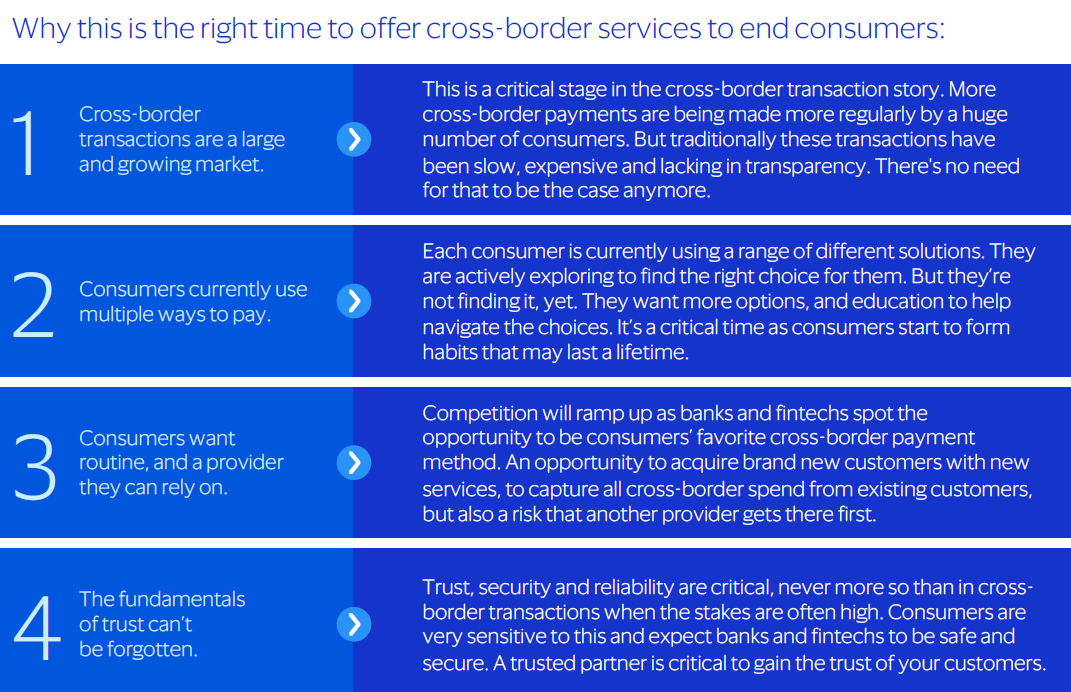

I just got an interesting report from Visa produced in late 2024. It is focused upon consumers, and their approach to cross-border payments. The research shows that the cross-border payment market is experiencing explosive growth, fuelled by a surge in international travel, ecommerce, and remittances. Consumers are spending more regularly cross-border than ever before and these payments are predicted to reach $250 trillion by 2027. But banks and fintechs are missing a trick as the one thing consumers are looking for is a go-to service that ticks all the boxes and no-one offers one (Wise? Revolut?).

Visa surveyed 6,500 consumers to find out more about their cross-border payment habits. Their report reveals how consumers are spending, where and on what. Visa also asked what methods they’re using to make these transactions.

You might think you understand your consumers’ cross-border behaviour, but with 77% of them saying that they use multiple methods you could be in the dark about their real needs.

In fact, the survey shows that most consumers haven’t found a way to make cross-border payments that works for them yet. Some interesting stats in the report include:

