Just continuing the AI theme, it’s really interesting to see what Stripe – latest valuation over $90 billion – is doing with the technology. Effectively, it’s tried to create a GPT for payments. The reason they are pushing the envelope is after seeing great results in earlier developments using traditional machine learning models. These resulted in a 15% uplift in conversion whilst reducing fraudulent transactions by 30%. The issue was that it required a lot of manual features, such as having to choose zip codes and things. The new system is far more sleek.

The way it works is applying LLM GPT thinking to payments. In this case, Stripe built a system that has been trained on tens of billions of transactions to learn the language of payments.

The way this works is to process transactions as a sequence of tokens, like the words in a sentence. Stripe can then use their AI model to look for trends and understand the underlying structure, behaviour, and contextual relationships within payment data.

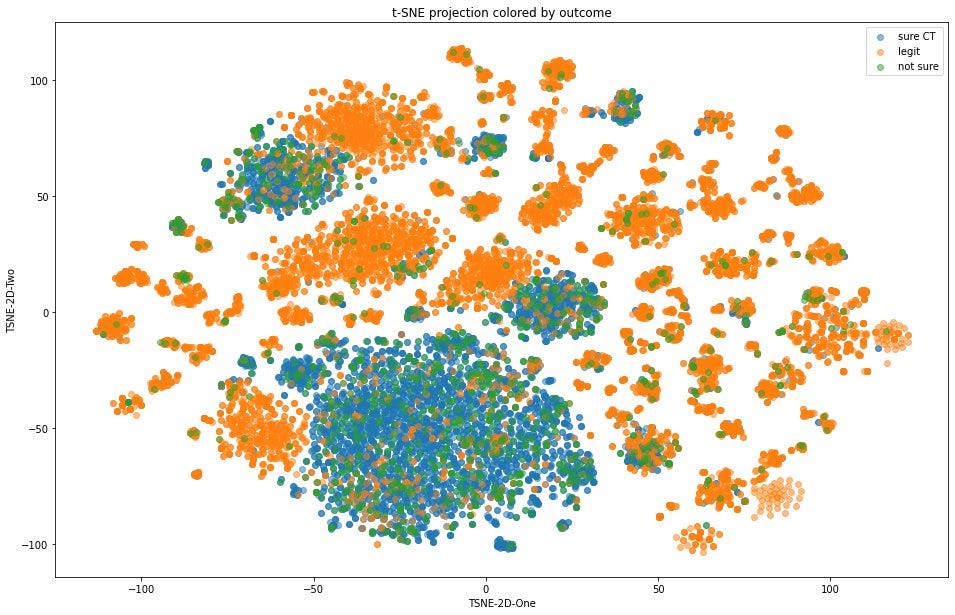

For example they can look for transactions with specific similarities, such as those from the same card issuer or sharing an email address, and cluster them together to look for those relationships and structures.

The result is that the AI model gains a deep, semantic understanding of the data. Rather than just processing transactions, the system is getting all of the detail about the patterns of payments, or language of payments if you prefer, and the underlying rules and nature of financial flows.

A specific example of the difference between the old machine learning model and the new GPT model is that the traditional methods achieved a 59% detection rate for attacks on large users. Stripe’s new system turbo-charged this to an astounding 97% overnight.

Source: @thegautam via X

Linas Beliūnas writes about this in-depth on his Substack newsletter and points to the fact that the Stripe developments should be studied by all in fintech and finance for the future of AI in fintech and finance.

Linas points out that their work highlights four big areas of change for the future:

- “Stripe has thrown down the gauntlet. This level of sophisticated, self-supervised learning on transactional data will likely become the benchmark. Other payment processors and financial institutions will be compelled to explore similar transformer-based architectures to remain competitive in fraud detection, risk assessment, and operational efficiency. This aligns with Andrej Karpathy’s insight that LLMs are general-purpose token stream modelers, and Stripe has powerfully validated this for the financial domain.

- Rise of Domain-Specific Foundation Models: We're witnessing the dawn of highly specialized foundation models. Just as Stripe has built one for payments, we can expect similar AI engines to be developed for other complex data ecosystems like supply chains, healthcare records, energy grids, and legal data. The focus will shift from merely labelling problems to achieving a structural and contextual understanding at scale.

- Beyond Fraud – Towards Proactive Finance: While the immediate impact is on fraud, the ability to understand the “semantic meaning” of transactions opens doors to hyper-personalized financial services, predictive analytics for cash flow, more nuanced credit scoring, and even automated compliance. For Stripe, this could mean an entirely new suite of AI-driven products and services for their merchants.

- Ethical and Interpretability Challenges: As these powerful models become more embedded, the “black box” problem will intensify. The concern raised about “opaque rejections” is now valid more than ever. The industry, including Stripe, will need to invest heavily in explainable AI (XAI) to ensure transparency, fairness, and to meet evolving regulatory demands. We may see a push for open research or shared methodologies to foster trust and broader innovation.”

For more on this you might want to subscribe to Linas and follow Guatam Kedia of Stripe.

Postscript:

Stripe's announcement of stablecoin transactions this week is also worth a mention:

• Instant settlement (under 10 seconds)

• No upper limits on transaction size

• Available in 101+ countries

• Lower, transparent fees

• 24/7/365 availability

A slight improvement on the traditional payment system where cross-border transfers take 3-5 days with fees of 2-4% of the transaction value.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...