After recently attending conferences in Zurich and Paris, with most of the audience coming from the banking community, this week is Money2020 in Amsterdam and the discussions are very different. What’s the difference? Well, bankers debate regulations and fintechs discuss innovations.

It constantly strikes me that, during the 2000s, I spent most of my time in banking and government conferences debating the Single Euro Payments Area (SEPA), the Payment Service Directive (PSD), the Markets in Financial Instruments Directive (MiFID) and more. Almost all of the banking conferences were about risk, compliance and regulations … and, based on the last two meetings, they still are.

Then you go to Finovate, Money2020, Fintech Meetup and similar events, and no one talks about regulations. Instead they talk about Agentic AI, Quantum Computing, Blockchain, Open Financial systems and more. It is a very different conversation.

The thing is that the discussions need to be integrated, not segregated, and this is something I’ve tried to highlight for a long time. Regular readers will know that there is this issue that FinTech is a parent-child relationship. The parent wants security, stability and control – these are the bankers; the child wants disruption, change and a rush to the future – these are the start-ups. Both have a valid role, but you need the two to be integrated, not segregated.

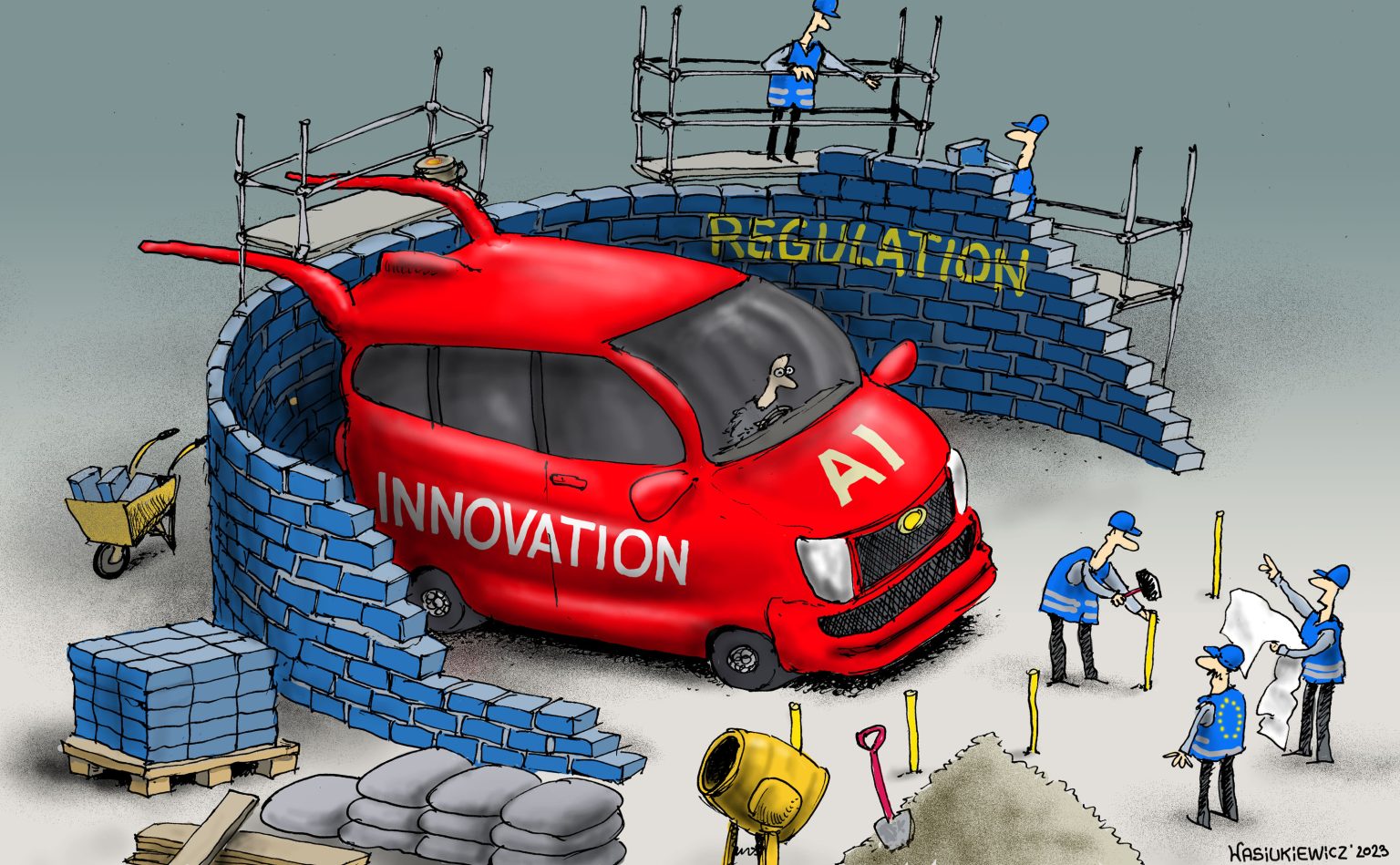

If you only talk about risk, compliance and regulations to deliver security, stability and control, then you miss all the opportunity for change in the future and the efficiency gains offered. Too much of the regulatory discussions in finance are about straightjackets rather than barn jackets. Regulatory discussions are all about getting the sheep in the pen and making them behave.

Equally, if you only talk about disruption with technology and the latest tech, you end up wasting an awful lot of investment. This is demonstrated by the fast fail rates of many fintechs. It is hard to get core numbers, but Statista’s statistics estimate that three out of four FinTech startups fail due to, in many cases, the fact that they overlook compliance. This is easily seen with even some of the successful firms like Monzo, N26 and Revolut. Compliance to deliver security, stability and control, is important.

This is why the best banks are now elevating visionary technologies to the executive leadership for digital bank balance; and why the best fintechs are headhunting bankers to provide executive leadership for compliance, risk and control.

The two areas need to work in harmony and be integrated, not segregated. Although this has struck me for years, it strikes me still when I go to bank meetings about regulations and see few FinTechs there and then go to a FinTech conference and see few bankers there.

Both need to be at the table or, otherwise, if never the twain meet, you end up with a chasm of risk and opportunity which creates huge friction. Innovation with no control is the road to hell but, equally, regulation with no vision is the same.

This is why I always look for bank executive leadership meetings where people can understand the different between AI and AGI, whilst entering FinTech leadership meetings looking for the person with grey hair in a suit. I’m looking for the parent and the child in the same room.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...