“All the work I’ve done in my life will be obsolete in a few years.” Steve Jobs

This statement is pretty fundamental to life as we know it. Everything you do is worth nothing tomorrow. It is only worth something today.

“Yesterday is history, tomorrow is a mystery, but today is a gift, that's why it's called the present.” Master Oogway, Kung Fu Panda

Today is your present.

There are many other quotes that fit into this space.

“Life is what happens to you while you're busy making other plans.” John Lennon via Allen Saunders

So, what’s the point?

The point is that change is the only constant. Every day, you can change something. Every day, something changes. Every day, the world is moving forward.

“Every day, in every way, I’m getting better and better.” Frank Spencer via Émile Coué

We all know and recognise these things, but do we internalise them? Do you realise that everything you do today will be forgotten tomorrow? Is that good or bad thing? Should we all just live in the moment?

“We’re so busy watching out for what’s just ahead of us that we don’t take time to enjoy where we are.” Bill Watterson

So, if you’ve bought into all those quotes and thoughts, here’s the rub. You build systems that you think should be around for years and yet, in a few weeks or months, they are obsolete.

This is a discussion I had had for years with financial institutions. Banks and insurance firms invested millions in systems built in the last decade and, because of the cost, were massively reluctant to change them. The result? They built all of their new systems on top of them, cementing them in place, never to be replaced. But let’s go back to that quote from Steve Jobs:

“All the work I’ve done in my life will be obsolete in a few years.”

In other words, what he was getting at here is that whatever systems and structures you implement today will be obsolete tomorrow … and you need to plan for that and, more importantly, accept that.

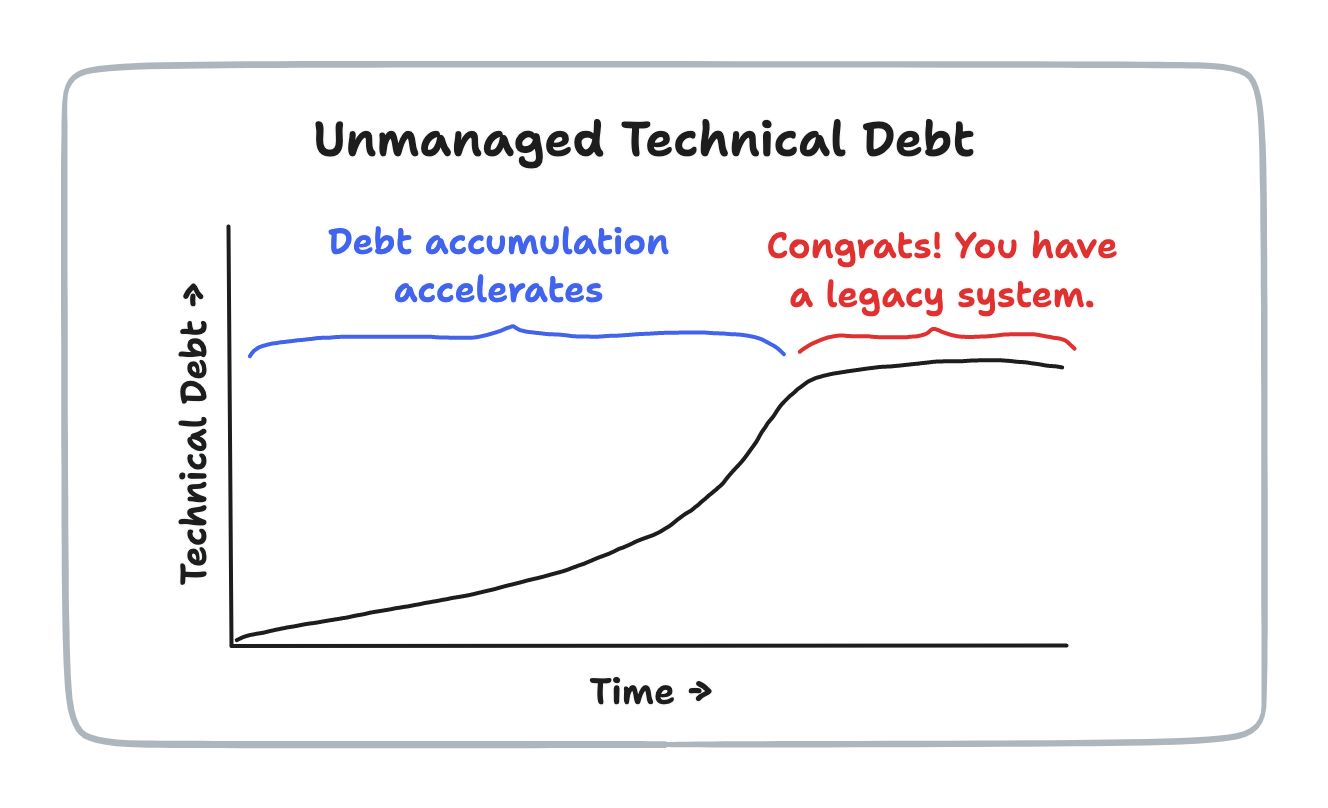

You invest $20 million today in an IT upgrade. Three years from now, do the same again. If you don’t, you end up with a larger and larger technical debt mess. Technical debt: the error of forgetting to invest in renewal.

If you accept that the only constant is change, then you also accept that the only constant is renewal. If you do not invest in renewal, you end up with this large pile of obsolescence that ruins you. This is true at a personal level – do you still have a Blackberry? – but also massively impacts any commercial institutions.

I’ve blogged about this often, but what should get attention today is technical debt, obsolescence and change.

“Technical debt is a measure of the amount of duct tape holding your system together, plus the amount of rust that it has accumulated.” Itzy Sabo

The thing is that we can make a decision in the present to change the future with a major investment in technology but then, and this has often been forgotten, we have to realise it will be obsolete in just a few years and therefore to reinvent it again.

This was a key learning experience when I visited Ant Group in Asia who reinvent their systems architecture every three years. This was a huge contrast with the US and EU banks I know, where their last reinvention of systems architecture was in the last century.

“People who cannot invent and reinvent themselves must be content with borrowed postures, second-hand ideas, fitting in instead of standing out.” Warren Bennis

Unfortunately, the last quote is the one that fits with most analogue banks and created the opening for the new fintech system of digital banks. The thing is that even digital banks have technical debt and need reinvention. AI, Agentic AI, AGI, quantum and more are all on the horizon … how fit are you to keep up?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...