I just downloaded the Chainalysis annual cryptocrime report and, as usual, it is fascinating. Ask almost any politician or banker about cryptocurrencies and they’ll say they all encourage crime except Donald Trump, but that’s because he is supposedly a criminal.

Here is a synopsis of the report taken from their introduction:

According to our metrics today, it looks like 2024 saw a drop in value received by illicit cryptocurrency addresses to a total of $40.9 billion. However, 2024 was likely a record year for inflows to illicit actors as these figures are lower-bound estimates based on inflows to the illicit addresses we’ve identified up to today.

A year from now, these totals will be higher, as we identify more illicit addresses and incorporate their historic activity into our estimates. For instance, when we published last year’s Crypto Crime Report, we reported $24.2 billion for 2023. One year later, our updated estimate for 2023 is $46.1 billion. Much of that growth came from various types of illicit actor organizations, such as vendors operating through Huione, which provide on-chain infrastructure and laundering services for high-risk and illicit actors*.

It stands to reason that 2024’s illicit cryptocurrency volume will exceed that of 2023. Since 2020, our annual estimates of illicit activity — which include both evidentiary attributions and Chainalysis Signals data — have grown by an average of 25% between annual reporting periods. Assuming a similar growth rate between now and next year’s Crypto Crime Report, our annual totals for 2024 could surpass the $51 billion threshold.

In general, our totals exclude revenue from non-crypto-native crime, such as traditional drug trafficking and other crimes in which crypto may be used as a means of payment or laundering. Such transactions are virtually indistinguishable from licit transactions in on-chain data.

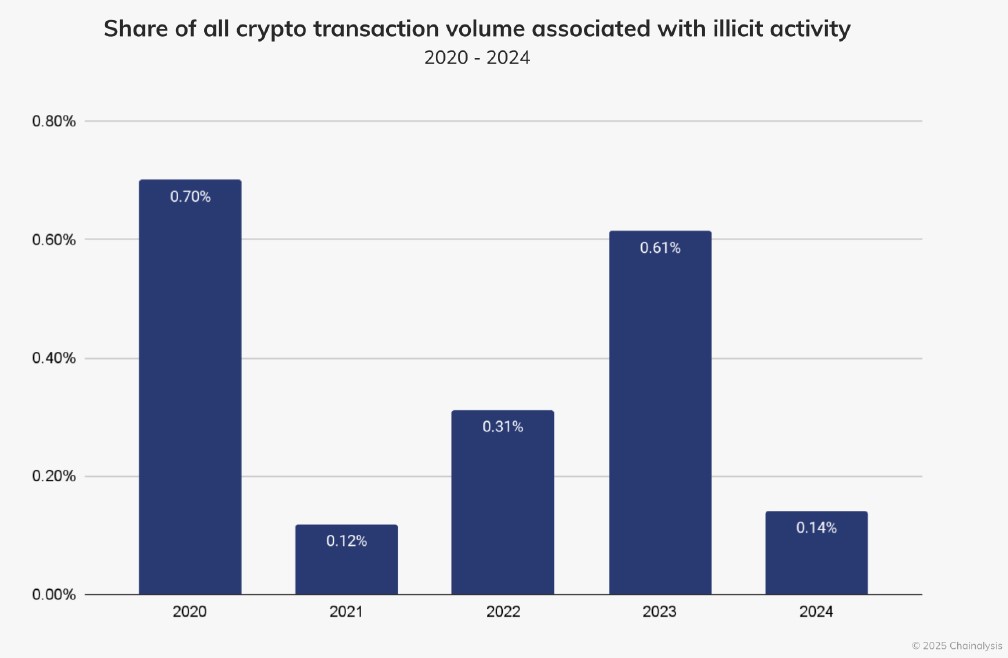

However, the main headline here for me is that only 0.14% of total on-chain transactions are designated to be illicit or criminal. Sure, of course, it may be billions of dollars but, when you consider the total cryptocurrency values today is around $3 trillion, it’s small beans. Sure, it’s $40 billion, but that’s just 0.14%**.

