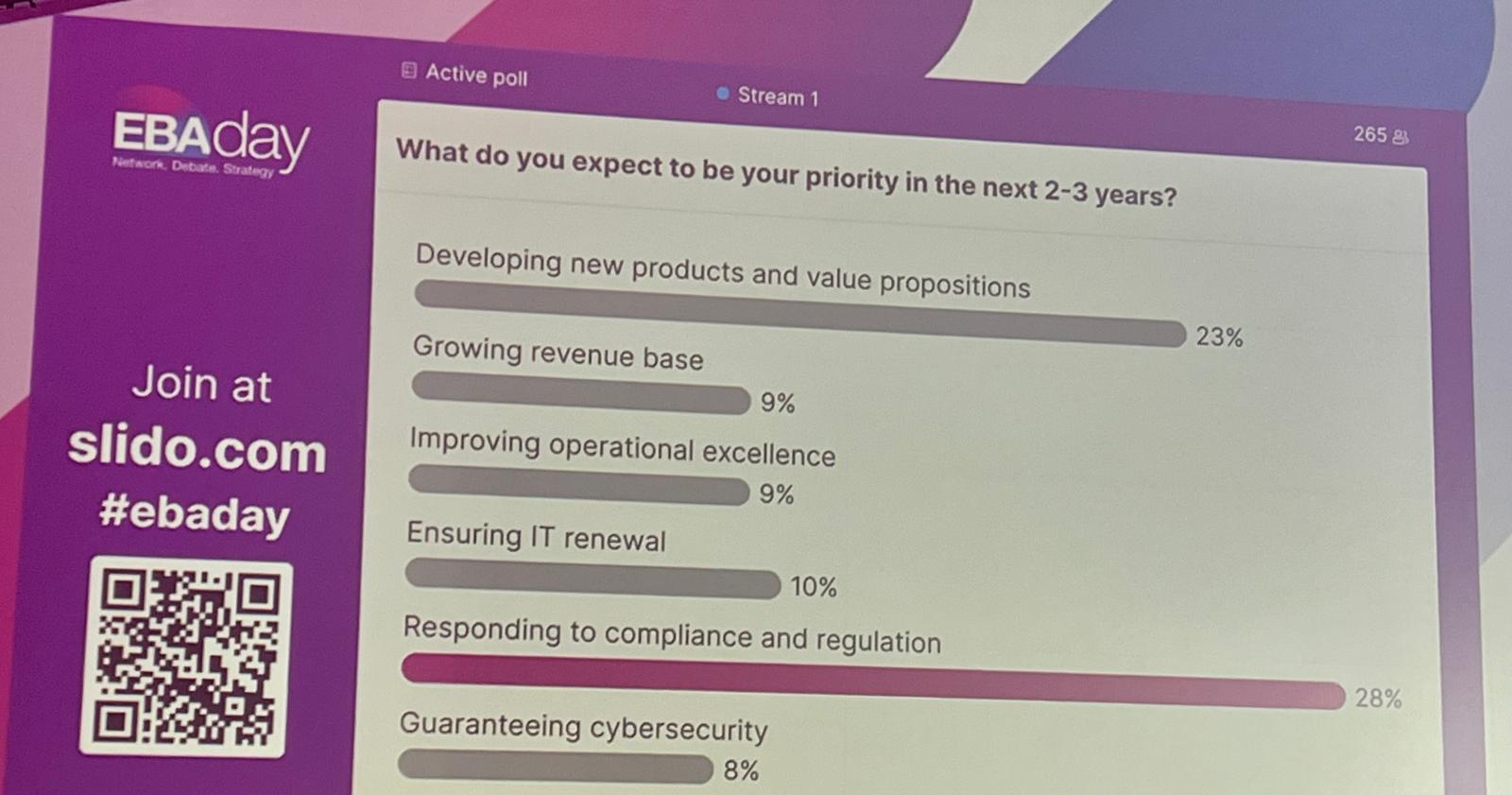

Following the Swiss meeting, I was then honoured to moderate an opening panel at EBAday with representatives of JPMorgan and Deutsche Bank. We had a wide ranging discussion but, similar to the details of CRD VI, a lot of regulations came up as top-of-mind. MCiA, EUID, CRDVI, PSD3, EUAI etc and it did intrigue me that, when the audience were polled about their #1 priority, it was regulations and compliance.

Luckily my panel was not that dry. It was all about ecosystems and platforms and a bank’s position in the new, connected world. Rather than writing this up myself, here’s how the EBA folks summarised the discussion:

Industry leaders discussed interoperability and how cross-sector collaboration is innovating the payments landscape in the second session of the day, ‘Strategic Roundtable: Innovative Collaboration – Building Ecosystems of the Future’. Chris Skinner, global fintech leader and CEO, The Finanser, moderated the panel featuring speakers Gayathri Vasudev, global head of cross-border payments, JP Morgan, and Marc Recker, global head of client solutions and partnerships in institutional cash management, Deutsche Bank.

Vasudev opens the session by agreeing with the speakers in the prior panel, that fintech is in a good position. She commented on the role of regulation to push payments into the future:

“Sometimes the public sector is able to mandate things, whether it's instant payments in Europe, India, Brazil, etc. - you would not have had that adoption of instant payments if it was not the regulators stepping in. In some ways it's good. I know all the bad pieces are also there. I think with ecosystems in general, you cannot ignore the network effect, because unless you have adoption, you don't have reach.”

Comparing European payments ecosystems to what is taking place in Southeast Asia, Recker highlighted how payments systems are supported and facilitated by regulators in countries that are making strides such as India, Thailand, and Singapore.

When asked what SWIFT and the EBA should be focusing on, Recker stated that standardisation should be a priority. He offered an example of the EBA bringing together a “coalition of the willing” of experts to create a working group for SEPA adoption. “I think that needs to continue,” he said. “If you look into the future, you don’t need to have 10,000 banks around, but you need to have banks that want to drive innovation, they would need to invest in first steps, and then convince the remainder to join the respective journey.”

Vasudev stated that “technology is an engine of growth”, citing how JPMorgan has invested in blockchain infrastructure for the long term. When asked about JP Morgan CEO Jamie Dimon's statements on how Bitcoin is a “scam”, Vasudev responded that while JP Morgan does provide trading for digital assets and tokenised money movements, and utilises the technology behind cryptocurrency, they do not use specific instruments.

Commenting on blockchain adoption, Recker stated that it is not needed to make instant payments, but to solve issues in asset chains, cost management, and risk reduction, among others. He noted that blockchain “has not yet the level potential of commercial utility that people would like to see, but is on the right trajectory”.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...