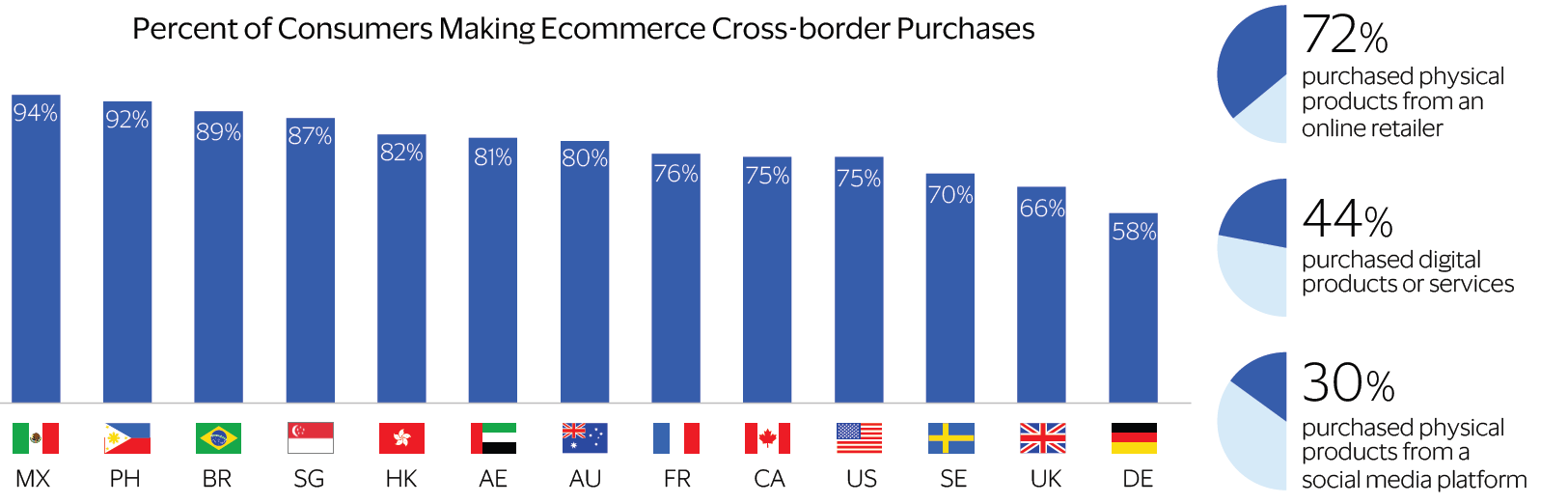

- Approximately 589 million people made cross-border ecommerce transactions in the past year with 72% of these purchases being physical products on online retailers such as Amazon and eBay;

- 67% make monthly ecommerce purchases and 30% make weekly cross-border ecommerce purchases;

- 45% send or receive remittances monthly;

- 52% travel more than once a year whilst 66% travel abroad annually;

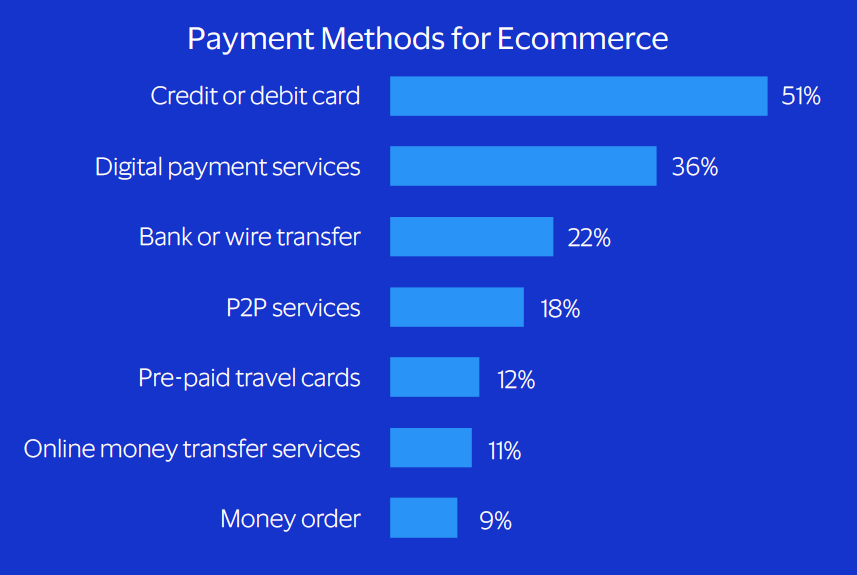

- They have no favourite way to pay: only 16% use a default payment method and yet 66% want to stick with one payment method, and 71% want guidance on the best option;

- Consumers in Germany are least likely to make cross-border ecommerce purchases, whilst Mexicans are most likely; and

- Underscoring all of it is the fact that trust the is key, with security their number one factor.

A couple of charts stood out for me. This one that shows who is making cross-border payments the most and least by country:

And this one showing that most are using their credit or debit card, but digital wallets are rising fast:

Their conclusion is that consumers are using a range of payment methods for ecommerce, travel and remittance transactions, but haven't found that one provider that ticks all their boxes – but they would like to. This is where banks and fintechs can step up and be the chosen provider for cross-border transactions and be that secure payment space consumers want. One that provides guidance, security, and a seamless, reliable service wherever they are paying to and from in the world.

Equally, to give context, here is the survey method:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...