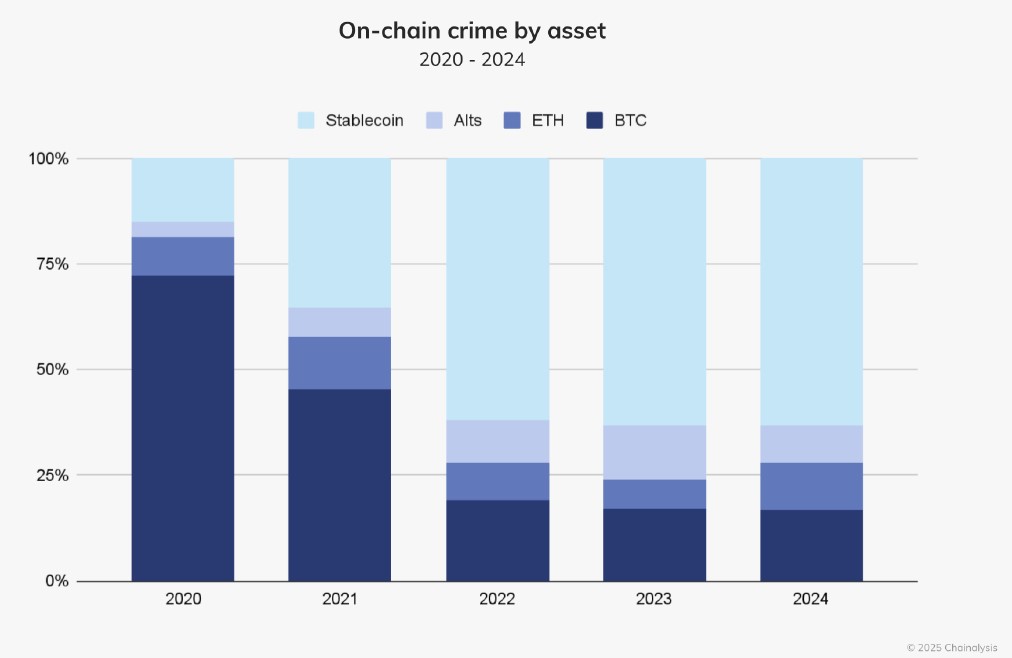

Interestingly, when analysing that 0.14%, Chainalysis conclude most of it is being created by stablecoins rather than bitcoins.

Through 2021, BTC was unequivocally the cryptocurrency of choice among cybercriminals, likely due to its high liquidity. Since then, however, we have observed a steady diversification away from BTC, with stablecoins now occupying the majority of all illicit transaction volume (63% of all illicit transactions). This new reality is part of a broader ecosystem trend in which stablecoins also occupy a sizable percentage of all crypto activity, demonstrated by total growth YoY in stablecoin activity around 77%.

Compare those figures with the traditional financial system where the United Nations Office on Drugs and Crime (UNODC) estimates that between 2% and 5% of global GDP is laundered each year, or between $800 billion to $2 trillion, then you get some context.

0.14% versus up to 5% … there’s the rub.

Many traditional financiers may claim that there is far more activity illegally on the cryptocurrency networks and it may be true. After all, there is little KYC, AML and onboarding controls in the crypto world (I should know!), but there is a critical difference. Around 99% of most crypto trading is traceable.

There are many more insights in their report and it is well worth a download.

https://go.chainalysis.com/2025-Crypto-Crime-Report.html

Meanwhile, coincidentally, the World Economic Forum issued a report on stablecoins on the same day. They estimate that the use of stablecoins has increased roughly 28% year-over-year in recent years, with a total transfer volume of $27.6 trillion in 2024, more than the total volume of Visa and Mastercard transactions combined.

Tether (USDT) is by far the largest stablecoin with a market capitalization of over $143 billion. Released in 2014, USDT is pegged to the US dollar and is available on several major blockchains like Ethereum, Solana and Tron. There are concerns associated with USDT, however, due to misleading statements regarding the stablecoin's underlying assets. The next largest stablecoin is USD Coin (USDC), which was created by Circle, and has a market capitalization of more than $58 billion. As Anton Golub underlines on LinkedIn, that's 1,000x bigger than all euro stablecoins combined. Europe needs to step up!

The reason why stablecoins are popular is because they are pegged to real-world reserve assets, like the US dollar, and therefore tend to maintain a constant value rather than the severe price fluctuations seen amongst other types of cryptocurrencies. This makes stablecoins ideal for payments, savings and remittances … and hacks and fraud.

These are interesting times for certain, and the fact that stablecoins are the target of most illicit activity reflects the fact that they are the most stable coins and therefore the most trusted.

* “on-chain” refers to transactions, data, and operations that are recorded directly on a blockchain

** Chainalysis admit that a lot darknet markets (DNMs) are hard to track and that they do not include currencies like Monero, which is the leading cryptocurrency focused on private and censorship-resistant transactions or, in other words, an anonymous and private currency.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...