I’ve been talking a lot about bank IT outages lately, as you can hear here on the BBC!

Tech Life - Surviving digital banking outages - BBC Sounds

Why? Because they are becoming more and more common and frequent:

- Big bank systems crashed for over 800 hours in last two years due to IT outages

- More than one month’s worth of IT failures at major banks and building societies in the last two years - UK Parliament

- Millions in compensation expected for customers hit by Barclays outages

- Hundreds of Santander customers in UK hit by banking problems

- Capital One January 2025 Outage Customer Communication

- CBA outage disrupts online trading for thousands of merchants and shoppers

- Bank ATM outages rise after call for more cash

I put it down to system updates and partner platforms. On the one hand, many banks run a weekend system update and, if it goes wrong, there’s an outage. Equally, banks are becoming more reliant on third party providers in their operations, thanks to open banking, fintech and outsourcing. Things go wrong.

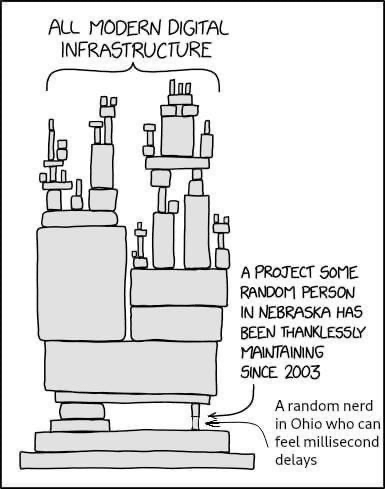

For years we have known this issue, as we called it Spaghetti Systems. That was when we were talking about the back office systems of banks being a complete mess. As time went by, that reference to Spaghetti Systems became, what I called, Bankenstein’s Monster. A whole load of dead parts that were only continuing to operate thanks to electricity.

But Bankenstein purely refers to the internal mess of legacy systems that are stitched together to keep everything going. Now, with open banking and many third-party providers, we have moved onto a new structure called Banking Jenga. For every piece you add, you take away a piece, and the structure of the technologies running the bank become shakier.

Of course, in Banking Jenga you could do something that isn’t done in normal Jenga. You could put a piece back to make the core stronger, not shakier. The issue with that is the more you mess around with the core of the Jenga structure, the more likely it is that the whole lot will fall down.

It is never easy ... but I like this analogy to bank systems being like a Jenga tower, as it illustrates the challenge we face well and then the question is: how do you deal with it? Two choices: you keep adding pieces to the tower and hope it does not fall down; or you replace the tower. Actually, there is also a third choice: build a back-up tower, which is what Monzo are doing. In their case, they are building a duplicate system to ensure that the bank still runs smoothly, even if the main system has an outage.

Monzo develops backup bank to cover outages

The Role of Parallel Core Systems in Preventing Bank Outages

Banking systems have always been an issue, and banking legacy systems have been discussed for years. Bear in mind, it is not just the banking systems but the systems provided to banks by their partners. The longer those systems have been built, the more the Jenga tower wobbles … and that’s the reason we are seeing so many bank outages in 2025, even with banks on the leading edge of digital transformation like DBS.

DBS cuts executive pay on banking outages; posts record earnings in 2023

MAS to ensure DBS identifies root cause of recent disruptions and addresses it effectively

This means there is no magic pill to solve bank outages. There is just the ability to manage the bank systems Jenga tower, and hope it doesn’t all fall down … except there’s a better answer. This answer came to me when I met Ant Group in China, who refresh their systems architecture every three or four years.

Surely, this is a better way to go, but harder. Changing core systems every few years rebuilds the Jenga tower, but it is challenging and expensive.

A final thought is around technical debt: the challenge of fixing old code that is no longer working or, in the context of my Jenga analogy, keeping the tower upright when it becomes unstable. Stripe reckon that developers spend about a third of their time on tech debt and fixing bad code. That’s in a fintech firm. In a bank, it would be two-thirds of their time or more.

In other words, a lot of time is being spent to stop the Jenga tower falling down, but it is becoming more and more difficult to keep up, as illustrated by the increasing frequency of bank outages. So the real question is how to fix the bank’s Jenga systems tower at lowest cost and least risk.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...