, Bain and Boston (MBB) – to analyse the data and give the final view.

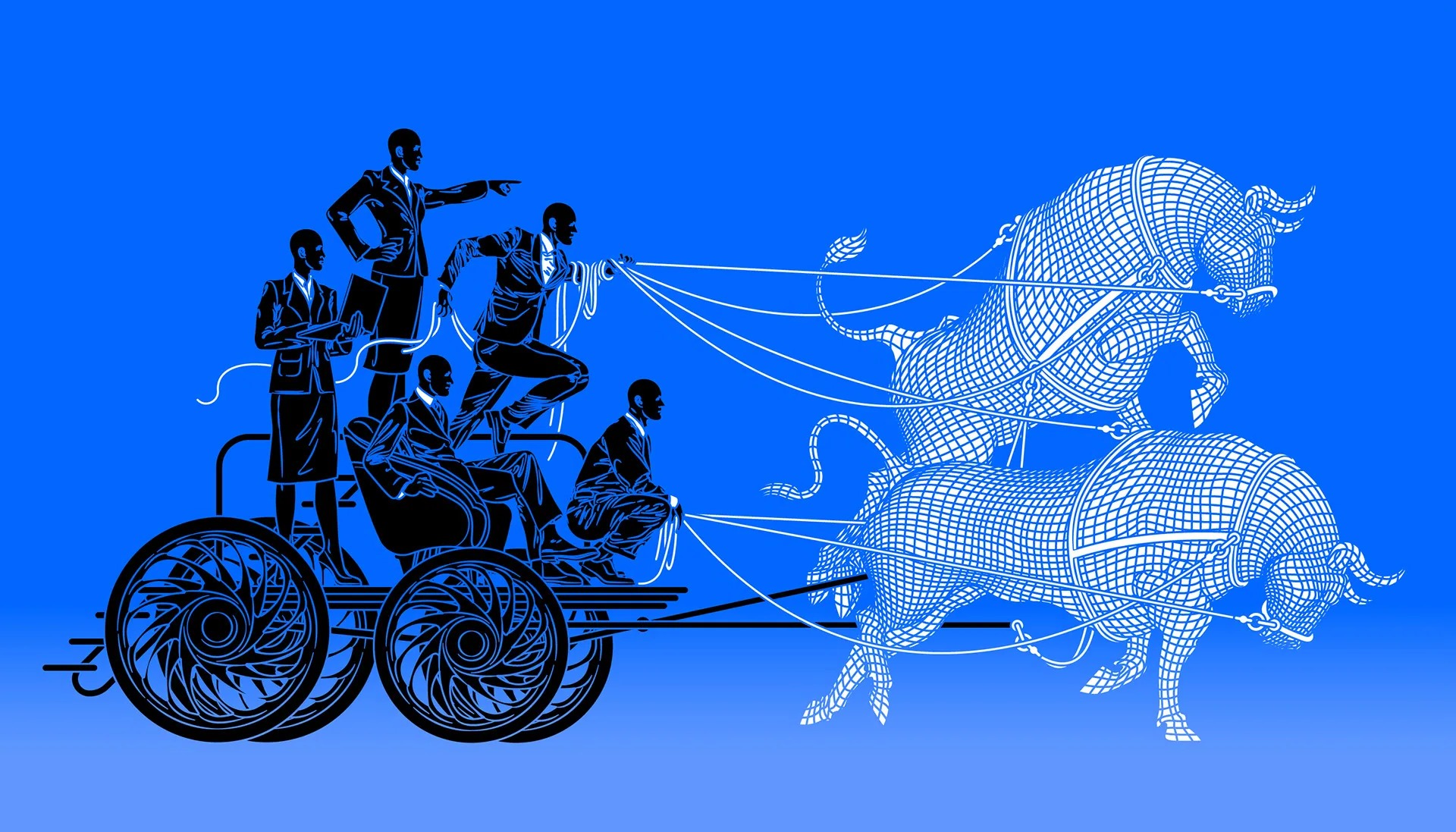

So it is a marriage of human and technology capabilities.

What it makes me realise is that the view I held a decade ago that AI could not replace humans still remains. We still need a middleman somewhere in the process. However, that view is now modified as, back then, I didn’t believe that AI could create art, music, ideas … and yet today, it can. For example, when you see an AI artwork of Alan Turing sells for $1m at auction, you know something has changed.

The world is moving at a pace, and AI is driving this. Just take the recent impact of DeepSeek, and we can see things changing fast.

What does this mean for financial institutions? Well, the latest NVIDIA survey of FSIs shows that it means more revenue and less cost

NVIDIA just published their fifth annual survey of the use of AI in financial institutions and the results show that 70% of respondents reckon that AI has driven a revenue increase of 5% or more, with some seeing a dramatic rise of 10-20%. More than 60% of respondents say AI has helped reduce annual costs by 5% or more. The top use cases are trading and portfolio optimisation followed by customer experience and engagement at 21%. Strangely, for me, is that most of the AI that I see in banks is focused upon risk, fraud and compliance, but hey, maybe I interview the wrong people?

Nevertheless, all in all, the speed of change of our world with technology is now on steroids. Are you keeping up?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...